2020-11-18 02:01 |

It appears that “aping” into new decentralized finance (DeFi) coins is back in vogue with Bitcoin pumping, Ethereum moving towards its summer highs, and money moving right down the DeFi risk curve. origin »

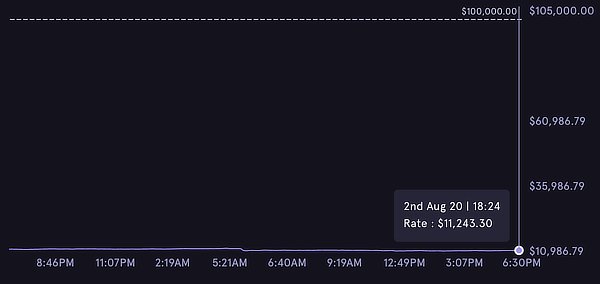

Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|