2026-2-8 12:50 |

The precious metals space has been a mess lately. Silver ripped higher, then collapsed almost 30% in what felt like days, and mining stocks have been swinging like meme assets. For most traders, that kind of volatility looks like danger. For macro investors, it looks like a reset.

That’s exactly the framing financial analyst Kevin Smith is pushing in a recent viral post, where he argues the pullback in gold, silver, and miners is not the end of the move, but the beginning of a much larger cycle.

His core point is simple: the dollar may be entering a third historic devaluation wave, and silver could end up being one of the most explosive trades of the decade.

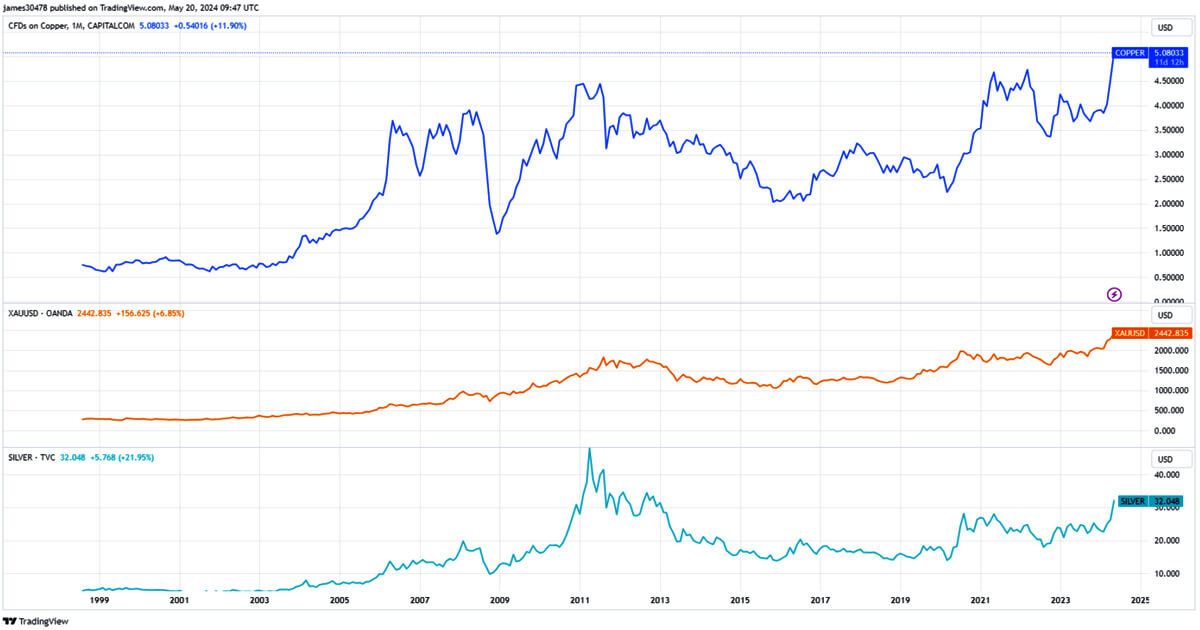

The Chart’s Message: Gold vs. Stocks Tells the Dollar StorySmith’s chart tracks gold relative to the S&P 500 over nearly a century, and it highlights three major periods where the dollar lost real purchasing power in structural waves.

When gold begins outperforming equities over long stretches, it’s usually not because investors suddenly love metals. It’s because confidence in the currency and the financial system is quietly eroding.

The chart marks two clear historical devaluation eras:

The first came during the Great Depression, when the US government forced citizens to surrender gold and then officially devalued the dollar by raising the gold price.

The second began in 1971, when Nixon closed the gold window, ending the Bretton Woods system and allowing the dollar to float freely. That decision unleashed a decade of inflation and a massive repricing of hard assets.

Source: X/@crescatkevinSmith argues we are now approaching the third.

The “False Start” in the 2000s Was Only the Warm-UpThe chart also points to what Smith calls a “false start” in the early 2000s.

Gold surged during the dot-com collapse and again during the 2008 financial crisis, but the system never fully reset. Instead, the US responded with financial engineering: low rates, QE, and an ever-growing debt burden.

That delayed the cycle, but didn’t eliminate it.

Now, the pressure is back, except the imbalances are far larger.

US deficits are historic. Debt servicing costs are rising. Equity valuations, especially in megacap tech, are stretched to levels that resemble 1929, 1972, and 2000.

That’s the backdrop Smith believes sets up the next major rotation.

Read also: Silver Price Crash Is Over “For Real This Time,” Analyst Predicts a Surge Back Above $90

Why Silver Matters More Than Gold in This SetupGold is the headline hedge. Silver is the volatility hedge.

Silver tends to lag early in macro cycles, then violently catch up once capital starts moving into hard assets in size. It’s smaller, thinner, and far more sensitive to both investor flows and industrial demand.

That’s why silver doesn’t grind higher. It snaps.

And Smith’s point is that the recent correction is not bearish. It’s a healthy pullback from overbought conditions before the next leg higher.

If the dollar devaluation thesis plays out, silver historically becomes one of the biggest upside expressions of that trade.

Read also: This Analyst Makes Urgent Silver Price Prediction

The Great Rotation Has Already BegunSmith describes what he calls the “Great Rotation” as a shift away from:

US megacap tech

Large cap stock indices

The US dollar itself

And into:

Precious metals like gold and silver

Critical materials

Resource equities

Foreign markets

This isn’t a retail narrative. It’s the kind of institutional repositioning that happens over years, not weeks.

The chart’s implication is that gold’s outperformance versus stocks may be entering an early-stage breakout, similar to prior devaluation cycles.

And if gold is starting that move, silver usually follows with far more torque.

Why the Recent Silver Crash Might Not Be the EndThe past few months have shown something unusual: commodities swinging 15–20% like crypto.

Silver touched extreme levels, then dumped hard, shaking out late buyers and leverage.

Smith argues this is exactly what happens at the beginning of new macro cycles. The early phase is messy, violent, and emotionally exhausting.

But those conditions often create the entry points that look obvious only in hindsight.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post The Next Dollar Collapse Has Started—And Silver Could Be the Trade of the Decade appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

LikeCoin (LIKE) на Currencies.ru

|

|