2022-4-12 14:23 |

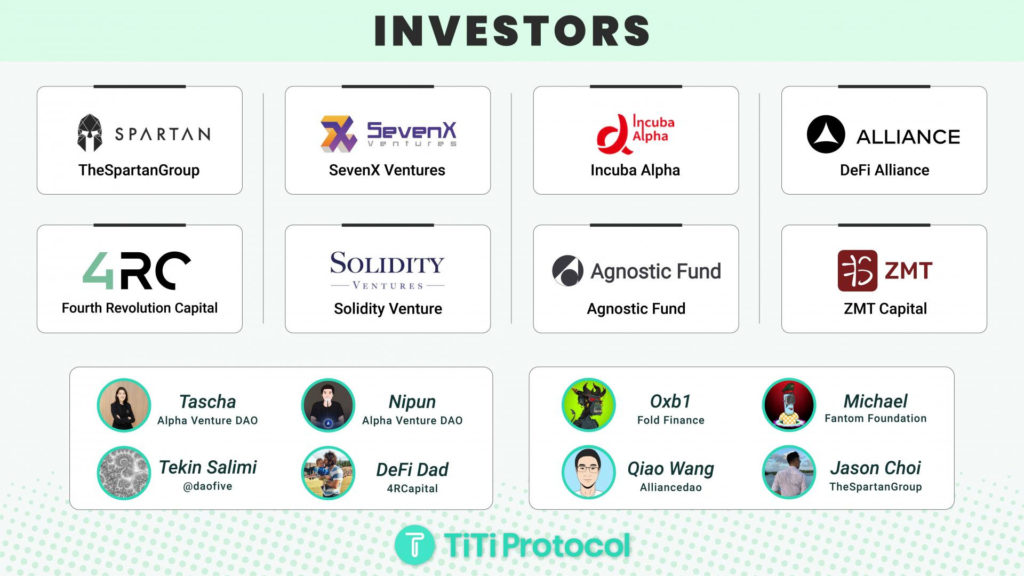

[Singapore], April 11, 2022 – TiTi protocol announces a successful fundraising round of $3. 5 million, led by Spartan Group, with participation from SevenX Ventures, Incuba Alpha, DeFi Alliance, Agnostic Fund, Fourth Revolution Capital (4RCapital), Solidity Venture, and other institutions, as well as other individual investors including 0xb1 (Fold Finance), Tascha and Nipun (Alpha Venture DAO), […] The post TiTi Protocol secures $3. origin »

Bitcoin price in Telegram @btc_price_every_hour

BlockMason Credit Protocol (BCPT) на Currencies.ru

|

|