2024-12-3 14:56 |

Data from blockchain analytics firm Arkham indicates that a government-linked wallet transferred 19,800 BTC to a Coinbase Prime wallet on Monday at 16:27 UTC. Each bitcoin was averaging $96,969 at the time of the transaction. This marks the government’s first significant on-chain Bitcoin movement since August, breaking a four-month hiatus.

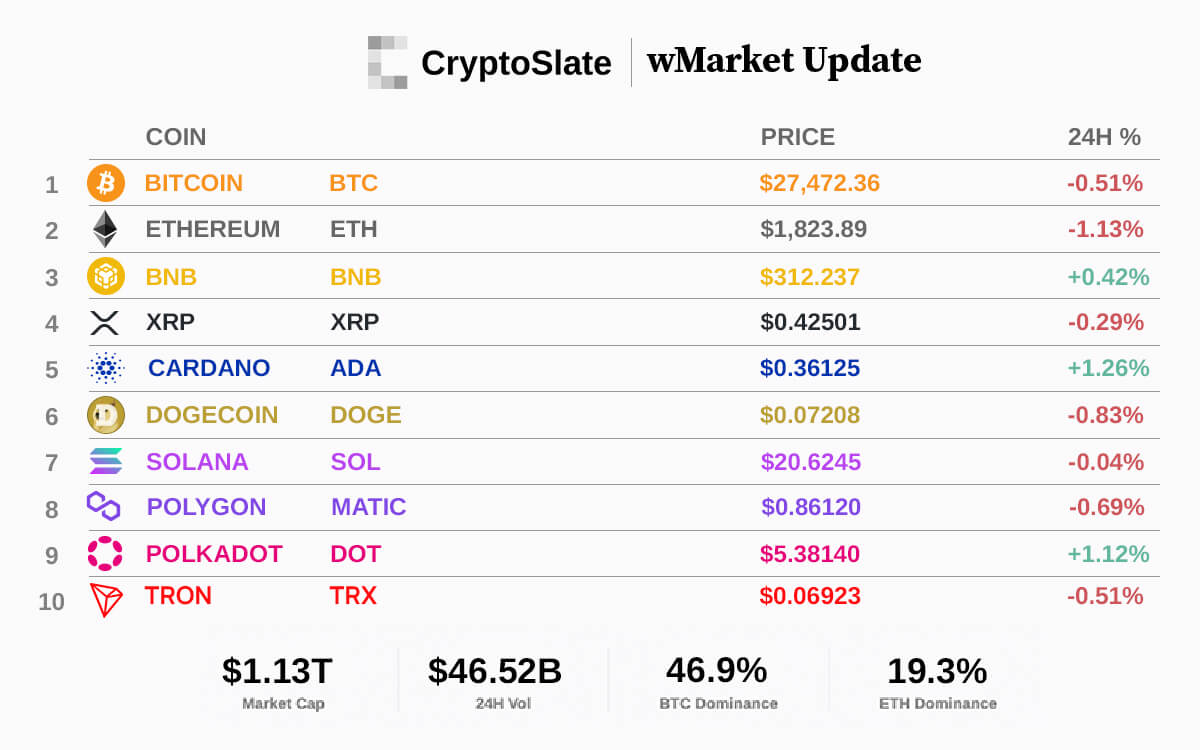

The bitcoins originated from assets seized during the crackdown on the Silk Road marketplace. In October, the Supreme Court authorized the U.S. to sell the confiscated 69,370 BTC tokens. Following this latest transaction, government wallets still hold about 188,309 BTC, worth an estimated $18.12 billion. These holdings also include substantial amounts of Ethereum, USDT, and BNB.

The transfer was executed with minimal cost, as the government spent only 3,440 satoshis—or $3.34—to send the funds. The Bitcoin blockchain transfer offered no privacy, scoring zero out of 100 on Blockchair’s privacy tool due to matched addresses, co-spending, and the near-roundness of the value transferred.

While the government moved the funds through an intermediary address before depositing them to Coinbase, Arkham’s data shows that 9,800 BTC were sent back to the intermediary wallet. This means the net inflow to Coinbase amounted to just 10,000 BTC.

The timing of the transfer coincides with increasing chatter about the establishment of a U.S. strategic Bitcoin reserve. With Donald Trump set to take office in January, his administration may advance this idea, which has already garnered support in Congress from figures like Senator Cynthia Lummis.

The Securities and Exchange Commission (SEC) under current Chair Gary Gensler has faced criticism for its regulatory approach to cryptocurrencies, prompting Trump to pledge significant changes to the agency’s leadership and policies. Gensler confirmed his resignation effective January 20, 2025, aligning with Trump’s inauguration as the 47th president of the United States.

Industry analysts suggest the government’s transfer to Coinbase Prime is likely a custody action rather than a prelude to selling the assets. In July, the U.S. Marshals Service—an agency under the Department of Justice—announced that Coinbase Prime would serve as a custody provider, offering management and trading services for confiscated digital assets.

Despite this, the substantial movement of bitcoins has fueled market speculation. Bitcoin’s price dipped by about 1% following the news, dropping from an intraday high of $96,303 to around $95,219, struggling to maintain the $95,000 level.

The government’s significant holdings and recent movements have left market participants questioning the potential impact on Bitcoin’s price and the broader crypto market. Previous sales of seized assets have been executed in tranches, and the government has historically liquidated such holdings over time.

origin »Bitcoin price in Telegram @btc_price_every_hour

DeFi Nation Signals DAO (DSD) на Currencies.ru

|

|