2021-2-6 21:31 |

Transforming art into a lucrative investment option through tokenization will weed out a number of issues plaguing the thus far regressive industry not equipped yet for the age of digitization.

2018 was a successful year for the art industry as several auction records were broken: a painting by British artist David Hockney was sold for a record sum of over $10 million and over 40 million transactions were conducted.

For an illiquid industry, this large figure indicates the overall significance and perfect fit for tokenization and the peer-to-peer-oriented blockchain technology.

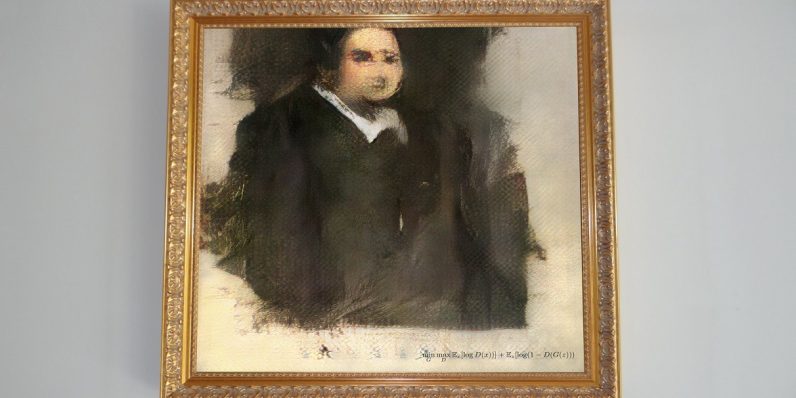

Also in 2018, a substantial landmark in the tokenization of art occurred: the first-ever tokenization of an artwork by the art investment platform Maecenas. They partnered with London-based gallery Dadiani Fine Art to mint and issue fractional stakes in Andy Warhole’s “14 Small Electric Chairs.”

Here, 31,5% of the overall value was tokenized and the respective tokens issued. Even purchasing these tokens with crypto assets such as bitcoin (BTC) and ethereum (ETH) was possible, pushing the total crypto share in the work close to an impressive $6 million.

On Oct. 11, 2018, Christie’s partnered with blockchain secured registry Artory to conclude the sale of a $318 million Barney A. Ebsworth collection, entirely on a blockchain-based system.

Ensuring easier access to the marketTokenizing art allows for easier access to the market, removes diversification-limiting obstacles and grants smaller investors access to this exciting market. This will result in an increase of liquidity and especially additional capital inflow will exponentially grow along mainstream adoption for tokenization.

Ethereum-based ERC20 tokens facilitate all the beneficial features, while smart contracts facilitate every process or transaction. Consequently, art becomes much more affordable and a decentralized architecture will help shape this new era of the art industry.

Further capital inflow will come from the rapidly growing pack of liquid crypto assets from investment gains in the crypto sphere. Especially during recent events such as the 2017 bull run, the DeFi hype in 2020, and, of course, during this years’ price rally from bitcoin and ethereum large amounts of money are generated.

Long-term blockchain advocates who have been able to realize considerable profits will want to spend, diversify, and de-risk their portfolios. At this point, it is worth mentioning that more than 50% of bitcoins have been “hodled” (a blockchain-specific term for holding onto your asset for a longer period of time despite volatility) throughout the past two years.

It comes without surprise that the pioneers rather choose to diversify with art tokens than with the latest, greatest initial coin offerings, as this might have been the case during the 2017 bull run.

An increased demand and growing adoptionIn general, the crypto market starts to mature as an increased demand of institutional interest is noticed and more governments start to adjust their legislation for crypto assets.

Investors now have the opportunity to effectively leverage art as a hedge against inflation and as an alternative asset, due to the fact that general blockchain features are automatically applied to these — now fragmented — art pieces.

Subsequently, no entire artwork has to be bought at a prohibitive price, but each investor can decide for themselves how much he or she wants to expose his or her portfolio to a certain object.

