2021-12-30 18:40 |

Maker MKR/USD is a governance token of the MakerDAO as well as Maker Protocol, which is a decentralized organization and software platform based on the Ethereum blockchain.

Through MKR, users can issue and manage the DAI stablecoin.

Aave AAVE/USD is a decentralized finance protocol that facilitates the process of lending and borrowing cryptocurrencies.

AAVE is the governance token that gives owners a say in the future development of the protocol.

1inch 1INCH/USD is a decentralized exchange that attempts to offer the best rates through discovering efficient swapping routes across all DEXes.

The 1inch network’s governance token is 1INCH and is used to vote on proposal parameters through the decentralized autonomous organization (DAO) model.

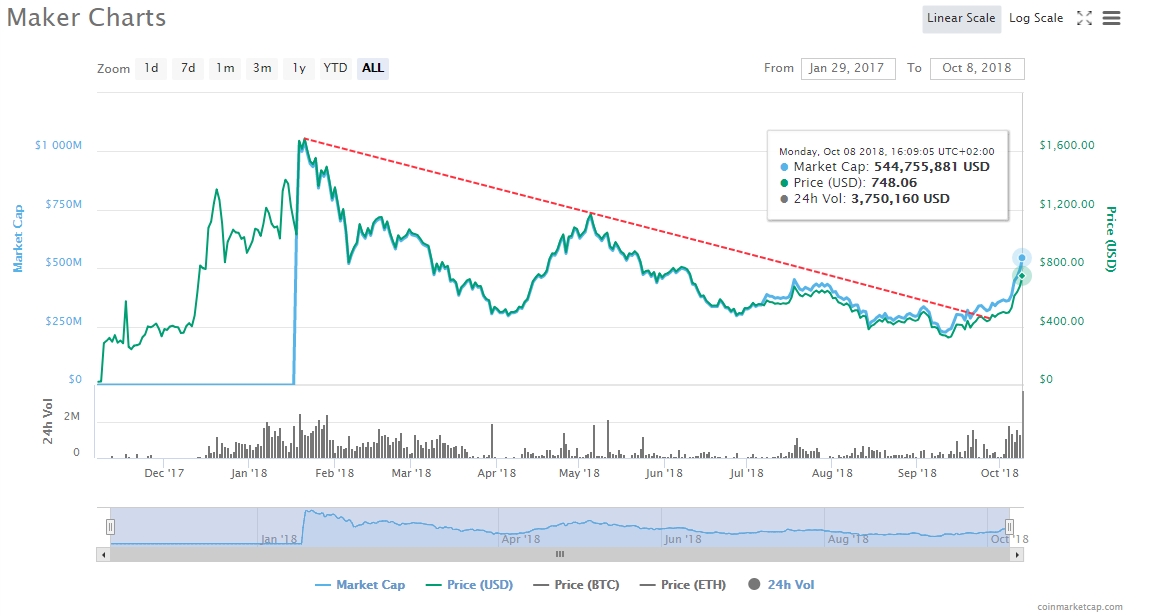

Should you buy Maker (MKR)?On December 29, Maker (MKR) had a value of $2,498.81.

To get a better perspective as to what this value point means for the MKR token, we will go over its all-time high value alongside its recent performance.

MKR’s all-time high value was on May 3, when it reached a value of $6,292.31. At its ATH value point, the token was $3,793.5 higher in value or by 151%.

When we look at November November 1, the token had its lowest point of value at $2,373.53.

Its highest value point, however, was on November 3, when it reached $3,542.97. The token increased in value by $1,169.44 or by 49%.

From November 3 to December 29, the token decreased by $1,044.16 or by 29%.

Based on its historic growth, we can expect MKR to reach $2,600 by the end of January 2022, making it a solid buy.

Should you buy Aave (AAVE)?On December 29, AAVE had a value of $251.75

To get a solid estimation as to what this value point means for the token, we will discuss its all-time high value and performance in November.

Aave reached an all-time high point of $661.69 on May 18. Here, we can see that the token was $409.94 higher in value at its ATH value point or by 162%.

On November 9, the token had its highest point at $346.86.

Its lowest value point, however, was on November 28, when it decreased in value to $224.69. Here, we can see that the token decreased in value by $122.17 or by 35%.

However, from November 28 to December 29, the token increased in value by $27.06 or by 12%.

With that in mind, we can expect AAVE to reach $300 by the end of January 2022, making it a solid token to buy.

Should you buy 1inch (1INCH)?On December 29, 1inch (1INCH) had a value of $2.55.

With the goal of establishing what this value means for the 1INCH token, we will go over the performance last month and its ATH value.

1inch had its all-time high value on October 27, when It reached $8.65 in value. At its ATH value point, the token was $6.1 higher in value or by 239%.

When we look at the token’s performance in November, we can see that on November 2, it reached its highest value at $4.74.

Its lowest value of the month was on November 28, when it reached $3.47. Here, we can see that the token decreased in value by $1.27 or by 26%.

With that in mind, we can expect 1INCH to see an increase to $3 by the end of January 2022, making it a solid buy.

The post The top 3 governance tokens worth your attention on December 29, 2021: MKR, AAVE and 1INCH appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Maker (MKR) на Currencies.ru

|

|