2023-10-2 19:00 |

October has dawned upon the crypto community, bringing with it a wave of speculations and analyses. A notable thread by Mags, @thescalpingpro, provides a meticulous insight into Bitcoin’s potential market movements, highlighting the possibility of Bitcoin reaching the $35,000 mark.

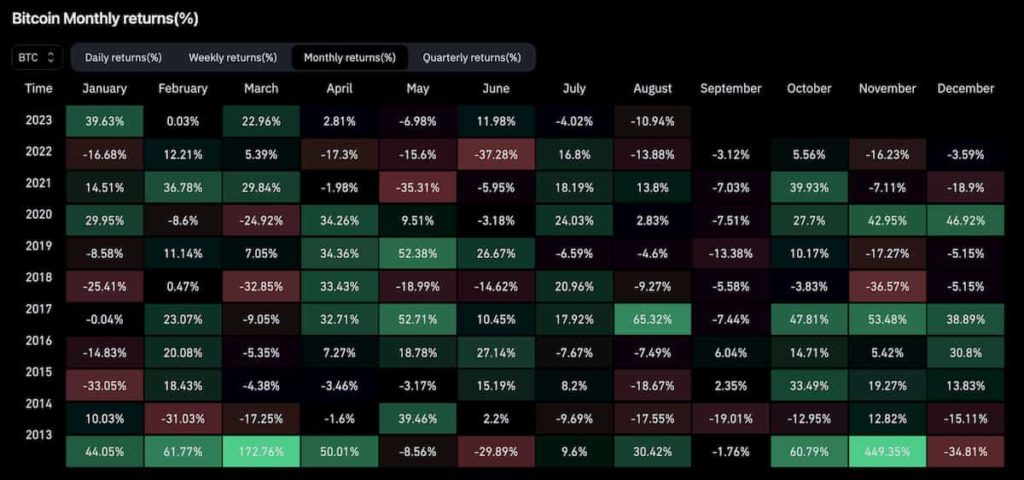

September Recap: Setting the Stage for ‘Uptober’September saw Bitcoin closing just below the $27,275 mark, thereby establishing this level as the new local monthly resistance. This pivotal closing sets the tone for October, a month historically known in the crypto world as ‘Uptober’ due to its bullish tendencies.

Key Levels to MonitorBitcoin’s price is currently encapsulated between two substantial levels:

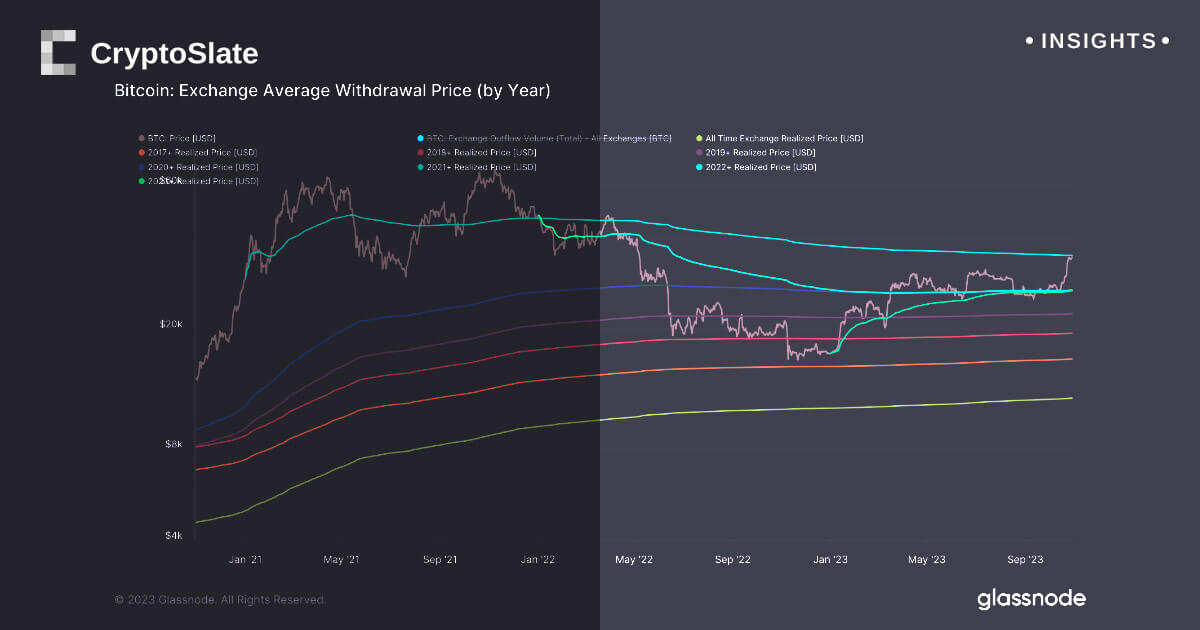

$23,400 Area: Surpassed in March, this level has evolved into a strong monthly support zone, acting as a bulwark against potential declines. $35,000 Area: This uncharted territory represents a strong monthly resistance zone, posing as a significant threshold to Bitcoin’s upward journey.Bitcoin has been maneuvering within these confines, creating a structured trading environment in recent months.

October Projections: A Glimpse into the FutureConsidering the prevailing market conditions, two potential scenarios are unfolding for October:

Scenario One: A re-test of the monthly support at $23,400 could be followed by an upward push towards the monthly resistance at $35,000, indicating a potential initial decline before a resurgence. Scenario Two: A proactive approach to the $23,400 support could propel Bitcoin towards the $35,000 resistance in the upcoming months. Market Sentiment and Analyst Perspective: A Convergence towards $35,000Currently, the market is leaning more towards the second scenario. Bitcoin has broken free from the downtrend on the daily chart, and Lower Time Frame (LTF) charts are also signaling favorable conditions. The convergence of these factors, coupled with October’s historically bullish nature, is fostering a conducive environment for Bitcoin’s potential ascent to $35,000.

Top analysts, including Mags, believe that the combination of positive market sentiment, favorable technical charts, and the historical bullishness of October create a compelling case for Bitcoin’s possible surge to $35,000. This level, if reached, could act as a catalyst, potentially triggering further upward momentum in the crypto market.

Conclusion: Navigating the Bullish Waves with CautionIn conclusion, the prevailing market structure and sentiments are painting a promising picture for a bullish October, with the $35,000 mark emerging as a plausible target. However, investors are advised to tread carefully and undertake exhaustive research, given the inherent volatility and unpredictability of the crypto market. The scenarios depicted are not absolute forecasts but potential trajectories based on existing market dynamics and historical patterns.

We recommend eToro 74% of retail CFD accounts lose money. Visit eToro Now Active user community and social features like news feeds, chats for specific coins available for trading.Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.

The post Top Analyst Reveals Why Bitcoin (BTC) Will Reach $35k in October: Identifies Key Levels to Watch appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|