2022-6-16 21:39 |

Software protocols that run on top of a blockchain network like Ethereum or Cosmos are called DeFi projects. To automate financial services, these projects use the underlying protocol technology and novel innovations.

DeFi Projects gets their name because they are non-custodial and decentralized. The term “non-custodial” refers to the fact that the system does not manage or control the user’s crypto assets.

Definitions – Decentralized Finance, or DeFi, is an ecosystem of financial applications built on existing blockchain networks.

Defi projects solve unique problems within the financial industry, such as Lending and Borrowing, Crypto Exchange, and Derivatives. In Our Today’s Pick, we will be looking at the Top 5 DeFi Projects With the Highest Total Value Locked (TVL) for June 2022.

Note: The list below is ordered by the TVL of each project, highest to lowest.

Oasis App TVL: $7.4 billionOasis is the frontend to access Maker Protocol and create Dai. Oasis Borrow aims to be the most trusted entry point to the Maker Protocol. The long-term mission is to allow users to simply and quickly deploy their capital into DeFi and manage it in one trusted place.

Maker Protocol is comprised of a decentralized stablecoin, collateral loans, and community governance. The Oasis App boasts about $7,464,464,617.53 in Total Value Locked.

Token Price Action:

Maker (MKR) is the governance token of MakerDAO and Maker Protocol, a Decentralized organization and a software platform, respectively. It is built on the Ethereum Blockchain, allowing users to issue and manage DAI stablecoin.

MKR currently trades at $756 after being affected by the general market dip, falling from $833 about 24hrs ago. Market Cap sits at $740 Million with about 85,309 holders, according to CoinMarketCap.

Aave Protocol TVL: $5.9 billionThe Aave protocol is a non-custodial, decentralized, open-source money market protocol. Depositors earn income by supplying liquidity to lending pools, while borrowers can borrow from these pools in either an overcollateralized or undercollateralized method.

The Aave system is unusual in that deposits are tokenized as aTokens that earn interest in real-time. It also includes access to cutting-edge flash loans, allowing developers to borrow money quickly and easily without collateral. The Aave protocol is the most diverse lending pool in the Ethereum ecosystem, with 16 different assets, five of which are stablecoins.

The AAVE Protocol boasts about $5,928,943,833.42 in Total Value Locked, making it second on our list.

Token Price Action:

The Aave price today is $58.07, with a 24-hour trading volume of $223,908,964. Aave is down 0.07% in the last 24 hours. The current market cap is at $806 Million with about 112,984 holders, according to CoinMarketCap.

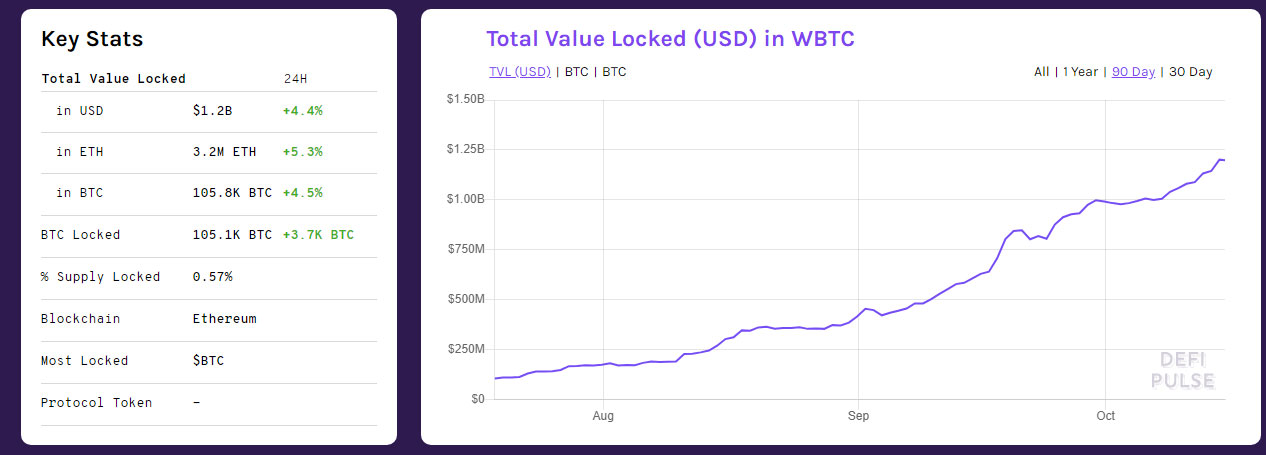

Wrapped Bitcoin (WBTC) TVL: $5.6 billionThe Ethereum ecosystem, which includes decentralized exchanges (DEXs) and financial apps, gains more liquidity with WBTC. The majority of Bitcoin trading volume now takes place on controlled exchanges. WBTC changes that by introducing Bitcoin’s liquidity to DEXs and allowing token exchanges with Bitcoin.

WBTC standardizes Bitcoin to the ERC20 format, allowing for the creation of Bitcoin smart contracts. This allows writing smart contracts that incorporate Bitcoin transfers easier.

The Wrapped Bitcoin (WBTC) boasts about $5,683,512,494.18 in Total Value Locked, making it third on our list.

Token Price Action:

Today’s Wrapped Bitcoin price is $20,989.09 with a 24-hour trading volume of $635,005,886. Wrapped Bitcoin is down 2.93% in the last 24 hours. The current market cap is at $5,658,683,682 with 49,053 holders according to CoinMarketCap.

The Lido Ethereum Liquid Staking Protocol TVL: $4.626 billionBuilt on Ethereum 2.0’s Beacon chain, the Lido Ethereum Liquid Staking Protocol allows users to receive staking rewards without locking their Ether or managing staking infrastructure.

The Lido smart contract allows users to deposit Ether and obtain stETH tokens in exchange. The smart contract then stakes tokens with the node operators chosen by the DAO.

Unlike staked Ether, the stETH token is not constrained by a lack of liquidity and can be transferred at any moment.

The Lido Ethereum Liquid Staking Protocol boasts about $4,626,489,088.39 in Total Value Locked, making it fourth on our list.

Token Price Action:

The Lido DAO price today is $0.556463, with a 24-hour trading volume of $26,520,104. Lido DAO is up 3.45% in the last 24 hours. The current market cap sits at $174,145,794 with 15,685 holders according to CoinMarketCap.

Curve TVL: $4.606 billionCurve is a stablecoin-optimized automated market maker that functions as an exchange on the one hand and allows liquidity providers to earn fees and lending interest on the other.

Curve has attracted a lot of attention by sticking to its mission as an AMM dedicated to stablecoin trading.

Given CRV’s usage for governance and the fact that it is distributed to users based on liquidity commitment and term of ownership, the debut of the DAO and CRV coin brought in even more wealth.

Curve is for everyone active in DeFi activities like yield farming and liquidity mining, as well as those trying to maximize returns without risk by owning stablecoins that are ostensibly non-volatile.

Curve boasts about $4,606,344,804.74 in Total Value Locked, making it fifth on our list.

Token Price Action:

Today’s Curve DAO Token price is $0.664874 with a 24-hour trading volume of $128,475,754. Curve DAO Token is down 2.23% in the last 24 hours. The current market cap sits at $335,241,933 USD with 72,793 holders according to CoinMarketCap.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any project.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: melpomen/123RF

The post Top 5 DeFi Projects With the Highest TVL (June 2022) appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|