2025-2-13 09:02 |

Uniswap price has rebounded in the past few days, moving from a low of $6.9565 last week to near $10 today. UNI token has jumped by over 42% from its lowest point this month, as the Unichain mainnet neared the 1 million transactions. So, what next for the Uniswap coin price?

Unichain growth continuedThe Uniswap token price has rebounded in the past few days as the developers unveiled the Unichain mainnet.

Unichain is the layer-2 network that aims to simplify how the Uniswap network works. It is network that aims to unify all the other chains. Unichain also has substantially lower fees, allowing users to keep most of their money.

The network also allows many popular developers to launch their networks on it. Some of the top players in Unichain are Morpho, Coinbase, and Lido.

Data by DeFi Llama shows that the top players in the Unichain network are Uniswap, DyorSwap, UCS Finance, and PassDEX. Its total value locked (TVL) in the ecosystem has jumped to over $3 million.

Unichain has handled over 957,000 transactions since its mainnet launch on Tuesday and handled over 3,206 smart contracts. The number of wallets in the ecosystem has jumped to almost 52,000.

There is a likelihood that the Unichain network will continue to do well in the coming months. Traders will likely continue selecting Unichain because of its interoperability and cheaper fees.

Uniswap is losing market shareThe UNI coin price has struggled as it lost market share in the industry. Data shows that PancakeSwap handled over $100 billion in volume in the last 30 days, while Uniswap processed transactions worth $105 billion. Raydium handled over $122 billion in the same period.

These huge numbers mean that Uniswap is losing market share in an industry it has always dominated in the last few years.

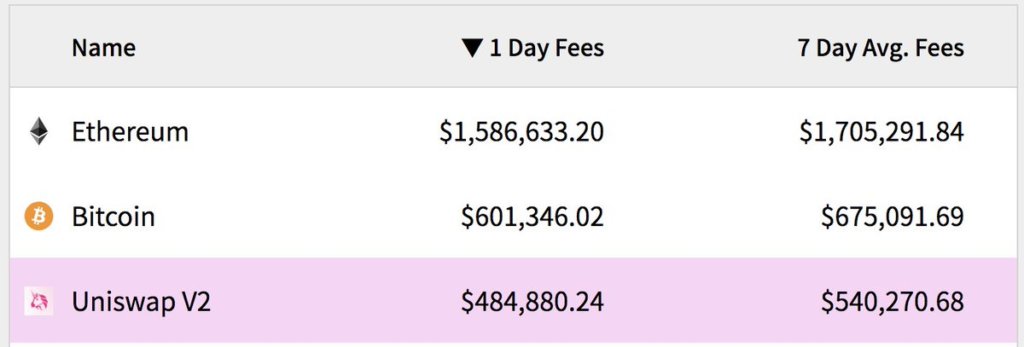

Still, Uniswap continues to generate substantial sums of money in the network. It has made over $171 million this year, making it more profitable than networks like Lido Finance, AAVE, Aerodrome, Sky, and PancakeSwap.

It has made over $2.3 billion in the last 365 days, making it the fourth-biggest network in the industry after Tether, Tron, and Ethereum.

Uniswap price faces numerous catalysts. The SEC will likely drop its charges against Uniswap, while the SEC may decide to approve a spot UNI ETF. In a note, one analyst said:

“Uniswap is one of the top blue-chip coins in the industry. It has numerous catalysts that could push its price higher in the coming months. Its DEX volume remains high, odds of a spot UNI ETF are rising, and it has strong technicals.”

Uniswap price forecastUNI price chart by TradingView

The weekly chart shows that the UNI price has moved sideways in the past few months. It rose to a high of $19.13 earlier this year, a notable level because it was along the 38.2% Fibonacci Retracement point.

Uniswap price has formed an ascending, broadening wedge chart pattern. It has also moved slightly above the 25-week Exponential Moving Average (EMA).

A rising broadening wedge pattern is usually a bearish sign. However, the bearish breakdown usually happens after it initially staged a strong breakout. This means that the coin will rise to the 61.8% Fibonacci Retracement point at $30.

On the other hand, a drop below the support at $4.8 will point to more downside, with the next point to watch being at $3.10, its lowest level in 2022.

The post Uniswap price prediction as Unichain nears a 1M milestone appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|