2018-8-9 12:42 |

For many new crypto investors, market cap isn’t usually a key factor when they’re looking to invest. They just look at the most popular coins or those in the top 20, and buy.

While this is not necessarily a bad strategy, the reality is that market cap can affect profit projections and token growth value. A token’s market cap often indicates the limits of its growth.

So, a cryptocurrency with a total circulation of 200 million, has more growth potential than that of a 2 billion. This is because the 200 million token can afford to be valued at $100 each, while the 2 billion token may be limited to a max of $20, resulting in a market cap of $20 billion and $40 billion respectively.

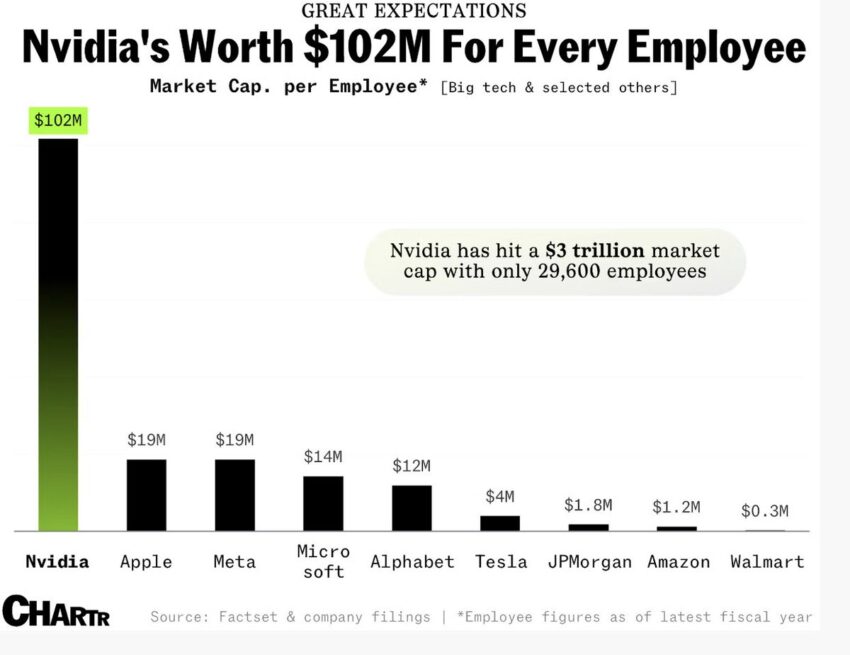

Anything more, and the price starts looking outrageous. Think about it for a moment, the world’s most valuable companies with tangible products and services that have a global reach, have market caps that are valued at an average of $300 billion each.

How then do you expect a cryptocurrency without any tangible products or services and maybe no global reach to be valued at that price?

Top Reasons Why A Coin's Market Cap Is VitalThere are quite a few reasons why market capitalization is just as important as the project itself. Let’s explore them.

