2023-6-27 21:00 |

In the early hours of June 27, 2023, the crypto world witnessed a significant event. Two large-scale Ethereum (ETH) transactions were executed on the decentralized lending platform, Aave, likely by the same individual or entity. The total deposit amounted to 14,771 staked Ethereum (stETH), with a subsequent borrowing of $14.5 million in stablecoins.

Crypto Market Surges: Discover Opportunities Creating Overnight Millionaires!Explore the fascinating trends shaping the crypto market and capturing the attention of investors worldwide. With a remarkable Wall Street Memes token raising over $10 million, the world of crypto is brimming with potential for financial gains. Find High-Potential Token, yPredict, powered by its native token $YPRED, is emerging as a significant player in the crypto space. The presale YPRED, which is ongoing at ypredict.ai, has already raised over $2.5 million in seed round funding from early investors. Don’t miss out on this once-in-a-lifetime opportunity to ride the wave of crypto success!

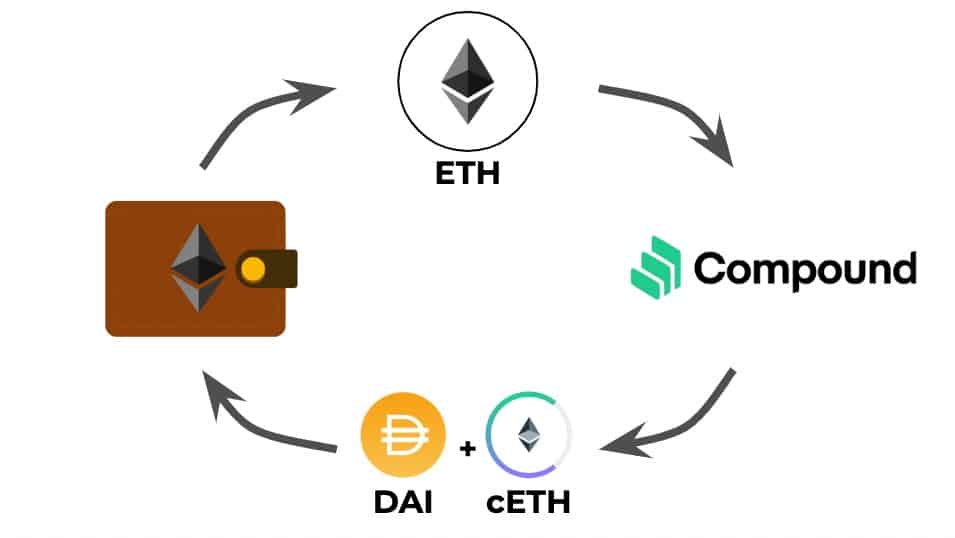

Show more +Show less –The first transaction was traced back to a wallet address, which we’ll refer to as “Wallet A”. The owner deposited 3,991 stETH and borrowed 2 million Tether (USDT) and 3 million Dai (DAI). They then purchased 2,678 ETH at a rate of $1,867 per unit and converted these into stETH. This was followed by another deposit of 2,675 stETH and a borrowing of 2.5 million USD Coin (USDC). The cycle repeated with the purchase of 1,344 ETH at $1,860, conversion to stETH, and a final deposit of 1,343 stETH.

The second transaction was linked to another wallet address, which we’ll refer to as “Wallet B”. This wallet owner deposited 3,963 stETH and borrowed 5 million USDT. They then bought 2,687 ETH at $1,860 each and swapped these for stETH. After depositing 2,685 stETH, they borrowed another 2 million USDT. The process was repeated with the purchase of 1,073 ETH at $1,864, conversion to stETH, and a final deposit of 1,073 stETH.

These transactions highlight the dynamic nature of the crypto market and the strategic maneuvers of large-scale investors, often referred to as ‘whales’. By leveraging the revolving loan feature on Aave, these whales were able to make substantial trades, potentially influencing the market dynamics of Ethereum and the associated stablecoins.

.rh-colortitlebox{margin-bottom:30px;background:#fff;line-height:24px;font-size:90%}.rh-colortitlebox .rh-colortitle-inbox{display:flex;align-content:center;padding:15px;font-weight:700;font-size:110%; line-height:25px}.rh-colortitlebox .rh-colortitle-inbox i{line-height:25px; margin:0 10px; font-size:23px}.rh-colortitlebox .rh-colortitle-inbox svg{width:25px;margin-right:10px}.rh-colortitlebox .rh-colortitle-inbox-label{flex-grow:1}.rh-colortitlebox .rh-colortitlebox-text{padding:20px}.rh-colortitlebox-text>*{margin-bottom:20px}.rh-colortitlebox-text>:last-child{margin-bottom:0}.rh-toggler-open{height:auto !important} .rh-toggler-open .rh-tgl-show, .rh-toggler-open .rh-tgl-grad{display:none !important} .rh-toggler-open .rh-tgl-hide{display:block !important} .rh-tgl-show, .rh-tgl-hide{cursor:pointer} .rh-contenttoggler *{box-sizing: border-box !important} .rh-toggler-wrapper{overflow: hidden;transition: all 0.5s ease; padding-bottom: 35px; margin-bottom:30px;box-sizing: content-box !important;position: relative;} .rh-toggler-wrapper p:last-of-type {margin-bottom: 0;}The post Two Whales Deposited 14,771 $stETH and Borrowed $14.5M Stablecoins on AAVE appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Two Prime FF1 Token (FF1) на Currencies.ru

|

|