2020-9-30 02:00 |

Uniswap’s UNI token has been slowly grinding lower over the past few days, with buyers being unable to gain control over its short-term trend as the hype surrounding the token’s launch begins fading.

That being said, UNI’s buyers are now moving to establish its recent lows as a long-term base of support, as it has posted multiple positive reactions to the lower-$4.00 region.

Interestingly, the Uniswap governance token only appears to be loosely correlated to the rest of the market, which may mean that smaller Bitcoin fluctuations will only have a limited impact on where it trends in the near-term.

One analyst does believe that upside could be imminent, noting that it is imperative that bulls reclaim $4.70, as a break above this level could be the event that helps fuel its next strong uptrend.

Other investors are also noting that its fundamental strength still remains and that its upside potential is significant.

Analyst: Uniswap’s UNI Bounces at Support as Bulls Attempt to Spark Trend ReversalIn the time following the release of the Uniswap governance token a couple of weeks ago, it has been subjected to some wild price swings.

Following its launch, the UNI price plunged down to lows of $1.00 before it garnered some significant momentum that sent it surging up towards $8.50.

This marked a local top, as its price has been sliding lower ever since. Bulls were able to establish $3.50 as a strong short-term bottom, with UNI now attempting to set a higher low as it consolidates above $4.00.

At the time of writing, the Uniswap token is trading up just over 1% at its current price of $4.29.

Here’s the Crucial Level UNI Must Break AboveOne analyst explained that Uniswap’s UNI token must surmount $4.70 in order to see further upside in the days and weeks ahead.

He believes that a break above this level could be enough to spark a fresh uptrend.

“UNI: There we go, bounce of around 10% since this area. Still, no clear trend direction given as $4.70 should be reclaimed, but at least a good entry.”

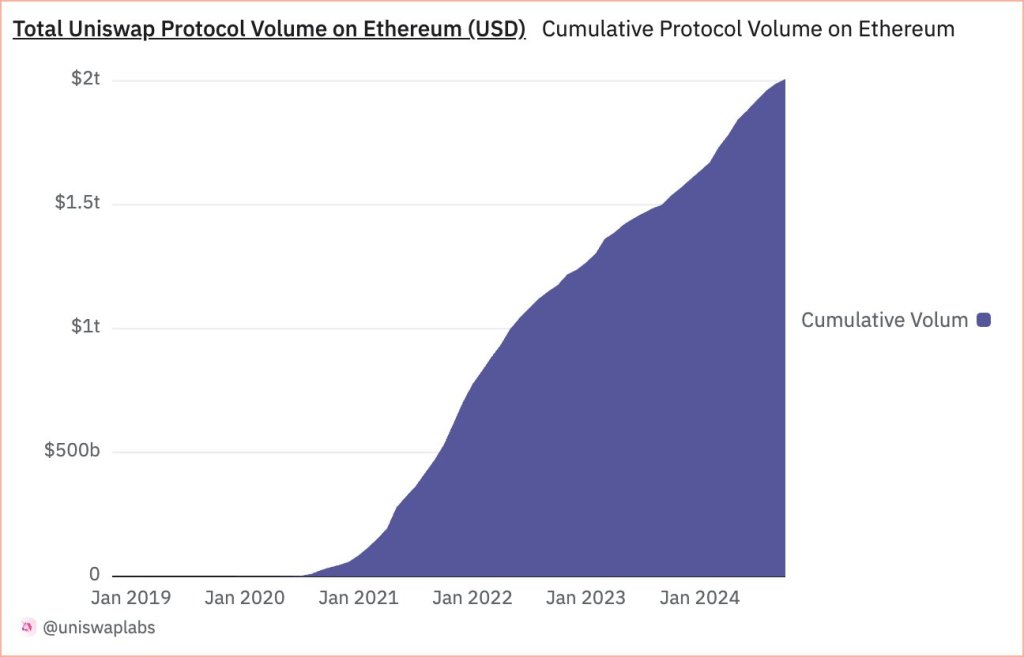

Image Courtesy of Crypto Michael. Chart via TradingView.Many investors are pointing to the potential release of a V3 of Uniswap as one factor that could boost the token in the near-term. This is expected to provide the DEX with many new features that make it more similar to a centralized exchange.

This may spur growth for both its trading volume and its liquidity.

Featured image from Unsplash. Charts and pricing data from TradingView. origin »Bitcoin price in Telegram @btc_price_every_hour

Waves Community Token (WCT) на Currencies.ru

|

|