2023-5-8 20:12 |

Bitcoin (BTC) has had a wild run this year after recording over 72% growth over the past months with several indicators pointing upward despite slight price corrections.

The price of BTC was riddled with a little over 10% price fluctuations between $27,000 and $30,000 from April 25 to May 1. On a much positive front, BTC is up 72% year to date (YTD) together with the S&P 500 has made 9%.

From its yearly high of over $30,000, BTC dropped as low as $21,700 with some experts predicting a sharp decline as low as $25,000 before another upward movement. However indicators like Bitcoin margin and derivatives market contradicts this view.

Data from OKX shows that traders increased their margin lending ratio between April 17 and April 28. On April 27, it recorded a positive 43% ratio on BTC longs marking its highest level in 40 days. Margin trading gives insight into the stance of professional traders because they borrow assets to leverage their positions.

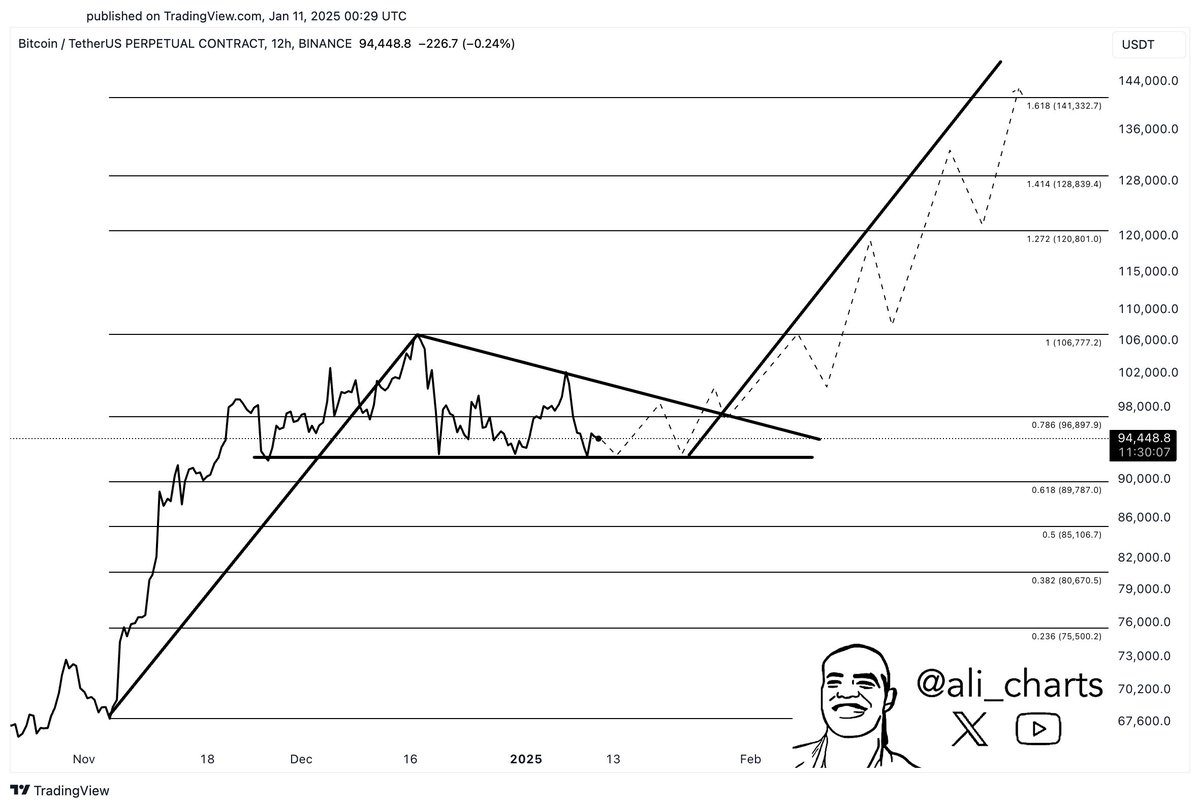

To properly get a grasp of traders’ sentiment, the long-to-short metric is used which gathers traders’ positions from perpetual and spot contracts giving better analysis. BTC currently trades at $28,190 at press time after ending April at $29,230.

The derivatives market is equally positiveLike the margin market, the BTC derivatives market shows strength despite failing to break past the $30,000 level. According to the long-to-short indicator, traders increased long positions with futures between April 17 and April 28.

On Binance, the long-to-short ratio increased with longs moving from 1.12 to 1.26 on April 30. A similar increase was also recorded on OKX after the long-to-short ratio increased from 0.66 on April 27 to 0.93 on May 1. As both future and margin market indicators show strength, some BTC faithful have expressed optimism about the asset’s growth.

The price of Bitcoin has climbed this year with a weaker US dollar and several banking debacles. First Republic Bank joins Signature and Silicon Valley Banks to become one of the most recent bank collapses this year. The fall in these three banks has sparked widespread speculation on BTC being the haven when traditional finance crumbles.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|