2021-12-16 04:00 |

The ability to quickly move bitcoin over the Lightning Network allows traders to expose themselves to minimal third-party risk.

The below is a direct excerpt of Marty's Bent Issue #1130: "The Lightning Network is creating efficiency for traders." Sign up for the newsletter here.

via KolliderHere's a great blog post from the team behind Kollider, an exchange that allows traders to trade bitcoin using leverage. In it, they dive into the typical needs and workflow of margin traders who have positions on multiple exchanges at the same time, how they operate natively with on-chain bitcoin transactions and how using the Lightning Network changes those operations and makes them extremely efficient. I highly recommend you freaks check out the post if and when you get a chance.

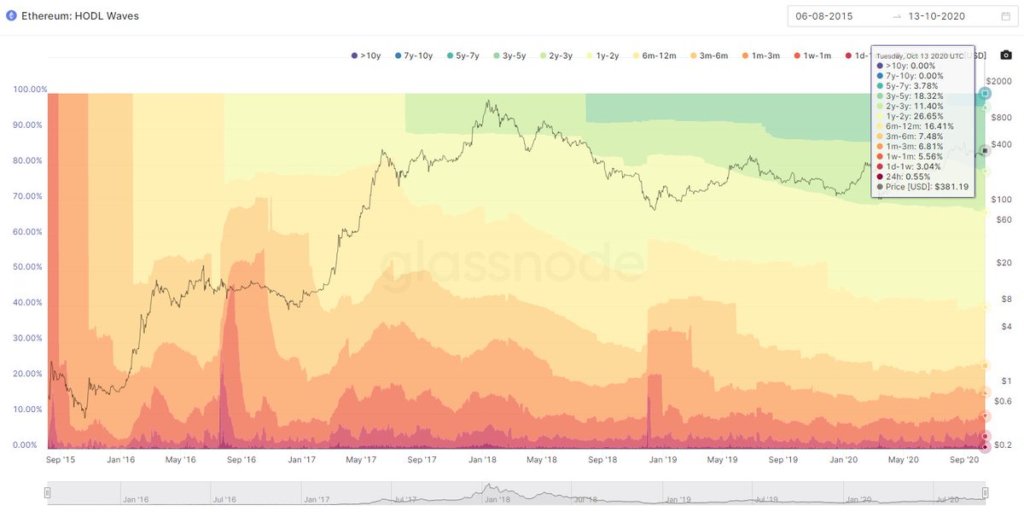

As you can see from the screenshot above, due to the nature of the type of instant settlement that the Lightning Network can provide in comparison to on-chain transactions, the amount of sats a bitcoin algo trader needs to hold on an exchange as a margin buffer is reduced significantly from 30% of value at risk to 5% of value at risk. The ability to quickly move sats over the Lightning Network from a wallet owned by a particular trader or trading fund to an exchange allows these traders to expose themselves to as little third party exchange risk as possible. And as you'll discover if you read the post, this 5% buffer is even a bit conservative as it factors in potential channel liquidity issues that could arise if many traders are moving a lot of sats during periods of high volatility. The margin buffers could get even smaller if fears over a channel liquidity are able to be quelled by increased liquidity on the Lightning Network, which seems to be coming every day.

Right now, intra-exchange activity via the Lightning Network is a very small percentage of overall intra-exchange activity. As time moves on, as the Lightning Network continues to mature, and as traders become more well versed on how to manage their funds over the Lightning Network we can expect more and more traders to begin leveraging this utility. Increased usage of this utility should have some positive externalities that include lower fees for traders (which means higher margin - at least temporarily as the rest of the trading world gets caught up to speed), and less third party risk which comes with holding funds on an exchange. The Lightning Network is enabling traders to hold less and less sats in a third party wallet while still reaping the same benefits of the trading platforms that they would when doing intra-exchange arbitrage via on-chain transactions.

It will be fun to watch this area of the market develop in the coming years.

Onward!

Bitcoin price in Telegram @btc_price_every_hour

United Traders Token (UTT) на Currencies.ru

|

|