2024-3-28 04:10 |

For decades, credit cards have provided consumers worldwide with convenience, flexibility, and significant purchasing power. In doing so they have become a fundamental element of contemporary finance. However, as technology continues to evolve, so do credit cards. Various dedicated platforms, such as MoneyFor, help people understand a wide range of financial concepts, including the intricacies of credit cards. In this article, we’ll try and do the same – offering a look into the future of these innovative payment solutions.

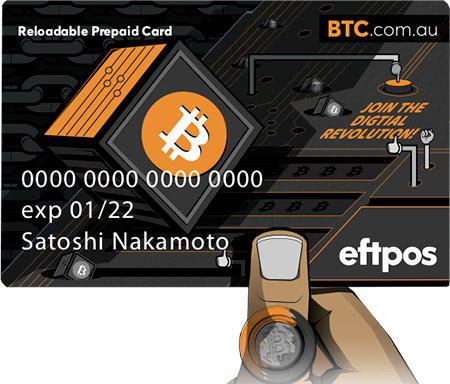

Blockchain Technology and Decentralized Finance (DeFi)The potential for blockchain technology to transform the credit card industry cannot be overstated. By leveraging blockchain’s inherent characteristics of transparency, security, and efficiency, electronic payment solution transactions will benefit from increased reliability and reduced vulnerability to fraud.

Decentralized finance (DeFi) platforms built on blockchain networks offer innovative alternatives to traditional banking and lending models. These platforms facilitate peer-to-peer lending, allowing individuals to borrow and lend directly without intermediaries. In addition, automated smart contracts executed on blockchain networks simplify transaction processes by eliminating the need for manual intervention and reducing administrative overhead.

Although blockchain credit cards are still in their infancy, their potential is significant. These solutions have the potential to democratize access to financial services, give consumers more control over their finances, and challenge the dominance of traditional banking systems.

Contactless Payments and Digital WalletsOne of the most noticeable trends shaping the future of credit cards is the exponential growth of contactless payments and digital wallets. The convenience and security offered by Near Field Communication (NFC) technology have transformed the way consumers interact with payment methods. By simply tapping their cards or mobile devices at checkout terminals, consumers can now make swift and secure transactions without the need for physical contact or swiping.

Digital wallet platforms such as Apple Pay, Google Pay, and Samsung Pay have played a pivotal role in driving the adoption of contactless payments, offering additional layers of convenience and security through features like tokenization and biometric authentication. As consumers increasingly prioritize speed, security, and convenience in their payment experiences, the prevalence of contactless payments and digital wallets is expected to continue its upward trajectory.

Enhanced Security FeaturesAs cyber threats continue to evolve and pose increasingly complex challenges, credit card issuers are doubling down on security enhancements to safeguard cardholders’ sensitive information. Chip-and-PIN or EMV technology, now a standard feature in many regions, offers an additional layer of security compared to traditional magnetic stripe cards. This technology encrypts card data and generates unique transaction codes, making it significantly more difficult for fraudsters to clone cards or steal sensitive information.

Moreover, credit card companies are leveraging advanced fraud detection algorithms and machine learning technologies to bolster their defenses against fraudulent activities. These sophisticated systems analyze vast amounts of transaction data in real time, enabling swift detection and prevention of unauthorized transactions.

Personalized Rewards and BenefitsIn their quest to attract and retain customers, credit card issuers are initiating new and new kinds of personalized rewards and benefits, tailoring offerings to align closely with individual spending habits and preferences. Gone are the days of generic rewards programs; instead, consumers now have access to a plethora of enticing incentives designed to cater to their specific interests.

From lucrative cashback incentives and coveted travel rewards to exclusive perks, such as priority lounge access and dedicated concierge services, credit card reward programs are evolving into sophisticated, targeted experiences. Moreover, many payment solutions are embracing the concept of bonus categories that rotate quarterly, providing cardholders with the opportunity to maximize their rewards earnings on specific types of purchases.

Sustainability and Environmental ImpactIn recent years, the escalating concern over the environmental footprint of traditional plastic credit cards has spurred a wave of innovation and sustainability initiatives within the industry. Recognizing the imperative to mitigate environmental impacts, credit card issuers are diligently exploring alternative materials and production methods to create more eco-friendly cards.

Biodegradable and recycled materials have emerged as promising alternatives, offering a greener option for card production while reducing reliance on non-renewable resources. Furthermore, financial institutions are proactively seeking partnerships with environmental organizations to pioneer eco-friendly payment solutions.

These initiatives extend beyond card material considerations; some institutions are pledging a portion of card spending toward conservation efforts or carbon offset programs, empowering consumers to contribute positively to environmental sustainability with their everyday transactions.

By embracing sustainable practices and championing eco-conscious initiatives, credit card issuers are addressing environmental concerns. They also try to align their offerings with the growing customer demand for ethical and environmentally responsible products.

In conclusion, the future of credit cards is undoubtedly bright, with technology driving innovation and reshaping the way consumers interact with financial products. From contactless payments and enhanced security features to personalized rewards and sustainable initiatives, credit cards are evolving to meet the evolving needs and preferences of consumers.

origin »Bitcoin price in Telegram @btc_price_every_hour

BlockMason Credit Protocol (BCPT) на Currencies.ru

|

|