2020-5-21 23:00 |

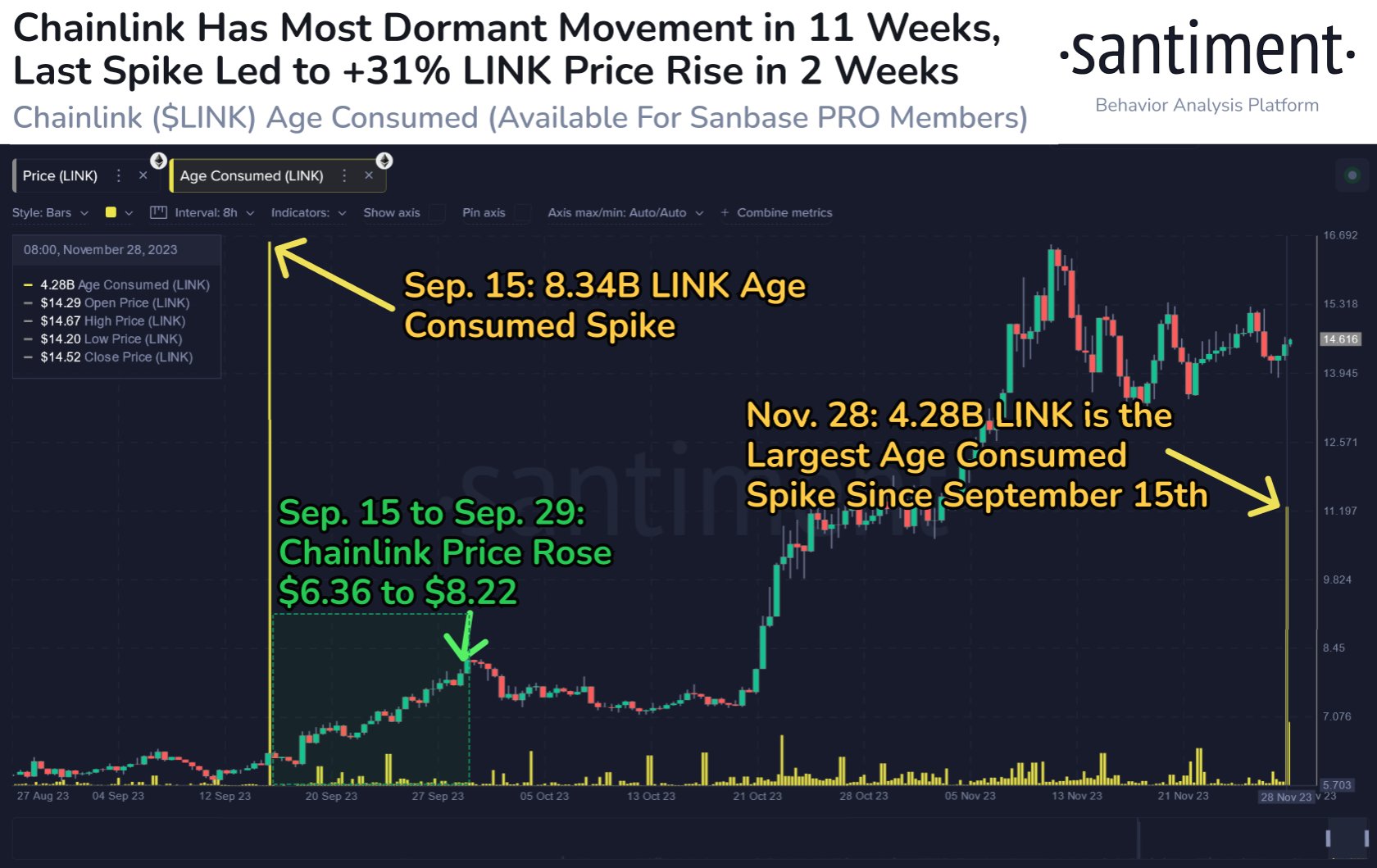

Chainlink has seen some immense bullishness throughout the past two years, but its strong market structure dates back even further In spite of the crypto’s ongoing upswing that has led it past $4.00, analysts are still cautious about where it may go next One trader is even noting that he believes it will soon invalidate a key growth curve that has been pivotal to its multi-year uptrend Chainlink’s immense bullishness seen throughout 2019 and 2020 has allowed it to recently set fresh all-time highs. Although it has underperformed against Bitcoin throughout the past several weeks, it is now moving to gain ground against the benchmark crypto. Analysts are noting that this immense parabolic ascent seen in recent times has been guided by a growth curve formed over a three-year period. It is now nearing the end of this curve and is even risking invalidation as it still flashes some signs of weakness against its Bitcoin trading pair. If it is able to thwart this potential market structure invalidation, however, it could be poised to see major upside. Chainlink Gains Against USD But Still Flashes Signs of Weakness Against Bitcoin Chainlink has been able to post a notable overnight upswing that has allowed it to gain ground against both Bitcoin and the USD. At the time of writing, the crypto is trading up just under 6% at its current price of $4.09, while trading up 5% against BTC. The growth seen today marks an extension of the uptrend seen throughout the past four days. This momentum has allowed Chainlink to climb from lows of $3.60 to highs of $4.10. It does appear to be facing some resistance at its current price level. In spite of this, investors are still optimistic about where the crypto trends next, with one analyst noting that a hold above support at $4.00 could be enough to spark a movement up to $4.90 – around where its all-time highs are established. “Holding the $4 level as support and I see continuation towards $4.60-4.90 as likely.” Image Courtesy of Crypto Michael Here’s Why It’s Too Early to Forecast Another Parabolic Rise In spite of it flashing signs of strength presently, analysts are noting that it is still at grave risk of invalidating its macro market structure. Another pseudonymous trader spoke about this, explaining that the parabolic growth curve is beginning to run out of room, signaling that the crypto could soon lose its momentum. “LINK: Wouldn’t rush into a trade here. 3 Year parabolic advance potentially ending however still bullish imo as long as 33k sats holds. Losing that would end the 3 years of bullish macro structure.” Image Courtesy of Pentoshi How it trends in the weeks ahead should provide vital insights into just how much longer its macro strength can last for. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) íà Currencies.ru

|

|