2020-11-5 02:00 |

Bitcoin is trading around the level it has been at for the past couple of weeks Bulls are vying to break above $13,800, but the resistance here is rather significant and is showing few signs of degrading BTC has now made multiple bids to break above $14,000, but each one has resulted in it seeing strong inflows of selling pressure that send it back down to the mid-$13,000 region There’s a good chance that Bitcoin will begin seeing heightened volatility in the near-term, as the leverage being used by traders on margin platforms like Binance is at an all-time high

Bitcoin and the aggregated cryptocurrency market have not been able to post any clear breakouts or breakdowns throughout the past few days and weeks.

It is still trading just below its crucial $13,800 resistance level, which is a level that analysts and investors alike have been closely watching throughout the past few days and weeks.

If this level isn’t broken above in the near-term, it could eventually catalyze a strong rejection that sends its price reeling lower.

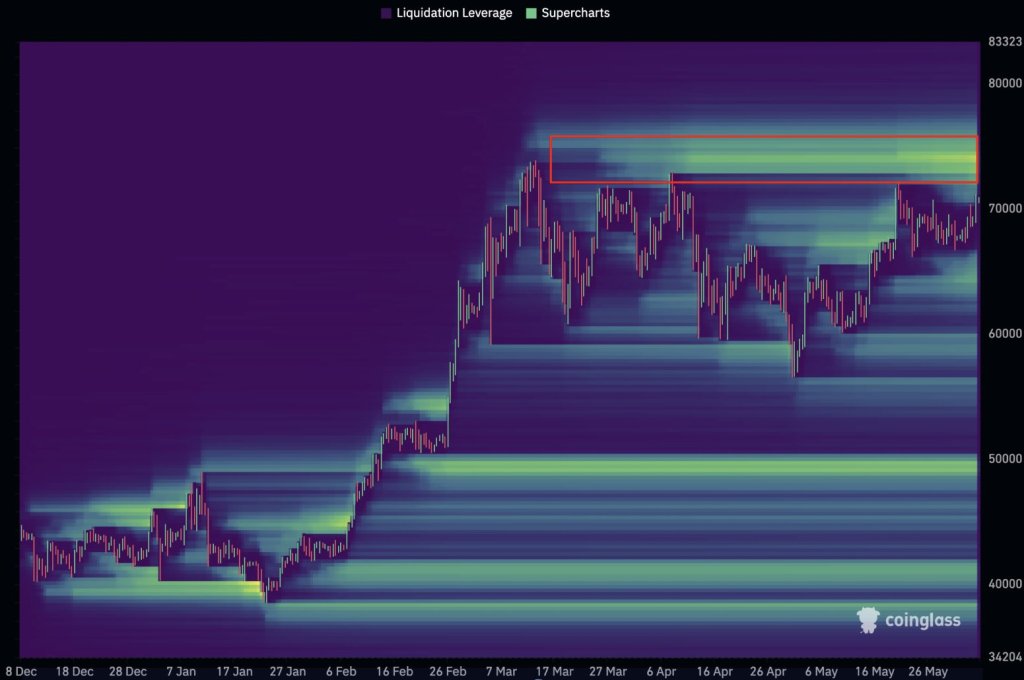

One trend that could contribute to the volatility stemming from a breakout or a breakdown is the massive leverage being used on trading platforms like Binance.

Bitcoin Continues Seeing Stagnating Price Action as Bulls Target $13,800 BreakoutYesterday evening was quite volatile for Bitcoin, with the cryptocurrency rallying as high as $14,100 before facing inflows of selling pressure that sent it down to $13,700.

It has been consolidating ever since and is currently trading down just under 2% at its current price of $13,786.

This is just a hair below its key $13,800 resistance level that has been holding strong for the past few days and weeks.

Traders Up the Leverage as Volatility LoomsOne analytics firm noted in a recent tweet that Bitcoin traders on margin trading platforms like Binance Futures have been greatly increasing the leverage they are using.

“BTC Estimated Leverage Ratio at Binance hits the all-time high,” CryptoQuant noted.

Image Courtesy of CryptoQuant.This trend suggests that, once Bitcoin makes a big movement, the volatility seen will be heightened and potentially set the tone for where it will trend throughout the rest of 2020.

It could also spark a liquidation cascade that fuels either a strong downtrend or uptrend – depending on how it reacts to $13,800.

Featured image from Unsplash. BTCUSD pricing data from TradingView. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|