2020-12-24 18:28 |

The US government is preparing to push the prices in all markets higher.

Calling the recently-passed coronavirus relief bill a “disgrace,” President Donald Trump is demanding Congress to increase stimulus payments from $600 to $2,000 and get rid of “wasteful and unnecessary items.” Trump said in a video,

“I am asking Congress to amend this bill and increase the ridiculously low $600 to $2,000, or $4,000 for a couple.”

BREAKING: Pres. Trump will send the COVID relief bill back to Congress so direct payments can be increased from $600 to at least $2000 per person.

He says he won’t sign the omnibus bill until “wasteful items” are eliminated.pic.twitter.com/ZPUWTyA9ip

— Alex Salvi (@alexsalvinews) December 23, 2020

However, the $900 billion COVID-19 stimulus bill was passed on Sunday in both houses of Congress with veto-proof majorities which means Trump might not be able to raise the direct payment limit. The good thing is top Democrats in Congress are in favor of bigger cheeks to people.

“Democrats are ready to bring this to the Floor this week by unanimous consent. Let’s do it!” House Speaker Nancy Pelosi tweeted in response to Trump's video.

It is not known if the $2,000 will replace the $600 check yet. Meanwhile, the recently passed pandemic recovery bill includes direct payments of up to $600 to eligible adults plus $600 per child dependent. Individuals earning up to $75,000 in adjusted gross income, or $112,500 as head of household and $150,000 as a married couple qualifies for the maximum benefit of this stimulus payment.

As we reported, Treasury Secretary Steven Mnuchin said on Monday that qualifying Americans could get their direct benefits as early as “at the beginning of next week.”

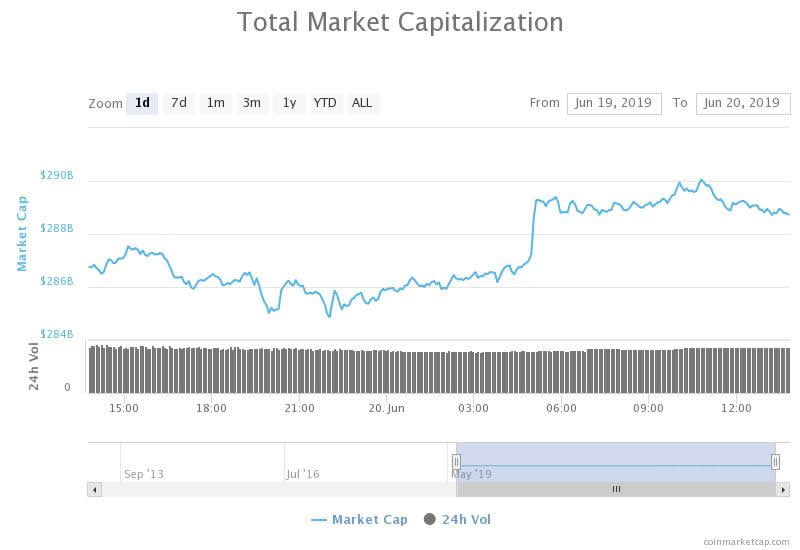

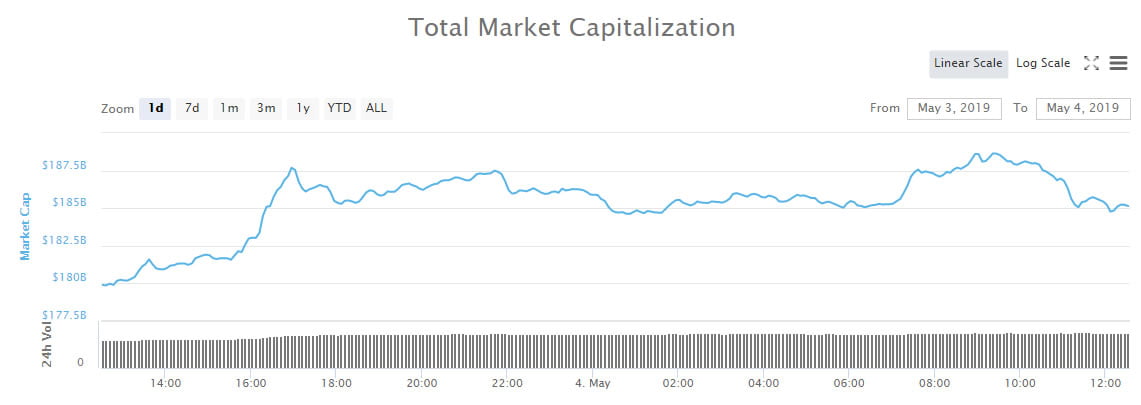

Now, if the latest $2,000 direct payments become a reality, “All markets will moon,” said one trader.

Up over 14% YTD, S&P 500 hit a new all-time high last week while the US Dollar index is at multi-year lows, down more than 12% from its March uptrend. When it comes to precious metals, gold is enjoying a 22.3% uptrend this year trading at $1,862 but down from its August peak of $2,075. As for silver, it rallied 47% year-to-date, currently at $25.5 but down from August's nearly $30 high.

Bitcoin, however, is the leading asset with 227% gains in 2020, making a new ATH at $24,300 just this past weekend.

Canadian fund managers are also revamping their portfolios and bringing BTC into the mix as COVID-19 vaccines roll out and central banks provide a historic level of stimulus. The Bitcoin Fund has actually soared 65% since it began trading in Canadian dollars in October.

“It’s a hedge against all the money printing that is going on,” said Arthur Salzer, chief executive officer of Northland Wealth Management, noting “institutional investors are embracing” this asset class.

Bitcoin/USD BTCUSD 23,319.1379 -$100.27 -0.43% Volume 53.21 b Change -$100.27 Open$23,319.1379 Circulating 18.58 m Market Cap 433.26 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Trump Calls for ,000 Stimulus Checks; Pelosi Agrees to Push Markets to the Moon first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

TrumpCoin (TRUMP) íà Currencies.ru

|

|