2020-7-29 21:28 |

Ripple CTO David Schwartz continues to explore the wider world of blockchain and digital assets on the Block Stars podcast. In the latest episode, he talks with Professor of Economics and Political Science at the University of California, Berkeley, Barry Eichengreen, about the current state of the global economy and where digital assets fit in a post-COVID climate.

As an economic historian, Barry usually looks to the past as a guide for understanding today’s economic problems. However, he admits that the impact of 2020’s global pandemic has few parallels from the past.

“We’ve never really had a crisis before that was precipitated by the need to shut down the economy,” he explains. “Typically, what you have is demand collapsing because of a financial crisis or bank failures or something. [It’s] very fast moving. This one is kind of going to be a slow-motion crisis. I don’t think there are really good historical analogies for what we’re about to go through.”

While he believes that governments have been right to provide funding to save businesses and preserve jobs, Barry acknowledges that today’s stimulus will likely lead to tomorrow’s problems.

“This pandemic is tantamount to fighting a war,” he states. “I think [governments have] to do what it takes to keep financial markets functioning…by buying everything that moves. There will be a bill to pay down the road.”

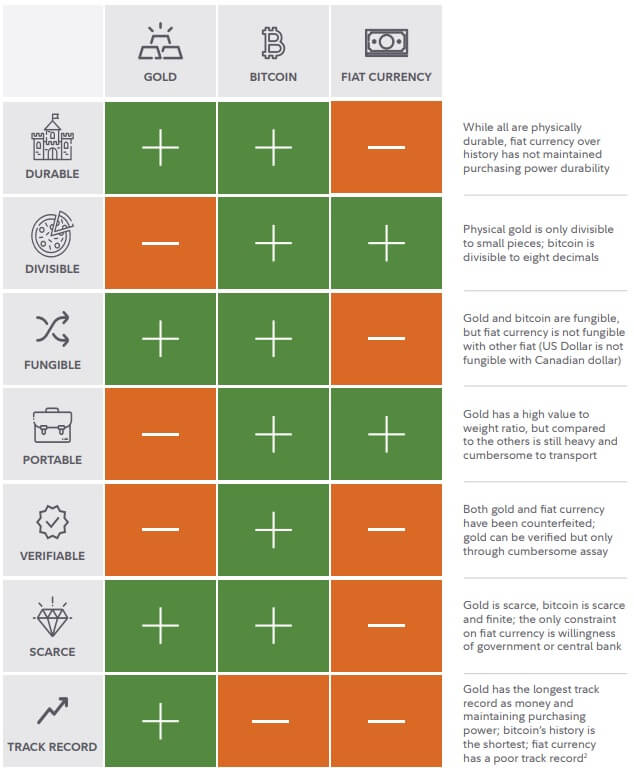

Some people believe increased liquidity in the market will lead to hyper-inflation and are looking for investment opportunities that can maintain value if dollar prices soar. Gold is traditionally considered a safe bet, while digital assets are increasingly seen as a new inflation hedge.

“Gold doesn’t really have any intrinsic value,” says Barry. “People [believe] it will hold its value because other people value it. There is, from that point-of-view, a parallel with cryptocurrencies. There isn’t an industrial use for Bitcoin any more than there is for gold. People pay actual U.S. dollars for it because they think other people will value it and pay actual U.S. dollars for it.”

Given Bitcoin’s history of price volatility, some investors are exploring stablecoins as a more reliable store of value. Yet Barry notes that most of these coins are stabilized by being pegged to the U.S. dollar and if the dollar loses its purchasing power due to high inflation, the same will happen to the stablecoin. Yet he remains optimistic that some digital assets will prove their value over the long term.

“I don’t think that thinking about crypto as speculative investments is really a long-term viable business model,” predicts Barry. “Speculative investments have come and gone throughout history. Tulips came as a speculative investment and they went. [Digital assets] that provide actual tangible services like cross-border payments are the ones that are likely to have legs.”

Barry points to a very recent example of where blockchain-based payments could have provided a more effective way for the U.S. government to get stimulus funds to millions of people around the country. The debate about whether to create a central bank digital currency (CBDC) or other blockchain solution will continue, especially given the continued global uncertainty caused by COVID. When David asked him for an economic outlook for the coming year, Barry replied:

“Better to ask an epidemiologist than an economist. The virus is still out there and as long as that’s the case, states and countries that open up will have to close down periodically. That will be a bumpy ride.”

Check out the latest episode of Block Stars for David’s full conversation with Barry Eichengreen, which also includes his thoughts on digital asset regulation, why hyper-inflation remains unlikely and whether he really believes that Facebook’s Libra project is a terrible idea.

The post The Role of Digital Assets in a Post-COVID World appeared first on Ripple.

origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|