2020-4-25 08:12 |

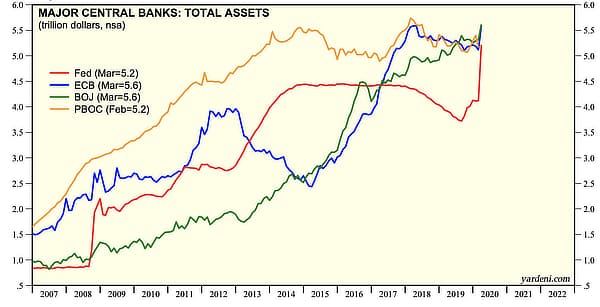

The Federal Reserve is expanding its balance sheet at a record pace—far greater than anything seen during the 2008 Great Recession.

The Federal Reserve is buying up assets and its balance sheet is growing rapidly, especially in the last two months. Currently, the Fed is purchasing some $41 billion in assets daily, and central banks around the world are following its lead.

According to one analyst, the economic fallout of this is clear: inflation is coming.

The Fed’s Buying SpreeThe current spike in the Fed’s balance sheet has not slowed down since March. In fact, it has only sped up—and the consequences could be inflation unlike what we’ve seen before. This is what analyst Mati Greenspan (@MatiGreenspan), founder of Quantum Economics, told his followers recently.

The situation is so unprecedented that the current balance sheet is growing at a rate many times faster than what we saw during the 2008 Great Recession.

As shown below, the grey zone was the most-recent recession. Since then, the Fed’s balance sheet has seen a steady uptick. That’s worrying by itself, yet it has really spiked in the past two months.

If you’re a believer in cryptocurrencies, what’s wrong with this picture is probably already obvious. Since then, this number has grown further amid the Fed’s buying spree and its many origin »

Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|