2022-3-16 02:58 |

Metaverse coins are currently under pressure. Although the broader crypto market has struggled in recent times, it seems like metaverse tokens have actually been hit hard. But this offers investors new opportunities to buy cheap assets. Is the dip worth it?

Most metaverse coins are over 90% down from recent peaks

These coins however still have so much potential.

Recent dips could be perfect for both short- and long-term plays.

Well, for dip hunters keen on the metaverse, we have created a list of three coins that should be worth it.

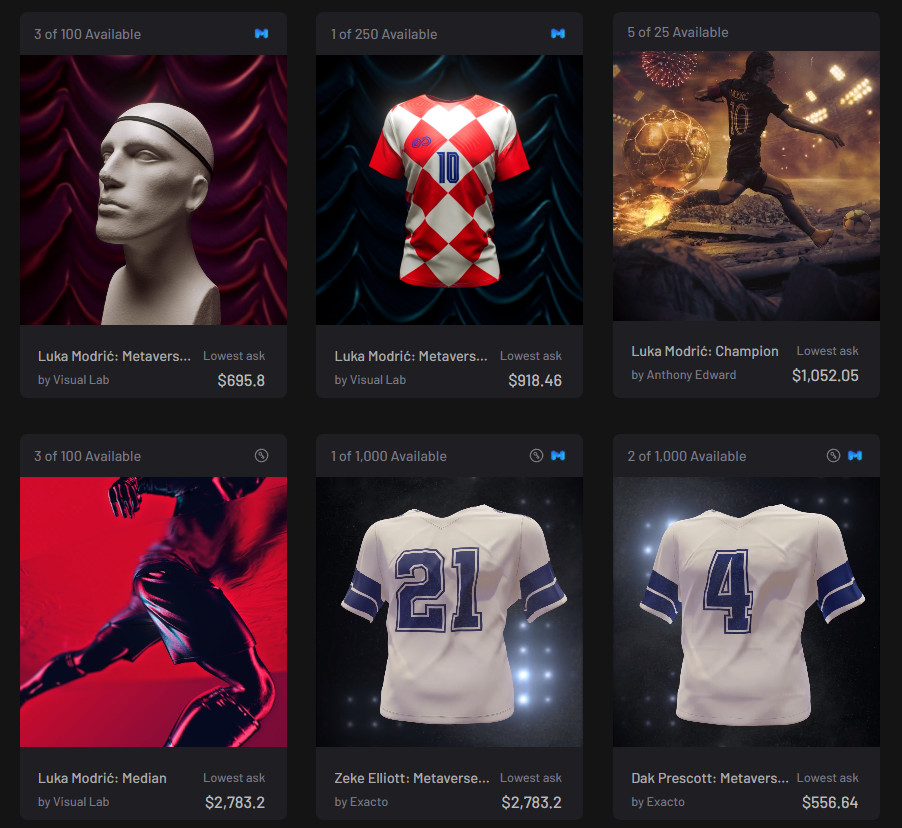

Decentraland (MANA)Decentraland (MANA) is a virtual platform that allows people to build digital communities. You can own virtual real estate here and interact with other users. MANA, the native token for the Decentraland platform, was a huge performer in 2021.