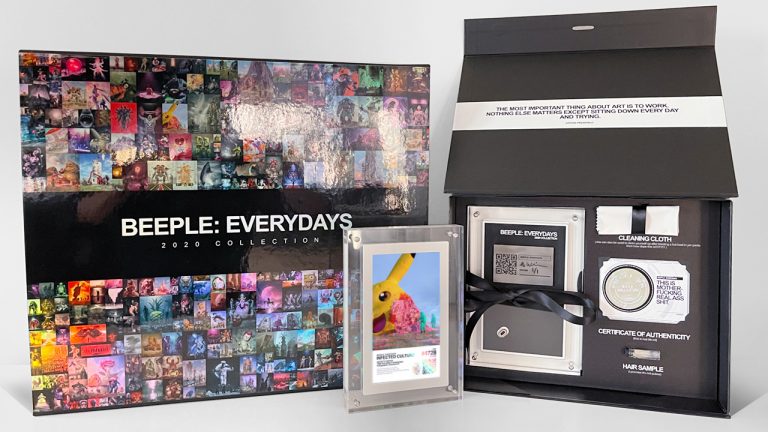

Also, the need to list and display art through expensive galleries acting as an intermediary on the one hand and as a marketplace on the other can be jettisoned. Artists now can promote art successfully online themselves, an ever growing market as seen in Figure 1 below.

Figure 1: Estimated value growth of the online art market worldwideReaping the benefits of tokenizing art will morph these culturally impactful pieces of history into dynamic assets such as shares. Holding, selling, and trading of tokenized art objects at any given time, purchasing art with crypto remotely and fundraising on the go will become the future of this industry.

Delivering the software and knowledge for tokenizing artThe above mentioned accomplishments may seem auspicious, but ultimately it is still quite difficult to tokenize art or have access to already tokenized art. Legal, financial and technological hurdles make it a challenging process, with many obstacles to surmount before the traditional model becomes obsolete.

Today, specialized platforms like Liechtenstein-based Amazing Blocks help users tokenize art or have access to already tokenized art. Liechtenstein, with the Liechtenstein Token Act, offers the best in class legal framework for tokenization in Europe.

In January 2020, the aspiring blockchain hub implemented the distinct legal framework empowering users with the certainty of ownership, as well as the power of disposition of the tokenized entities in form of ERC20 tokens.

Besides, the framework complies with the EU and EEA laws, since Liechtenstein is a proud member of both organizations. Furthermore, the proactive legal approach is intended to avoid becoming irrelevant or deprecated due to growth, by always leaving room for further adjustments based on new information. This aspect is quite substantial in the ever evolving world of technology.

Executing the tokenization processOnce selected for tokenization, an accredited curator will appraise the art and determine the value. Now the tokenization process can begin. This can be executed with the lowest degree of work possible through a customer-oriented software like the Tokenpad of Amazing Blocks.

It is also a form to collect relevant tokenholder’ data and receive legally mandatory consents. Also, APIs to comply with anti-money-laundering regulations if needed are integrated.

After successful tokenization, a potential buyer now can purchase tokens for multiple artworks and create a diversified portfolio. In overall, this will lead to a larger network of investors in this space.

Moreover a democratization of the art industry will follow suit by breaking up the single ownership principle thus far present. The gates to the billion dollar art industry are therefore as open as ever for an astonishing amount of capital influx.

Focus on promising innovationEven software specialist and serial entrepreneur John McAfee is on his path to secure his piece of the pie of the rapidly evolving industry of tokenized assets.

On Nov. 13, 2018, he tweeted the following statement:

“I am helping to tokenize rare art objects — a groundbreaking blockchain application. We will auction a tokenized Picasso at the end of December. This is our second tokenized painting.”

This emphasizes the fact that while we are still at the early stages of implementation, the pioneers of our world have already focused their intentions on this promising innovation.

Experts and insiders expect exponential growth for the future ahead, as fractional ownership and peer-to-peer trading are not only the future of blockchain, but the future of finance as a whole.

Be sure to check out The History of Art Tokenization. Part I.

The post The History of Art Tokenization. Part II appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Maecenas (ART) на Currencies.ru

|

|