2020-7-29 18:16 |

Bitcoin has been doing what it does best: taking the market by surprise. After months of being trapped within a boring range of around $9,000, Bitcoin performed one of its classics upward moves and broke through $11,300 on the morning of the 28th of July.

What’s causing this sudden rally? We’ll explore several narratives that are converging now, like the post-halving bull run or the COVID-19 pandemic consequences. Geopolitical risks are also on the rise, with China and Turkey moving troops around their borders.

And last, but certainly not least, central banks keep printing money, which is causing a general depreciation of all fiat currencies.

Just Another Halving… or Is it?Traditionally speaking, the halving results in a Bitcoin rally. Fundamentally speaking, the halving means a contraction in Bitcoin’s supply. When the inflation rate of a given coin decreases, the value of the coins in circulation should increase, at least in theory.

Bitcoin price runs post halving. | Source: Tradingview.We saw some signs of this trend in the first half of February, with most cryptocurrencies going up. However, the March Flash Crash threw a spanner in the works, caused by uncertainty around the COVID-19 pandemic.

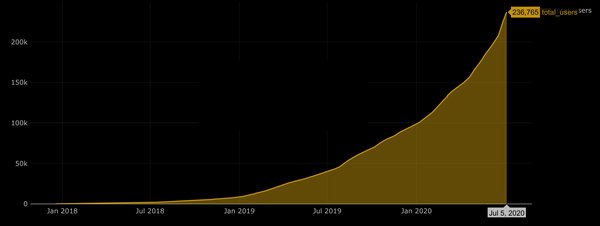

The halving kicked in, in May, and Bitcoin consolidated just above $9,000. While investors became bored and transferred to more volatile assets like LINK, some big players were quietly accumulating Bitcoin.

07/27/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $4.8 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/JwvRSzk0Ns

— Grayscale (@GrayscaleInvest) July 27, 2020

There’s one important thing to remember when comparing this year’s halving with the previous ones: this is a different age for Bitcoin.

The Game Has ChangedWhen the first halving occurred in 2012, Bitcoin was still an obscure asset that only a few thousand people knew. A digital coin that few cypherpunks and privacy advocates mined with their laptops.

In 2016, it became popular, yet most governments and institutions steered clear. By this time, Bitcoin mining was only possible in large facilities filled with expensive hardware.

Now in 2020, it’s different. Everyone has heard of Bitcoin, and in particular, institutional money with its deep pockets. Indeed, in the interim, Bitcoin trading has become a lot more sophisticated. Head of Research at Blockchain.com, Garrick Hileman, explains:

“It is a very different world in 2020 than it was during the last two halvings, the derivatives market is much larger and more important.”

He adds:

“One way I would say the market has changed is that historically the trading market was more lopsided toward upward transactions because there were not as many ways to speculate on the price going down, for example, the ability to borrow and sell short. That’s something that now exists through futures and options. So all these products have created a more level playing field for people who want to bet on the price going down.”

The small, close-knit crypto community is long gone. We now live in a growingly competitive environment, where retail investors are ‘timing the market’ on Coinbase against whales with algorithms. This, of course, isn’t the only issue to keep in mind.

The Dollar’s Weakness is Bitcoin’s StrengthIt’s no secret that central banks are printing money like there’s no tomorrow. Soon there might not be. Looking at the DXY index, that weighs the strength of the American dollar, we see that it’s currently resting on critical support:

Do NOT ignore this. #DXY sitting at a critical support. If if bounces here, everything will reverse, I mean everything. #Miners will retrace 30%-40%. #Silver #Gold, #Bitcoin will dump HARD

I took some profits today, will do tomorrow again

You have been WARNED!! https://t.co/wW7dKXAC2D

— Gold, Silver, Geopolitics & Bitcoin (@Super_Crypto) July 28, 2020

There’s an inverse correlation between the DXY and Bitcoin. Almost every time the dollar goes down, Bitcoin goes up. The last time both trended in the same direction was in February and March 2020. America is immersed in one of the most complex crises in history.

Besides all of the geopolitical fears surrounding China and its position on the global stage, America is suffering from one of the worst COVID-19 rates worldwide. With over 4 million confirmed cases and 150,000 deaths, American cases account for one-fourth of the global virus toll.

If this wasn’t enough, there have been several violent riots against police brutality following George Floyd’s death. The hospitality, tourism, and air travel sectors are being decimated, and next week millions of Americans will run out of unemployment benefits, all while preparing for the November general election.

The forecast doesn’t look good for the dollar. On Wednesday 29, the Federal Reserve will meet to announce its plans regarding interest rates.

If the Federal Reserves stays its course, we may well see John McAfee’s prediction of a “one million dollar bitcoin” finally come true. The question is, when will a dozen eggs cost fifty dollars?

The Geopolitical Risk FactorGeopolitics is usually harder to measure. During 2017, when Trump was threatening to nuke North Korea, the Bitcoin price seemed to react to the increased risk.

Every time Trump tweeted against Kim Jon-Un, bitcoin spiked a few hundred dollars. The orange president has made it pretty clear how little he likes Bitcoin.

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity….

— Donald J. Trump (@realDonaldTrump) July 12, 2019

The traditional safe-haven against geopolitical risk used to be gold and other precious metals. However, the growing perception of Bitcoin as digital gold has seen many countries jump aboard to protect their wealth.

The citizens of Zimbabwe, Venezuela, Turkey, and more recently, Lebanon and Argentina are using Bitcoin to protect their purchasing power from hyperinflation. Bitcoin is now surely intertwined with the geopolitical ups and downs.

Sabers RattlingAs noted by the authors of the research paper ‘Jumps in Geopolitical Risk and the Cryptocurrency Market: The Singularity of Bitcoin:’

“Further analyses show reasonable evidence to imply that co-jumps are significant for the case of Bitcoin only. This finding nicely complements previous studies arguing that Bitcoin is a hedge against geopolitical risk.”

During 2020, we’re witnessing several confrontations between China and its neighbors, especially along the Indian border. This is hardly the only conflict involving the Asian giant, which is growing more assertive in its boundary conflicts.

Another country wreaking geopolitical havoc is Turkey. The Erdogan regime has, for years, been involved in the Syrian conflict, dealing internally with the Kurd rebels.

Recently, the Pentagon reported that Turkey had moved mercenaries from Syria to Lybia, and is taking an active role in the ongoing Lybian Civil War. Egyptian leaders recently received parliamentary permission to send troops to Lybia to fight the Turkish.

Erdogan has also been accused of instigating conflict between Azerbaijan and Armenia, which caused a few casualties in armed encounters over the past few days.

This increasing geopolitical risk may be behind gold’s recent rally and probably have impacted Bitcoin’s too. With all these factors at play, will Bitcoin continue to head higher?

The post The Global Factors at Play as Bitcoin Holds $11,000 appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|