2022-4-19 19:00 |

Bitcoin users need to seriously consider their plan for what will happen to their bitcoin when they pass away. Having an estate plan is necessary.

Have you thought about what will happen to your bitcoin when you die? For many of us, the thought has at least crossed our mind. But the number of HODLers we know that have actually put in place a legally sound plan of action ensuring both the sovereignty and privacy of their holdings is very few. This is understandable. For starters, most of us don’t expect to die anytime soon. Even those of us who have planned ahead with a well-crafted testamentary device still likely haven’t considered the nuance of proper estate planning for digital assets. And there is no digital asset we know of whose custody and conveyance requires more nuance than bitcoin.

Most people think about trusts in terms of an irrevocable trust. These trusts can be an excellent tool to confer tax advantages to both your estate and beneficiaries if crafted properly. Under such circumstances, legal and equitable title must be split between trustee and beneficiary, meaning the grantor necessarily cedes either legal control or, perhaps more commonly, a portion of his equitable claim to the trust property. While this may be perfectly acceptable for some, others may balk at the mere thought of imposing any limitations on the use and enjoyment of their bitcoin while alive. Here we will examine the revocable living trust as an estate planning instrument for your bitcoin.

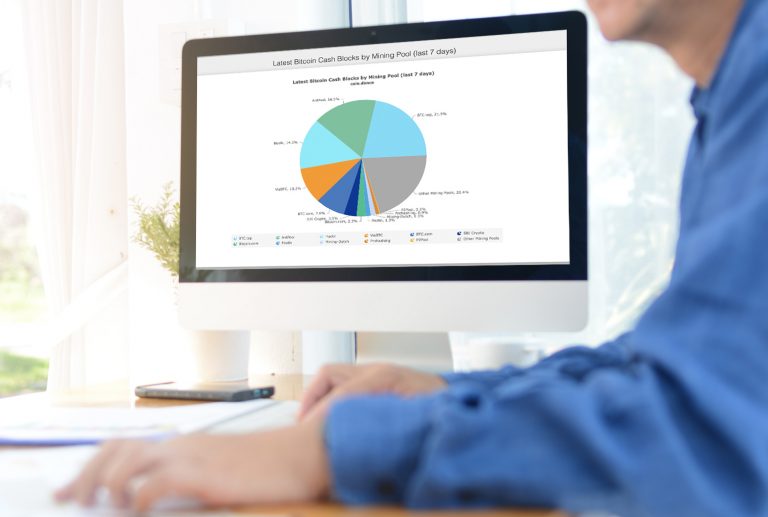

Do you know what will happen to your bitcoin when you’re gone? (source) Will Your Bitcoin Be Secure If You Die Tomorrow?For those of us that have gone through the trouble of setting up a properly executed will, there’s a tendency to treat our bitcoin in the same manner we treat dollars in an account. This may work out just fine if our assets are held on an exchange like Coinbase or Gemini, but what if they’re not? If you died tomorrow, would your next of kin know how to access your funds? Would they know what to do with the seed phrases you buried next to the tree in the backyard, or how to interpret BIP39 punched into steel?

In a rapidly growing number of instances, proper estate planning requires a level of technical competence and understanding that the majority of estate planners do not possess. With the trend continuing towards technological decentralization, an increasingly significant portion of a decedent’s assets will no longer be accessible with a mere email or letter to the decedent's bank, stockbroker or bitcoin exchange.

Self-custodied bitcoin requires more than an account password to assume ownership. (source) Digital Asset Protection Trusts And How They FunctionDigital Asset Protection Trusts are a relatively new element of an estate plan. Lawyers in the estate planning community are beginning to realize that an increasing portion of an individual’s net worth can be found in this rapidly-evolving asset class. The legal community has been forced to account for cryptocurrencies, NFTs, digital photo accounts, email accounts, social media profiles and so on. While lawyers react to the idea that someone’s Twitter profile, or Bored Ape NFT is worthy of new regulation, we look to these regulations in the context of the primary digital asset we believe is worthy of preservation: bitcoin.

Revised Uniform Fiduciary Access To Digital Assets Act (RUFADAA)Most states have either adopted the RUFADAA or plan to. In many instances, RUFADAA will empower the executor of your estate with the authority to request access to most of your digital assets in a manner that takes into account your privacy interests and the terms of service agreements of the big tech companies. But when it comes to permissionless, decentralized monetary energy, e.g., bitcoin, the RUFADAA will be of little use on its own.

This is why we at BTC Trusts recommend placing your bitcoin into a living trust. A living trust will allow you to maintain access to your assets in the same manner as you do today, but also rest assured that if the unexpected happens, those assets won’t be lost, forgotten or misused.

Achieving Maximum Flexibility With A Revocable TrustWith a revocable trust, you may elect to act as the trustee of your digital assets pending a future event, e.g., death or disability. As both the grantor and trustee, you are free to change or amend the trust as often as you like. Unlike an irrevocable trust, the property is not protected from creditors and even though it technically belongs to the trust, it will not receive any special tax treatment while you’re alive. However, provided these assets can be managed distinctly from non-trust property, a revocable living trust can be crafted to convey your bitcoin to your heirs without limiting your use or enjoyment of those assets while you’re alive.

Documenting A Secession Plan Without Compromising Privacy“Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn’t want the whole world to know, but a secret matter is something one doesn’t want anybody to know. Privacy is the power to selectively reveal oneself to the world.” — “A Cypherpunk’s Manifesto” Eric Hughes

Is privacy important to you? You may or may not be aware that whether you have a will or not, the assets of your estate will pass through a legal process known as probate. Probate is a legal process that becomes public record. If you don’t want the public to know how many bitcoin your next of kin just took possession of, probate is something you want to avoid. Setting up a revocable trust or testamentary trust for your bitcoin will allow you to maintain the privacy of your holdings — something your heirs are likely to appreciate.

Disposition through probate could expose the contents of your estate to the world. (source)How you store and manage your bitcoin while you’re alive is up to you. At BTC Trusts, we find that most of our clients with significant holdings will choose to secure their digital trust property via noncustodial, cold storage solutions. While this provides the highest level of security and privacy, it also introduces a level of technical complexity into the conveyance. Accounting for this is an aspect often overlooked at traditional estate planning firms. That’s why it’s important to select an estate planning firm that can ensure the conveyance is well documented not just legally, but in a technically sound manner as well. A competent digital-estate planner will work with clients to craft the best possible conveyance plan that will maximize security without introducing uncertainty or confusion. Don’t forget — you won’t be around to answer questions if something is unclear. Your estate planner should consider the use of smart contracts, multisignature cold storage and encryption when crafting the optimal manner to effect the conveyance.

Get In Touch For A Free ConsultNow is the time to plan for the unexpected. If you hold significant value in bitcoin, a proper estate plan is going to be needed at some point. The sooner this is in place, the more protection and more value it will provide. Take the first step and reach out today. We’ll be able to share our insights to tailor a plan that works for you and your family.

(Source)This is a guest post by Scott Worden. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|