2019-8-17 13:30 |

The London-based Monolith just added DAI to its crypto debit card product. But the startup itself has long used DAI to manage its treasury. origin »

Bitcoin price in Telegram @btc_price_every_hour

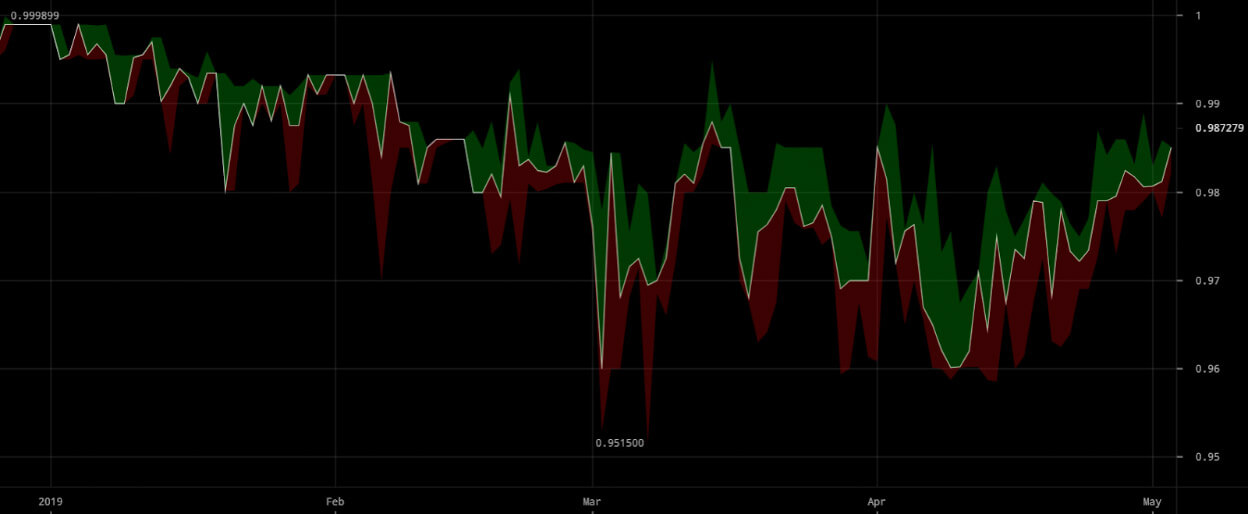

Multi collateral Dai (DAI) на Currencies.ru

|

|