2023-5-12 21:00 |

As we explore the world of artificial intelligence (AI) and its implications, it is essential to recognize the ongoing tug-of-war between embracing cutting-edge innovations and preserving time-tested traditions.

With this in mind, let us now examine the Buffett-Munger perspective on AI, seeking to understand their apprehensions and the broader implications for society as we stand at the crossroads of technological transformation.

The Dynamic Duo’s View of AIWarren Buffett and Charlie Munger, investing titans revered for their financial acumen, have made the news once more. After likening Bitcoin to “rat poison squared,” they’ve now dubbed AI an “atomic bomb.” This provocative comparison has left many pondering the duo’s concerns about AI’s potential dangers and its growing use in society.

To better understand their skepticism on AI, it is worth looking at instances where Buffett and Munger’s wary outlook may have missed the mark.

Tech Stocks: A Missed Opportunity?During the 1990s dot-com boom, Buffett and Munger famously avoided investing in technology stocks, citing a lack of understanding and their preference for more traditional businesses. While their caution allowed them to dodge the later dot-com crash, it also meant missing out on the rapid rise of companies like Amazon and Google, which have since become dominant players in the market.

In fact, Buffet shared that he was “too dumb” to appreciate the potential of Amazon.

Bitcoin: Rat Poison or Digital Gold?Buffett and Munger’s strong aversion to Bitcoin and crypto have also sparked debate. Their likening of Bitcoin to “rat poison squared” shows skepticism toward its long-term value and utility. However, many investors and tech leaders see cryptocurrencies as a means of decentralizing financial systems and curbing the risks associated with traditional currencies.

While the long-term fate of cryptocurrencies is still uncertain, it’s worth noting that Bitcoin’s value has grown rapidly since Buffett and Munger’s initial dismissal.

The Apple ExceptionInterestingly, despite their general reluctance to invest in technology, Buffett and Munger’s Berkshire Hathaway took a significant stake in Apple in 2016. This investment has proven highly successful, showing that even the most wary investors can recognize the value of certain tech innovations. It also suggests that Buffett and Munger’s aversion to AI may not be set in stone.

While Buffett’s concerns about AI’s potential dangers should be taken seriously, it is crucial to remember that their track record in assessing technological innovations is not infallible.

Ray Kurzweil, Director of Engineering at Google, discusses the power of disruptive technologies, like artificial intelligence, to improve lives Tech Innovations: Fear, Resistance, and AcceptanceThroughout history, emerging technologies have often faced opposition and skepticism. This resistance often stems from a mix of fear, uncertainty, and a reluctance to abandon familiar ways of life. Let us examine specific examples of this pattern.

The Telephone: A Threat to Societal Norms?When Alexander Graham Bell invented the telephone in 1876, it was met with concern. Critics believed the device would disrupt social norms, erode privacy, and foster laziness by discouraging face-to-face communication. However, as the telephone began to gain wider use, society adapted to the new technology, embracing its myriad benefits.

Today, it is hard to imagine a world without telephones or their modern-day successor, the smartphone.

Automobiles: Driving Disruption and ChangeSimilarly, the advent of cars in the late 19th and early 20th centuries faced significant opposition. Detractors cited concerns about noise pollution, environmental ruin, and the loss of traditional forms of transport, such as horses and buggies.

Over time, though, the car’s numerous advantages—greater personal freedom, higher efficiency, and better connectivity—won out. Cars are now a pillar of modern society, shaping our urban lives and habits.

The Internet: From Information Superhighway to Essential UtilityThe internet, too, experienced its fair share of skepticism. In the early days, some critics feared that this new technology would worsen social isolation, add to the spread of false data, and pose serious privacy risks. While some of these concerns persist today, the internet has revolutionized communication, business, and education, among many other aspects of our lives. As a result, the vast majority of people have come to regard the Internet as a key tool.

In each of these cases, innovation ultimately triumphed over resistance. Societies adjusted to the disruptions and reaped the rewards of technological advances.

This pattern highlights the need for adaptability, resilience, and a balanced evaluation of risks and benefits when assessing new technologies.

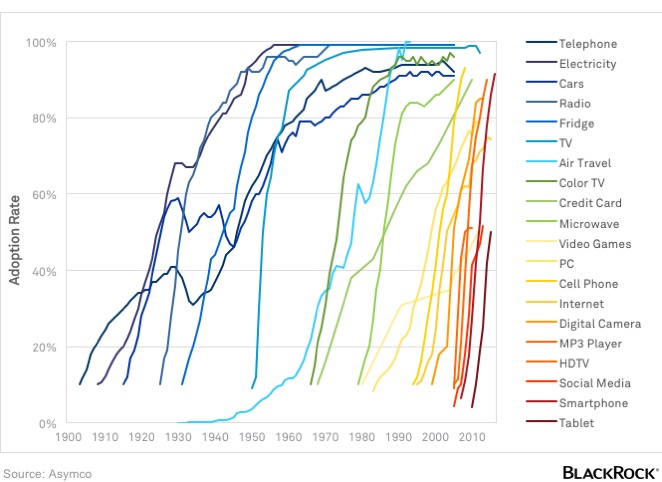

Historical technology adoption rates help us understand the potential reach of AI | BlackRock AI: Promise or Peril?In the case of artificial intelligence, debates about its potential dangers versus its benefits to humanity have reached a fever pitch. Proponents argue that AI can shake up industries, reduce human error, and provide valued assistance in fields like health, finance, and environmental conservation. Critics, however, warn of job loss, loss of privacy, and even the potential for AI-driven weapons.

Navigating these competing perspectives requires a fair approach, one that sees both AI’s risks and its potential. The challenge lies in bringing about the responsible development and use of AI while curbing negative consequences.

As top figures in the business world, Warren Buffett and Charlie Munger have held much sway in shaping public ideas and debate on new technologies. Their view of AI, therefore, merits further study.

Are their concerns about the “atomic bomb” of AI valid? Or do they simply reflect a gut resistance to change and innovation?

One possible explanation for this wary stance is the duo’s creed. One which favors long-term, stable investments in established companies. Artificial intelligence, by nature, upsets traditional industries, breeding FUD. This volatility might be at odds with Buffett and Munger’s investment credo, adding to their unease.

Lessons from History: Technology’s Unstoppable MarchDespite the concern over artificial intelligence, it’s crucial to remember that technology has always forged ahead, regardless of initial resistance. As a society, we must address valid concerns while welcoming AI’s potential for positive change. Through open dialogue and joint action among innovators, lawmakers, and the public, we can enable responsible AI use.

Ultimately, Buffett’s stance on AI reminds us that even respected financial minds can doubt groundbreaking technologies. Navigating the AI sector requires adaptability, vigilance, and openness to innovation’s transformative power.

Balancing Innovation and TraditionThe Buffett perspective on AI reflects the old struggle between invention and tradition. While their concerns about the dangers of AI warrant consideration, history has shown that tech advances, when well managed, can yield immense benefits.

As we chart our course in the age of AI, let us strive for balance, embracing change without losing sight of the values that have served us well in the past.

The post Unpacking Warren Buffett’s Stance on AI: Innovation vs. Tradition appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Innovation Blockchain Payment (IBP) íà Currencies.ru

|

|