2023-9-2 22:00 |

The trend in the total supply of the stablecoins may have hinted in advance that the Bitcoin rally wouldn’t last too long.

Bitcoin Stablecoins Supply Hasn’t Moved Much RecentlyAn analyst in a CryptoQuant Quicktake post explained that the latest news has been unable to make the stablecoins supply budge. The “stablecoins supply” here refers to the total circulating supply of all stablecoins in the sector.

Generally, investors use stables to escape the volatility associated with most coins in the rest of the cryptocurrency sector. Thus, whenever this metric rises, new tokens of the stablecoins are being minted because there is a demand for converting to them from the other assets or fresh demand is coming into the market.

Such investors who seek safety in these fiat-tied tokens usually do so because they don’t want to exit the cryptocurrency sector completely; they only require a temporary place to station their capital.

When these holders eventually find that the prices are right to jump back into the volatile coins like Bitcoin, they swap their stablecoins into them, thus putting buying pressure on their prices.

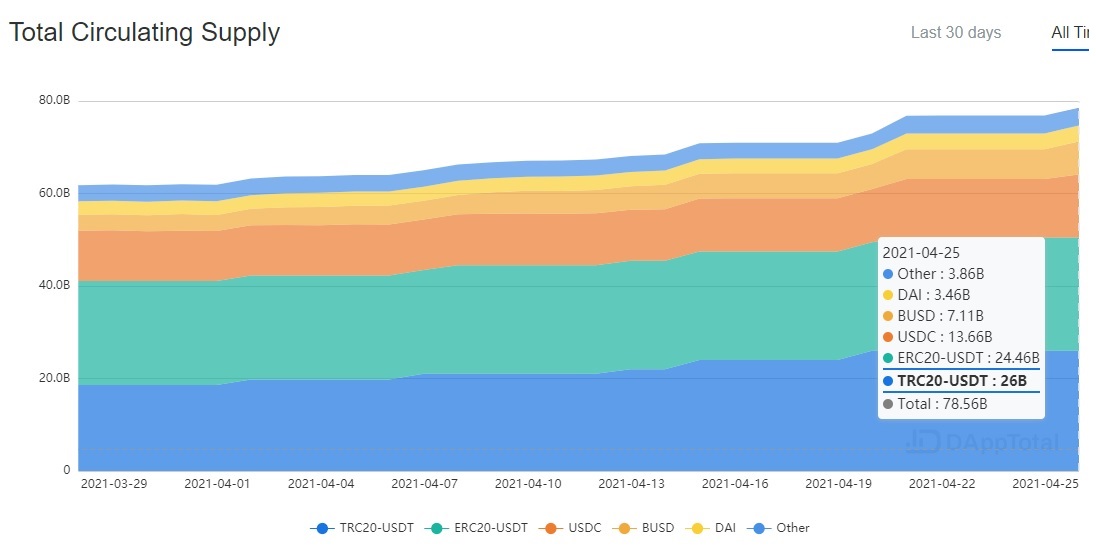

Now, here is a chart that shows the trend in the stablecoins supply over the past year:

In the graph, the quant has marked a specific correlation between the Bitcoin spot price and the stablecoin supply. It would appear that all the major increases in the former during the past year have come following rises in the latter metric.

There are three instances of this trend in this period: the first formed before the January rally, the second before the March rebound, and the third before the June surge.

From the chart, it’s apparent that the price increase in the asset wasn’t caused by the increases in the supply of the stables but rather the decline in them that followed afterward.

The increases in the supply of the stablecoins likely occurred because of fresh capital injections. When this new capital was deployed into Bitcoin and the others (when the indicator declined), the assets obtained the fuel for their rallies.

With the most recent rally in the asset instigated by the news of Grayscale’s victory against the US SEC, there was no such pattern in the supply of these fiat-tied assets.

This may have been one of the early signs that the rally wasn’t backed by constructive market growth, as the stablecoins supply has only been moving sideways. The Bitcoin retrace below the $26,000 level may have only been a natural consequence of this weak structure.

BTC PriceBitcoin had earlier fully retraced the gains of the Grayscale rally, but it would appear that the decline isn’t over just yet, as the asset has now gone below the $26,000 level it had been at before the surge.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|