2020-3-22 20:30 |

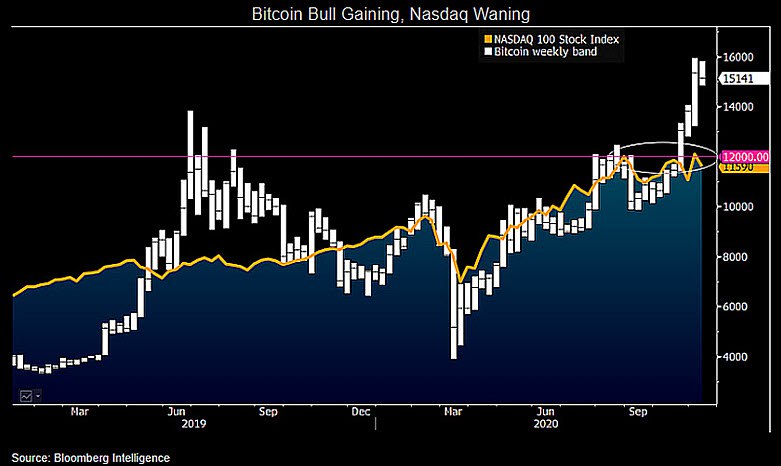

Bitcoin has found some stability within the lower-$6,000 region over the past couple of days, with its recent rally to highs of $6,900 resulting in a relatively strong rejection that has called into question the strength of its recent uptrend. Although BTC has been able to climb significantly from its recent lows within the $3,000 region, it is important to note that many analysts are now noting that the benchmark cryptocurrency appears to be in a precarious position. One top trader is now noting that Bitcoin is trading just above a make or break level that could determine its fate in the weeks and months ahead. Bitcoin Struggles to Gain Momentum as Analysts Eye Significant Downside At the time of writing, Bitcoin is trading down just under 6% at its current price of $6,190, which marks a notable decline from daily highs of $6,900 that were set at the peak of the cryptocurrency’s recent rally. In the time following this rejection, Bitcoin has entered what appears to be another consolidation phase around its current price levels, as it has struggled to garner any momentum in either direction. George, a prominent cryptocurrency analyst on Twitter, explained in a recent tweet that he believes BTC is positioned to see significant near-term downside, offering a chart showing a target within the $4,000 region. “BTC: I trailed stops to $6502 and added on full risk. MS broken, broke below key levels, think we dump more soon. Let’s see,” he noted. $BTC I trailed stops to $6502 and added on full risk. MS broken, broke below key levels, think we dump more soon. Let's see. pic.twitter.com/hDSTKRgkJF — George (@George1Trader) March 21, 2020 BTC Hovering Just Above a “Make or Break” Level TraderXO – a prominent cryptocurrency analyst on Twitter – explained in a recent tweet he believes the $5,700 to $5,800 region is a critical area for Bitcoin bulls to defend, although he believes that its market structure is still firmly bearish. “BTC – weekend charts. 57-58 is the make or break level I will be looking out for over the next several days. Various charts shared below. Bias = Bounces are for shorting until proven otherwise,” he explained. $BTC – weekend charts 57-58 is the make or break level I will be looking out for over the next several days. Various charts shared below Bias = Bounces are for shorting until proven otherwise. pic.twitter.com/JDfghdak5f — TraderXO (@TraderX0X0) March 21, 2020 If bulls are unable to defend this level in the days and weeks ahead, it is possible that a break below it will catalyze an intense selloff that leads it to reel significantly lower. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|