2023-9-1 18:00 |

The Cambridge Centre for Alternative Finance (CCAF) has revised its Bitcoin electricity consumption estimates, addressing longstanding concerns about the accuracy of its Cambridge Bitcoin Electricity Consumption Index (CBECI). The new study, titled “Bitcoin electricity consumption: an improved assessment,” dated August 31, 2023, has ignited discussions among crypto enthusiasts and environmentalists alike.

Cambridge Revises Down False Bitcoin Energy EstimatesDaniel Batten, a prominent climate activist and Bitcoin environmental analyst, was quick to weigh in on the matter. He tweeted, “Cambridge have just updated their Bitcoin power/energy consumption methodology. It’s decreased around 25% and is now looking much more accurate. My model says 13.095 GW. Very similar to Cambridge now.”

Batten further elaborated on the key takeaways from the revised study: The CCAF model overestimated the BTC energy demand by 16.8% in 2021, and 10.2% in 2022. This is in alignment with his previous research where he suggested earlier this year that their model was overestimating by 20.6%.

He debunked Greenpeace USA’s claim, stating there’s “clear evidence that Greenpeace USA’s claim that Bitcoin used as much energy as Sweden was incorrect, and was based on CCAF historical overstatements.”

On a lighter note, the CCAF’s new estimates equate Bitcoin’s energy use to “tumble dryers in the US.” Batten also highlighted that while CCAF has adjusted their energy consumption figures, they “have not yet revised their emissions estimates beyond the direct impact of revised energy consumption.”

Batten also pointed out that the emissions are still overestimated by 67.6% due to outdated emission intensity calculations. He commended CCAF for their transparency and alignment with industry data, stating, “While there is still much work to do on the emissions estimate side, CCAF should be praised for updating their model.” He further agreed with CCAF’s potential to reduce their emission estimates to around 34 Mt CO2e/year once certain factors are considered.

The CCAF report delved into the reasons behind the discrepancies in their previous model. It stated, “The backbone of our previous CBECI methodology was the assumption that every profitable hardware model released less than 5 years ago equally fuelled the total network hashrate.” This led to an overrepresentation of older devices.

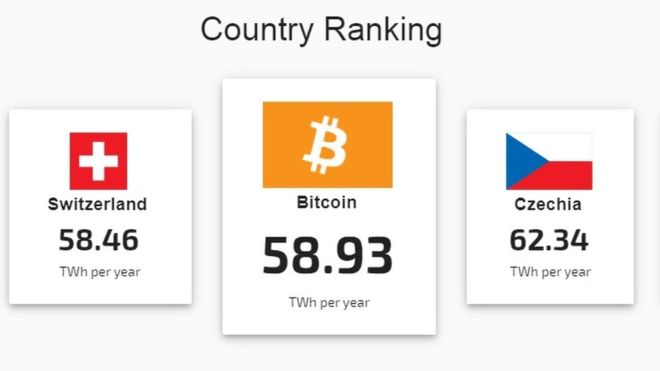

Upon re-examination, they found that newer equipment was underrepresented. This resulted in a significant discrepancy in the 2021 and 2022 estimates, which have now been revised to 89.0 TWh and 95.5 TWh respectively.

The Tide Has TurnedBatten, in a subsequent tweet, declared, “OK I’m calling it. The tide has turned in the narrative around Bitcoin & energy.” He cited recent acknowledgments from Cambridge, academic papers, and a KPMG report that gave Bitcoin a positive ESG rating. He cautioned, however, that misinformation still persists, particularly from outlets like the NY Times and Greenpeace USA.

Batten concluded with a hopeful note, emphasizing that while there’s work to be done in educating the public about Bitcoin’s energy consumption, “The process has begun. The tide has turned.”

For those interested in delving deeper into the revised estimates and the methodology behind them, the full report is available at Cambridge’s official website.

At press time, BTC traded at $26,041.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|