2019-5-13 22:57 |

In early April bitcoin prices broke out, surging on news that the US Securities and Exchange Commission would allow two companies to create a cryptocurrency ETF. If this occurs, it will be the first time that US traders, will have access to cryptocurrencies through equity-like instruments. A measure like this could enhance the volume that is experienced in the cryptocurrency market on a daily basis.

Bitcoin is Breaking HigherBitcoin prices have recaptured the 6K handle for the first time in 6-months. As riskier assets came under pressure in late 2018, bitcoin prices tumbled, pushing the worlds most liquid cryptocurrency down to 3,215. Prices have nearly doubled since hitting their lows in December of 2018, and are poised to test the top of a new range if prices can steady at these levels. The new range would be floored by 6K and the cap would likely be the July 2018 highs at 8,500. This new range would provide cryptocurrency traders with some hope that prices could begin to find a new uptrend, washing away the negative sentiment that has encapsulated the cryptocurrency market for all of 2018. You can trade and graph bitcoin prices on a crypto currency trading platform.

The downtrend in the cryptocurrency markets has enhanced negative sentiment which has eroded volumes seen in digital currencies. Volumes hit their peaks in December of 2017, as bitcoin roared to 19K. The decline in the price and lack of interest in shorting the cryptocurrency market has allowed hot money to venture away from the cryptocurrency trading arena. For a while, hot money traders focused on cannabis stocks, but with bitcoin prices recapturing the 6K handle, hot money will likely be back. The hot money can generate additional volatility and in the cryptocurrency market that could mean spikes, as well as, volatile drawdowns.

The Positive and the NegativesCryptocurrency trading has seen its fair share of disappointing news. New information in the form of one-off events that create excess volatility. For example, large scale hacks, and negative SEC files can generate volatility. The long term fundamentals appear to be buoying the price. As bitcoin adds to its payment network and Ethereum introduces mainstream contracts, the price of the major coins might continue to experience an upward trend.

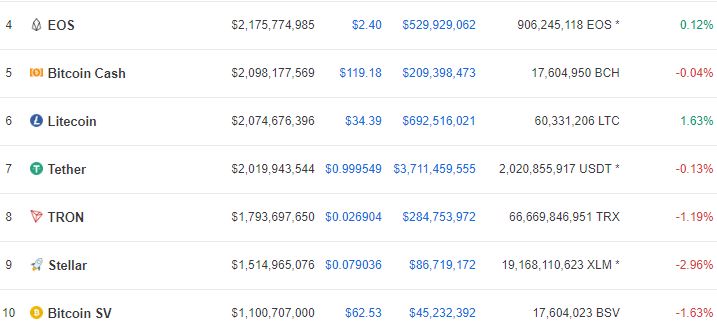

Not All Coins are RisingWhile bitcoin and Ethereum are trending higher, other coins are not following suit. Ripple’s XRP appears to be stuck and moving sideways, while Litecoin has formed a bull flag consolidation pattern. Generally, this is the pause that refreshes. Maybe only the most liquid will survive, but alternatively, once bitcoin volume increases, the positive sentiment could spill over allowing the rising tide to lift all boats.

The post The Second Quarter Has Been Kind to the Crypto Markets appeared first on ZyCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|