2021-7-29 15:03 |

With bitcoin further integrating itself into Wall Street, large-scale speculative attacks will become far more prevalent.

The below is a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In a recent podcast discussion with Frank Chaparro of The Block, Patrick Sells, head of banking solutions at NYDIG, discussed what NYDIG was doing to help integrate Bitcoin with the incumbent financial system.

During the discussion, Sells explained how NYDIG was working with thousands of regional banks to not only bring bitcoin purchases to the institutions, but also the desire to introduce a variety of lending and credit products involving bitcoin.

“Any type of fiat financing for a home, a car, a line of credit, whatever, credit underwriting doesn't take into account your bitcoin, right?” - Patrick Sells

The Financialization Of BitcoinWhile this type of announcement may seem rather insignificant, it has broad implications. In the legacy financial system, it is rather easy and straightforward to borrow against all traditional asset classes, whether it be equities, real estates, or a portfolio of bonds, as collateral.

This is particularly important because it enables wealthy clientele the ability to hold certain assets forever and to simply leverage up when liquidity is needed by borrowing against a small fraction of their assets.

It is also important to understand that in the fractional reserve banking system that exists today, commercial bank lending creates dollars. Thus, with the ability to forgo selling assets and instead borrow at very low interest rates (due to the credit risk associated with borrowing money being mitigated due to the collateralized asset), the borrower is satisfied and can avoid the capital gains taxes associated with selling the asset, and the lender can make a low-risk loan, at least compared to unsecured lending. A win-win.

Currently, the crypto ecosystem has built out a sophisticated set of derivatives and contracts that are able to be entered with bitcoin as collateral.

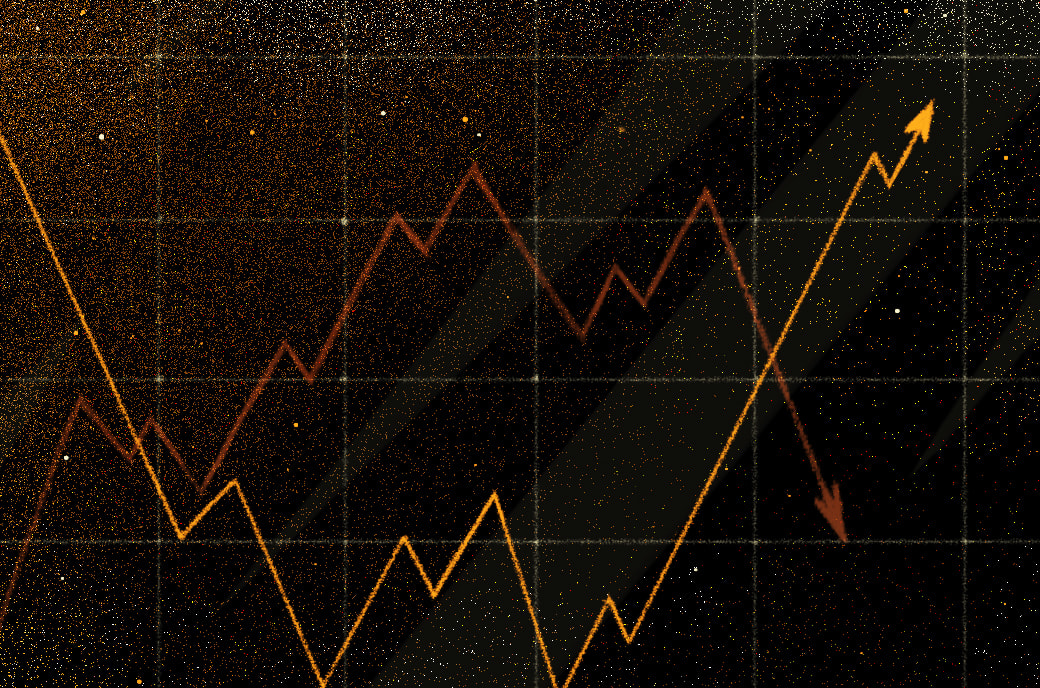

Below is the open interest for futures and options markets that use bitcoin as native collateral.

Futures Open Interest With Bitcoin As CollateralBitcoin Options Open Interest On Deribit

As you can see, bitcoin is already being used on crypto native rails as collateral on a very large scale, to the tune of hundreds of thousands of bitcoin. The real seismic shift is when bitcoin further penetrates the legacy system, and removes the friction for holders of the asset to need to sell, or find financing in other ways.

With bitcoin further integrating itself into the plumbing of Wall Street, large-scale speculative attacks, similar to what Michael Saylor has conducted with MicroStrategy, will become far more prevalent.

A speculative attack for those unaware is the act of borrowing in a weak currency to acquire a strong currency.

With the dollar, additional units are created through lending, whereas with bitcoin, there will only ever be 21,000,000, and this is strictly enforced by network consensus.

Thus, large-scale bitcoin holders can use their existing bitcoin to leverage up in an over-collateralized way to borrow at very low rates (due to their being zero credit risk) to acquire more bitcoin. This will happen at scale, and NYDIG’s partnerships with thousands of banking institutions is just the start.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|