2022-4-27 00:00 |

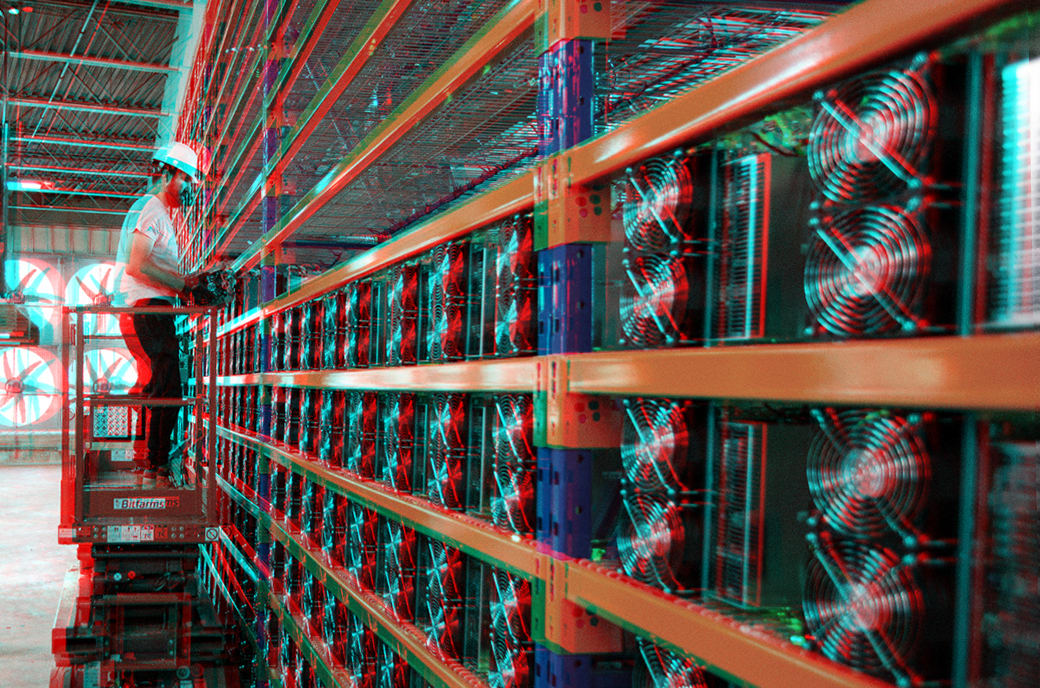

The trend of falling hash price will force weaker miners to unplug, find more efficient energy sources and/or sell off machines or bitcoin holdings.

The below is a full, free excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Public Miner Equities Versus BitcoinAs for most risk-on assets, including bitcoin and public bitcoin mining equities, the drawdowns from all-time highs have been substantial. As bitcoin has fallen 41.20% from its November all-time high, the entire bitcoin mining industry has performed much worse, facing an average drawdown of 64.10%. Public bitcoin miner stocks have acted as additional investment vehicles for indirect bitcoin exposure with opportunity for outperforming bitcoin over the last few years — at least until the market shifted in November 2021.

Public miner stocks percentage drawdown from all-time high Year-to-date performance of public miner stocksApart from pricing miners in USD terms, how well do they perform priced in bitcoin? Those using bitcoin as a unit of account will naturally look for opportunities that will outpace bitcoin in an attempt to grow their overall bitcoin position and share of a limited supply. With the latest drawdowns, bitcoin miners are starting to look relatively cheap when priced in BTC terms, as many of these stocks are nearing or making new 12-month lows.

Although our base case is that the broader equities market (and likely bitcoin) has more downside to come this year, individual mining stocks could be closer to a bottom than the rest of the market, with most down 60% to 70% already. Below are some of the top public miners priced in BTC over the last year, well below their annual averages.

Public miner stocks priced in bitcoin Marathon Digital Holdings Inc stock priced in bitcoin Riot Blockchain Inc stock priced in bitcoin Hut 8 Mining Corp stock priced in bitcoin Bitfarms stock priced in bitcoin Core Scientific Inc stock priced in bitcoinThe performance decline relative to bitcoin is more recent over the last six months. Select miners have had strong outperformance relative to bitcoin since 2020 with bitcoin’s hash price rising from $0.07 to $0.42 at its recent peak. As price exploded and hash rate was lagging behind, miners have been in a golden period making more revenue per hash leading to a period of higher profits, higher earnings and higher market valuations.

Since 2020, here were some of the miner equity returns when priced in bitcoin across the top market capitalization miners. This hash price boom mixed with rising investor demand and speculation led Marathon and Riot stocks to outperform bitcoin by 202% and 70% respectively. Picking and timing the right miner stock (or basket of miner stocks) to outperform is also crucial, which makes self-custody bitcoin the best approach for most.

Returns of public miner stocks priced in bitcoin since 2020Since 2021, those returns and outperformance are more muted (or even negative), showing how difficult it’s been for miners to outperform bitcoin with hash price peaking during a broader macro pivot to a risk-off market regime.

Returns of public miner stocks priced in bitcoin since 2021Hash price (miner revenue per terahash) now sits at around $0.182 and continues to fall from its higher short-term trend as price stagnates and hash rate growth diverges, down 14.46% and up 22.23% year-to-date respectively. At a roughly annualized 66.69% growth rate almost through April, that would put the total hash rate close to 289 EH/s by the end of the year.

Although it is a massive task to bring that much hash rate and power online this year amid ASICs supply chain delays, power capacity issues and rising energy costs, select top public miners are still planning to grow their hash rate by 154% through 2022 — from 37.1 EH/s to 94.1 EH/s. This growth (table below) includes all announced 2022 plans across self-mined and hosted hash rate.

Public miner hash rate projectionsWithout a bullish price catalyst in the short term, expect the network’s hash rate expansion to continue; higher difficulty adjustments will continue to push hash price lower. Hash price is naturally trending towards zero over bitcoin’s lifetime as the marginal cost of producing a bitcoin becomes more competitive over time, but there will be lucrative periods where price appreciation outpaces hash rate’s capacity to grow in the short term.

Bitcoin hash price Hash rate 7-day averageDespite the recent fall in valuations, we’ve seen little change in public miners to curb their hash rate expansion plans for 2022 and 2023 or downsize their BTC holdings. Reported bitcoin holdings grew 7.3% month-over-month in March, showing signs that bitcoin miners aren’t yet facing major capitulation or selling pressure to reverse this new industry trend of rising bitcoin accumulation.

Reported bitcoin holdings by public mining companiesThe trend of falling hash price will force weaker miners to unplug machines, find more efficient energy sources and/or sell off those machines or bitcoin holdings in the worst case. Some of those market dynamics can be tracked via a mining rig price index in USD with data from Luxor and their Hashrate Index.

Overall, USD prices of ASICs across efficiency tiers have been falling significantly after a local peak in November 2021. This could make ASICs more appealing at lower prices for buyers but will also bring down asset values for holders of large fleets. Like hash price, Hashrate Index is expecting prices to continue trending towards post-China ban lows.

Asic price index for miners of various efficiency origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|