2024-9-9 11:31 |

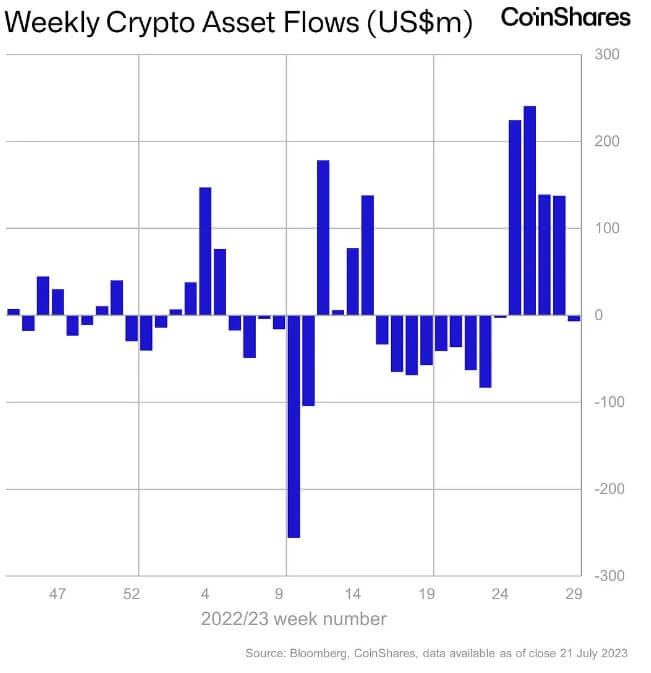

US Bitcoin exchange-traded funds (ETFs) are experiencing their longest stretch of daily net outflows since their launch earlier this year part of a wider retreat from riskier assets in a challenging period for global markets.

Investors have withdrawn close to $1.2 billion from a group of 12 ETFs over the eight days leading up to September 6, with mixed US jobs data and deflationary pressures in China influencing traders’ sentiment.

Economic concerns impact Bitcoin performanceThe cryptocurrency market, closely tied to stock market movements due to a rising short-term correlation, has also felt the impact of these economic concerns.

Bitcoin, the largest digital asset, has struggled in September, posting a loss of around 7%.

However, it managed to recover slightly over the weekend, climbing approximately 1% to $54,870 as of Monday afternoon in Singapore.

Sean McNulty, director of trading at Arbelos Markets, pointed out in a Bloomberg report, “The small relief rally seems to be driven in part by some prominent influencers closing out their shorts.”

He highlighted a social media post by Arthur Hayes, co-founder of BitMEX, as an example.

Another factor contributing to the market’s volatility is the upcoming debate between US presidential candidates.

McNulty noted that improved polling for Donald Trump, the pro-crypto Republican nominee, could be influencing the market.

He also mentioned increased demand for options hedges in case the debate between Trump and Vice President Kamala Harris triggers further volatility.

Harris has yet to clarify her stance on cryptocurrency.

Outlook for BitcoinUS Bitcoin ETFs, which debuted with high expectations in January, initially saw strong demand that helped drive Bitcoin to a record high of $73,798 in March.

Institutional interest in cryptocurrencies has also surged as ETFs gained traction.

However, inflows have slowed since March and Bitcoin’s year-to-date rally has cooled to around 30%.

Caroline Mauron, co-founder of Orbit Markets, suggested that Bitcoin will likely continue trading within the $53,000 to $57,000 range until the US releases its consumer-price data on Wednesday.

The inflation figures could shape expectations for future monetary easing by the Federal Reserve, further influencing Bitcoin’s trajectory.

The post US Bitcoin ETFs face $1.2 billion in losses amid longest streak of net outflows appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|