2023-9-20 16:30 |

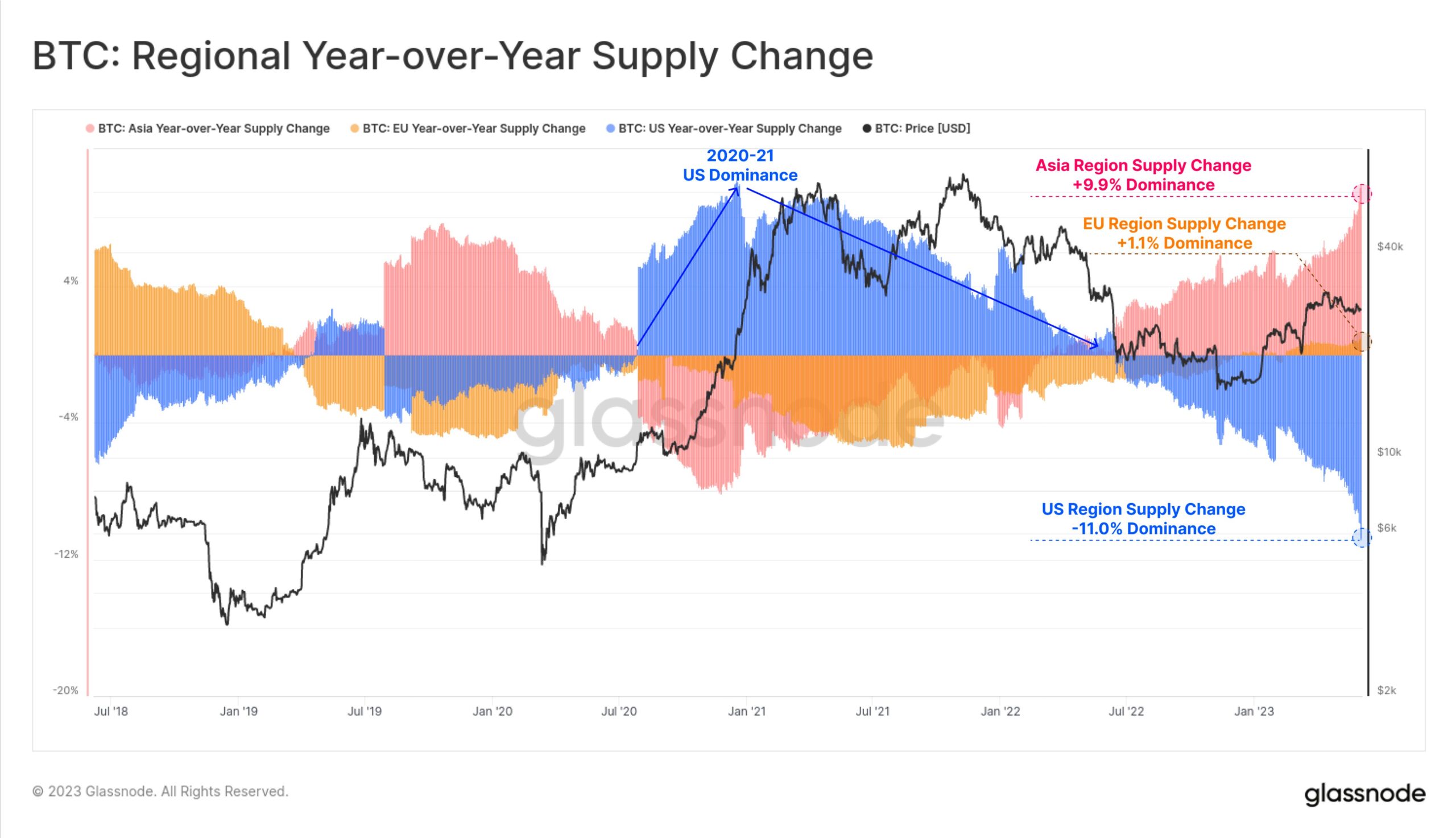

In a recent post, The DeFi Investor (@TheDeFinvestor) succinctly captured the contrasting approaches to cryptocurrency between Asia and the United States. While the U.S. remains cautious, Asia is forging ahead with crypto-friendly initiatives. This article expands on those observations, diving deeper into the current state of the global crypto landscape.

Asia’s Growing Affinity for CryptocurrencyWhile the United States grapples with regulatory uncertainty surrounding cryptocurrencies, Asia is making significant strides in embracing the digital asset ecosystem. Recent developments in the region underscore this trend:

Crypto Adoption Rankings: A recent study revealed that six out of the top ten countries leading in cryptocurrency adoption are in Asia. This indicates a robust and growing market for digital assets in the region. Japan’s Banking Milestone: Mitsubishi UFJ Financial Group, Japan’s largest investment bank, has launched a Bitcoin fund. This move signifies mainstream financial institutions in Asia are increasingly warming up to crypto investments. Thailand’s National Airdrop: The Thai government announced a national airdrop, a groundbreaking initiative that aims to distribute digital assets to its citizens. This is a strong endorsement of blockchain technology at the governmental level. Singapore’s Token2049: The Token2049 conference held in Singapore was a resounding success, attracting industry leaders and innovators from around the globe. The event served as a testament to Singapore’s status as a burgeoning crypto hub. The U.S. Regulatory Landscape: A Turning Point?In contrast, the U.S. has been cautious, if not skeptical, about the crypto industry. Gary Gensler, the current U.S. SEC Chair, has been particularly stringent in his approach to regulating digital assets. However, the winds of change could be blowing:

2024 U.S. Presidential Elections: The upcoming elections could be pivotal for the crypto industry in the U.S. Several presidential candidates have expressed support for blockchain technology and cryptocurrencies. Potential Regulatory Shift: If the next U.S. SEC Chair adopts a more crypto-friendly stance, it could mark a significant turning point for the industry, aligning the U.S. more closely with Asia’s progressive approach. The Next Crypto Bull Run: A Global Phenomenon?Should Asia continue its crypto-friendly policies and the U.S. pivot towards a more accommodating regulatory environment, the stage could be set for an unprecedented global crypto bull run. The synergy between these two major markets would not only legitimize digital assets but also propel them into a new era of financial innovation and inclusion.

In summary, as Asia continues to lead the charge in crypto adoption and the U.S. stands at a regulatory crossroads, the global crypto landscape is poised for transformative changes. The decisions made today could very well shape the financial systems of tomorrow.

We recommend eToro 74% of retail CFD accounts lose money. Visit eToro Now Active user community and social features like news feeds, chats for specific coins available for trading.Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.

The post This Will Happen If the U.S. Meets Asia’s Crypto Pace – Expert appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Electrify.Asia (ELEC) на Currencies.ru

|

|