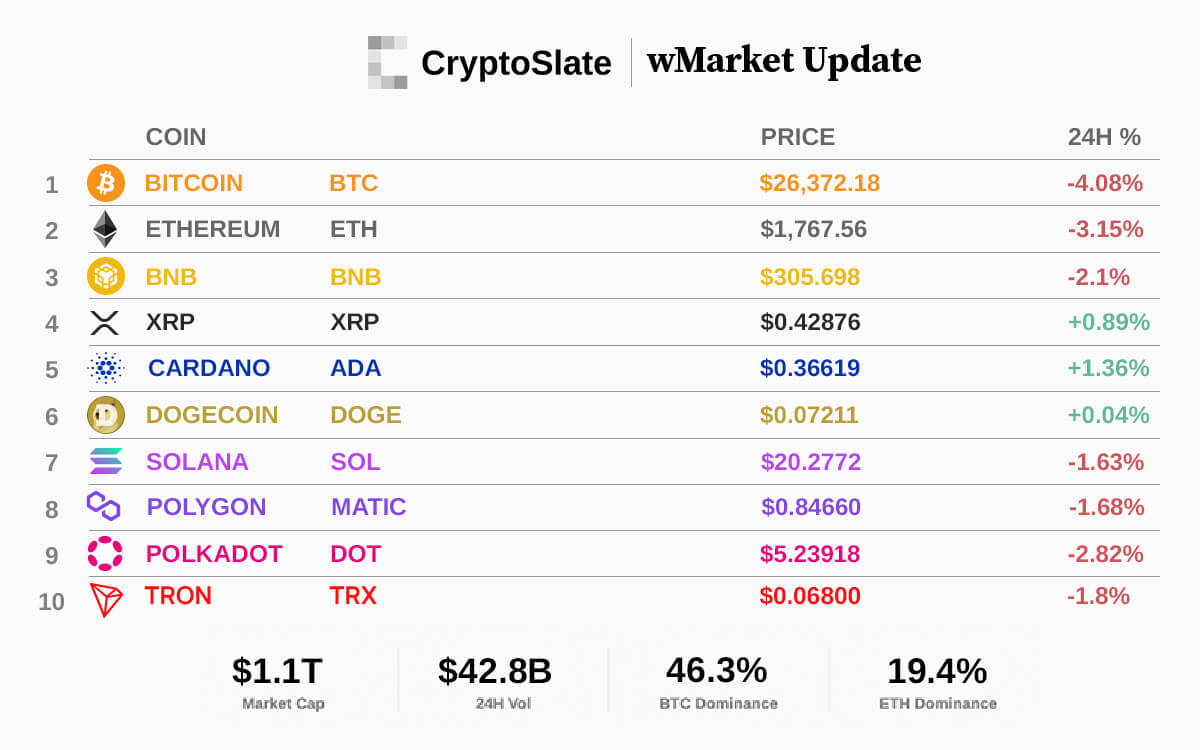

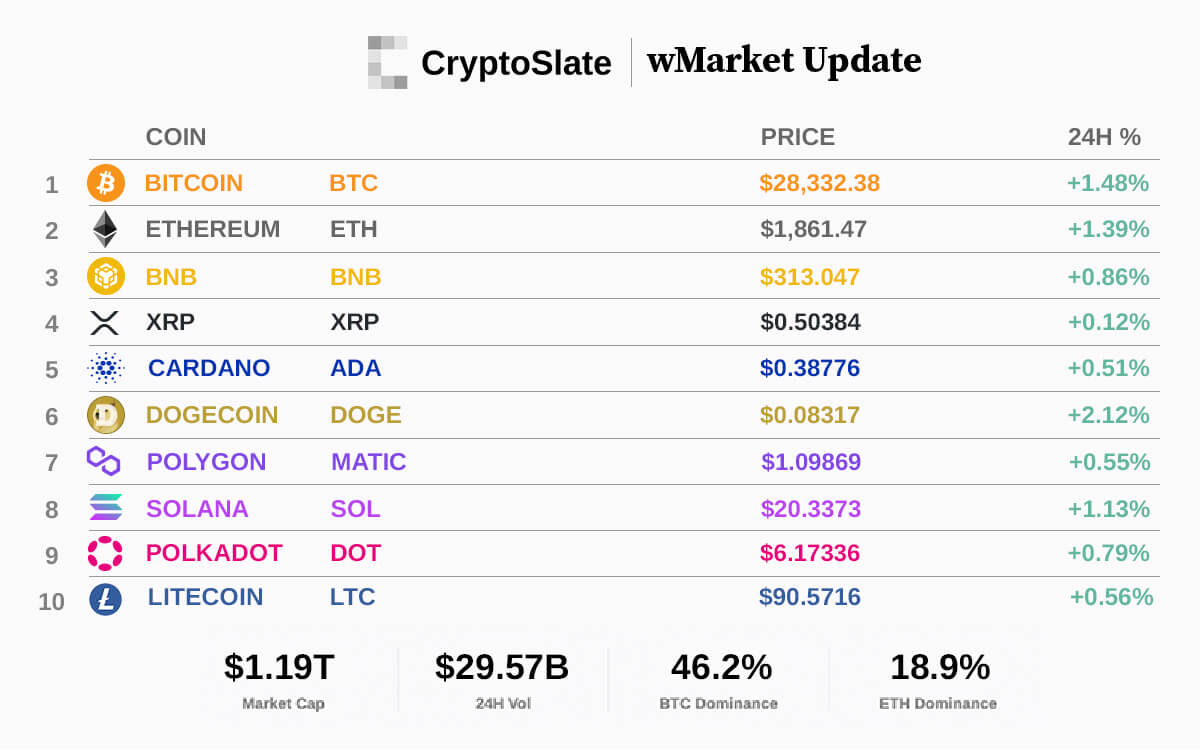

Can Be An Indicator Of Investor SentimentsAs we speak, there are currently only four cryptocurrencies with a market capitalizations exceeding $10 billion. These are bitcoin, ethereum, ripple and bitcoin cash. The rest have a significantly lower market cap than these four.