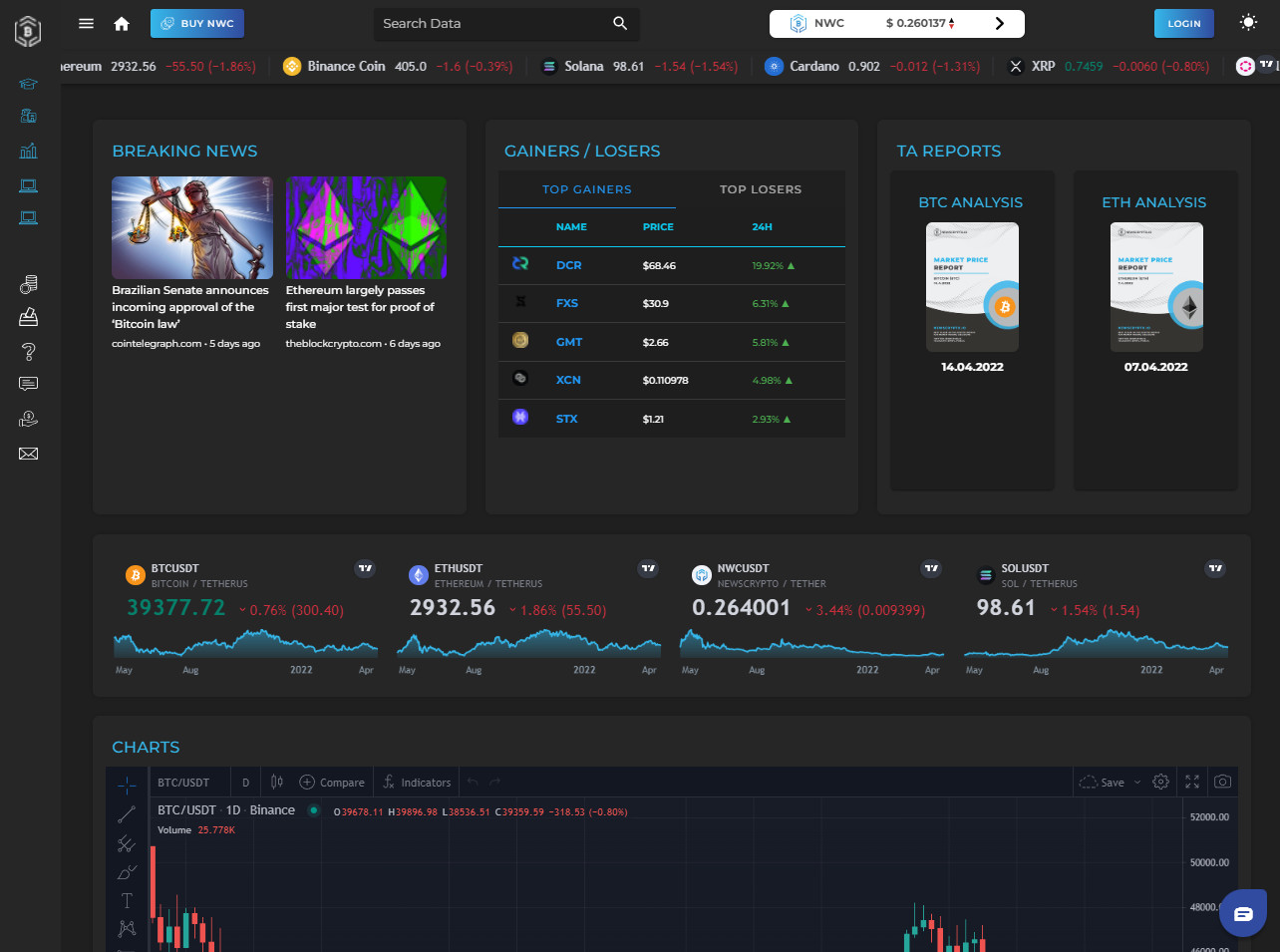

Data Source: Tradingview

But after peaking in February, it’s been free fall ever since. According to current estimates, MANA is now nearly 60% off from its recent highs. This presents the ultimate dip for both short-term traders and long investors. At press time, MANA was selling at $2.26 with a market cap of around $4.1 billion.

Victoria VR (VR)Victoria VR (VR) is a metaverse microcap that has also been feeling the pressure. The token is based on the Victoria VR MMORPG virtual reality universe. At press time, it had a market cap of about $100 million. In most cases, when large-cap coins like MANA rally, microcaps tend to see higher gains. Victoria VR (VR) could give investors a chance to make some returns.

Stacks (STX)Stacks (STX) is also another metaverse coin that has been deep in the red over the last two weeks. Like MANA, it has lost around 65% from its recent peak. Stacks is actually a very interesting project with superb long-term utility. The 65% dip is such a perfect entry for anyone interested in it.

The post Top 3 coins to buy after the metaverse bloodbath appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Metaverse ETP (ETP) на Currencies.ru

|

|