2020-6-23 23:00 |

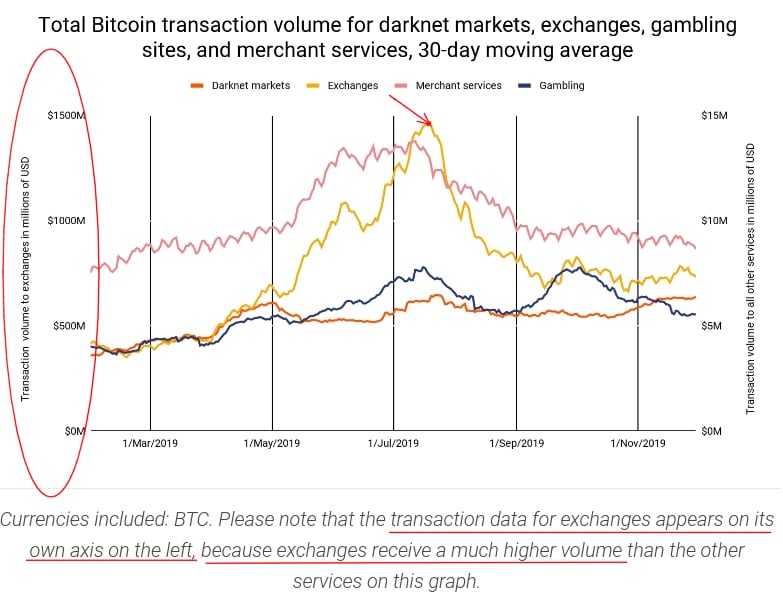

Ethereum has been moving in close tandem with Bitcoin throughout the past several days and weeks, struggling to garner any independent momentum as it ranges This sideways trading has done little to bolster the cryptocurrency’s bull case That being said, analysts have been pointing to its fundamental strength as a reason why it may soon explode higher Data seems to suggest that the crypto only has a 7% chance of seeing any type of intense parabolic rally before the end of the year This chance is degrading by the day too, as ETH may be growing weaker the longer it consolidates Ethereum and the aggregated cryptocurrency market has been able to post some upwards momentum over the past day, with buyers attempting to catalyze enough buying pressure to invalidate its recent weakness. This movement has been tempered, however, and heavy resistance just above ETH’s present price level may prove to be insurmountable in the near-term. New data also shows that the cryptocurrency’s mid-term outlook may not be too bright, as there is only a 7% chance that it climbs by 100% from its current price levels by the end of the year. This comes despite there being many positive fundamental developments seen over the past few months. Ethereum’s Technical Outlook Weakens Despite Strong Fundamentals Ethereum has formed a relatively wide trading range over the past several days and weeks, struggling to garner any decisive momentum as it trades between $230 and $255. Earlier this week, the crypto’s sellers did attempt to push it down below the lower boundary of this trading range. This movement was short-lived. It now appears that the cryptocurrency’s technical situation still remains weak. Bitcoinist reported yesterday that one venture capitalist recently claimed that the chances of Ethereum reeling lower grow the longer it remains in this trading range. “The longer BTC & ETH fade here the more likely we take another leg down to test key supports, despite the strong fundamentals of both.” This weakness comes despite it seeing immense strength on its fundamental front. In addition to seeing heightened stablecoin issuance, the DeFi ecosystem has also seem a massive amount of growth in recent times, driving a significant amount of usership and utility to ETH. ETH’s Chances of Going Parabolic in 2020 are Slim In spite of this fundamental strength, Ethereum does not appear to have a great chance of seeing any type of parabolic 100%+ movement by the end of the year. According to recently released data from analytics platform Skew, the probability of ETH climbing to $480 by the end of the year sits at 7%. “Probability of ether > $480 (+100%) by End of Year = 7%. Stable coins and DeFi seems like a more sustainable product / market fit for Ethereum compared to ICOs in 2017 but the market doesn’t see it (yet?) necessarily as adding as much $ value for ether,” they noted. Featured image from Shutterstock. origin »

Bitcoin price in Telegram @btc_price_every_hour

ANYONE (ANY) на Currencies.ru

|

|