According to traditional investment parameters, these four make a more reliable and steady investment than the others because of their huge value. For example, even though Ripple is currently valued at under 45 cents per token, it has a market cap of about $17 billion.

This means that investors are more confident of buying and holding its 39+ billion tokens than say, EOS token’s less than 1 billion token, even though EOS is better priced. This also means that investors have spent that money on the token.

Based on this therefore, you can easily tell where investors’ money is going. Using this information therefore, you can easily decide if you want to invest in those tokens or not.

May Indicate Price And Value GrowthTo be honest, it’s very tempting to look at some those cryptos that are valued at less than a $1 and think they have more growth potential than the more expensive ones. Yet, that could be a risky bet if the number of tokens in circulation is huge.

For example, it is easy to look at Stellar with its roughly 19 billion tokens and price at 24 cents and imagine that it will perform better than Litecoin’s roughly 58 million tokens, priced at $74 each.

Yet, if anything, the sheer number of tokens in circulation should show you the limits of that crypto’s growth potential. Litecoin is still at roughly $4 billion, while Stellar’s is currently at $4.55 billion.

With this data, it’s easy to see that Litecoin can afford to quadruple its value and grow to $296 per token and still have its market cap at less than $20 billion. Stellar on the other hand, can never be priced the same, unless the company carries out a massive coin burn that will drastically reduce the number of tokens in circulating supply to less than 60 million.

At best, Stellar with its current circulating supply will probably grow to be valued at $10-$15 each -and even that price is farfetched as it would have to come up with an incredibly innovative product or service to justify that value. Anything more, and it just stops making sense.

However, it’s easy to see just how people might fall for the lower price points and assume they will become more valuable than established cryptos, even when it doesn’t tell the true story about the future of the coin.

So, pay a lot of attention to a cryptocurrency’s current circulating supply before investing in it for the short, medium or long term. As a rule, lower circulating supply implies massive growth potential, while higher circulating supply implies limited growth.

Functions As A Risk IndicatorMarket capitalization may also be indicative of the crypto project’s risk profile. Cryptocurrencies with large market caps are considered relatively safer than those with smaller market caps.

Although this might be a moot point when you consider how many tokens they have in circulation. Less risky cryptocurrency projects would be those with high market capitalization and lower total supply.

Just because a cryptocurrency has high market cap doesn’t mean it is a safe bet –remember the supply factor. If it has a huge total supply, then you know that it may have no bearing on its risk profile. In fact, some crypto founders have been known to intentionally create tokens with huge circulating supply so they can become overnight billionaires.

Just understand this, and you will be able to take advantage of those tokens with hug circulating supply. These are typically cheaper and are great for traders looking to make some money buying low and selling high.

Can Help You Spot Projects Prone To Price ManipulationThe crypto industry is known for its susceptibility to the influence of whales who can artificially increase the price of a cryptos, and then sell off when the price is high. However, some cryptos are more susceptible to this than others.

Those with a lower market cap can be easily influenced than those with higher market caps. This makes sense because those with lower market caps tend to be cheaper, which means whales with a huge budget can influence their prices if they buy up huge quantities.

For instance, it’ll be easier for investors with a $2 billion budget to artificially influence the price of Stellar, than bitcoin or ethereum as the latter are both more expensive per unit and have a huge market cap. With Stellar, they can easily buy up huge volumes, while that won’t be possible with bitcoin.

Why Market Cap Is Important ConclusionWhile the ideal coins for investment purposes are those with huge market caps and decent pricing, not everyone has enough cash lying around to buy up quantities that will make a sizable portfolio.

So, you might want to take a look at some of the other cheaper or penny cryptos and invest in them. Just understand that they probably would never be as hugely priced as any of the most valued cryptos.

But the returns on them can be enough for you to build a decent sized and profitable portfolio. Just make sure that the teams behind the project are serious, have a valid use case, a solid roadmap, an active community, and are transparent and competent.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|