2024-4-19 16:00 |

Today marks a significant event as Bitcoin experiences its fourth scheduled halving. This event, also known as the halving, occurs approximately every four years and has far-reaching implications for the Bitcoin ecosystem. As Bitcoin Magazine prepares for a halving livestream, powered by Kraken, to commemorate this event, it's crucial to understand what the halving is and why it's so important.

What is the Bitcoin Halving?The Bitcoin halving refers to the process by which the reward for mining new blocks on the Bitcoin blockchain is reduced by half. This reduction occurs approximately every 210,000 blocks, or roughly every four years.

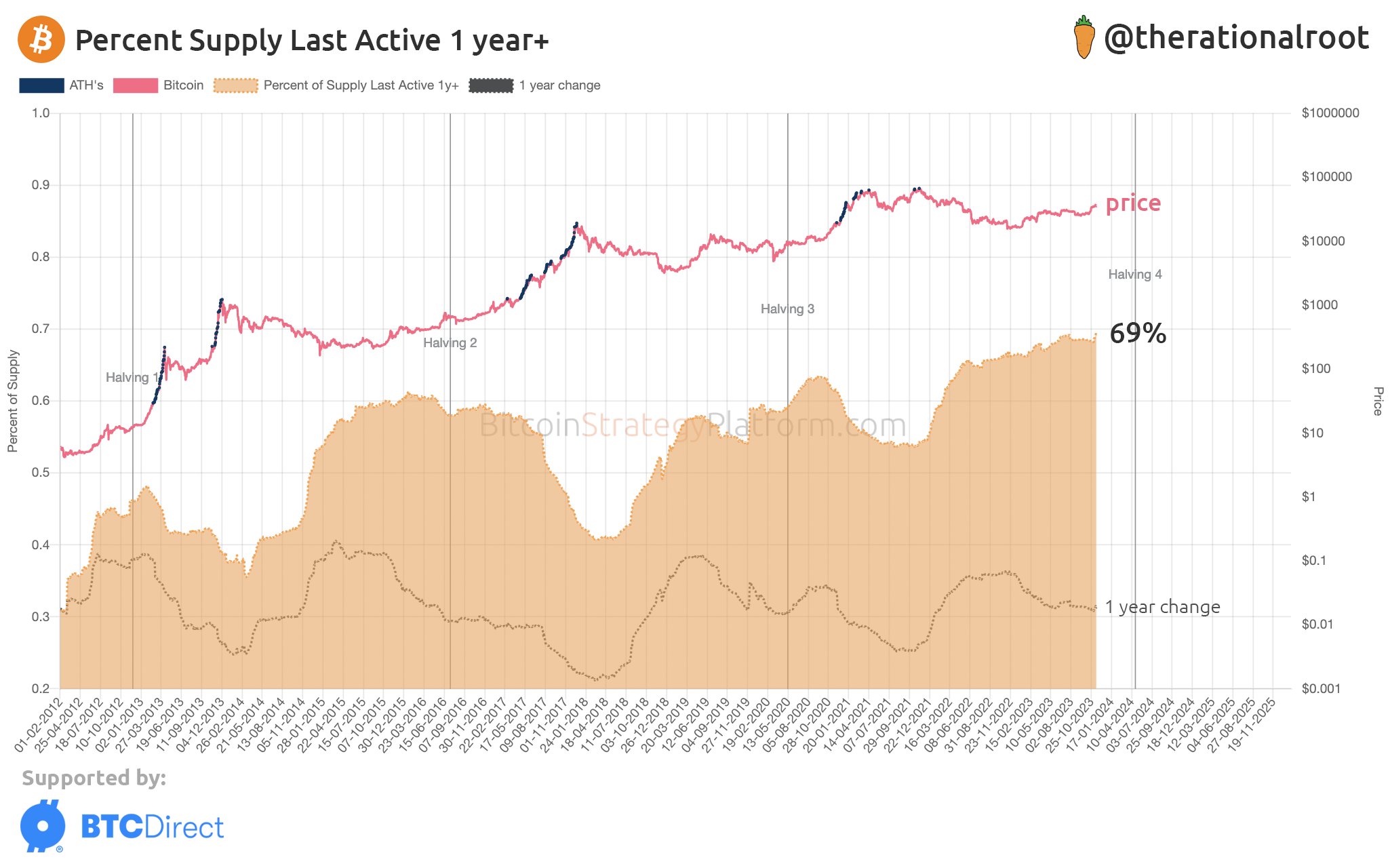

Not all bitcoin were released onto the market at the same time, but rather new coins are slowly mined by Bitcoin miners every day as a reward for mining new blocks in the blockchain. The halving is encoded into Bitcoin's protocol to control its inflation rate and ensure that only 21 million bitcoins will ever be mined, making it a deflationary asset.

In the very beginning of Bitcoin’s history, the first block reward was 50 BTC. After the first halving in 2012, the block reward was cut in half to 25 BTC per block, and then cut in half again in 2016 to 12.5 BTC per block, and once more in 2020 to 6.25 BTC per block. Now, the block reward is getting cut in half to 3.125 BTC per block, with the next halving expected in 2028, cutting the reward down to 1.5625 BTC per block.

Bitcoin will continue to cut its new supply creation in half until there is no more bitcoin left to be mined, which is currently slated for the year of 2140 in May.

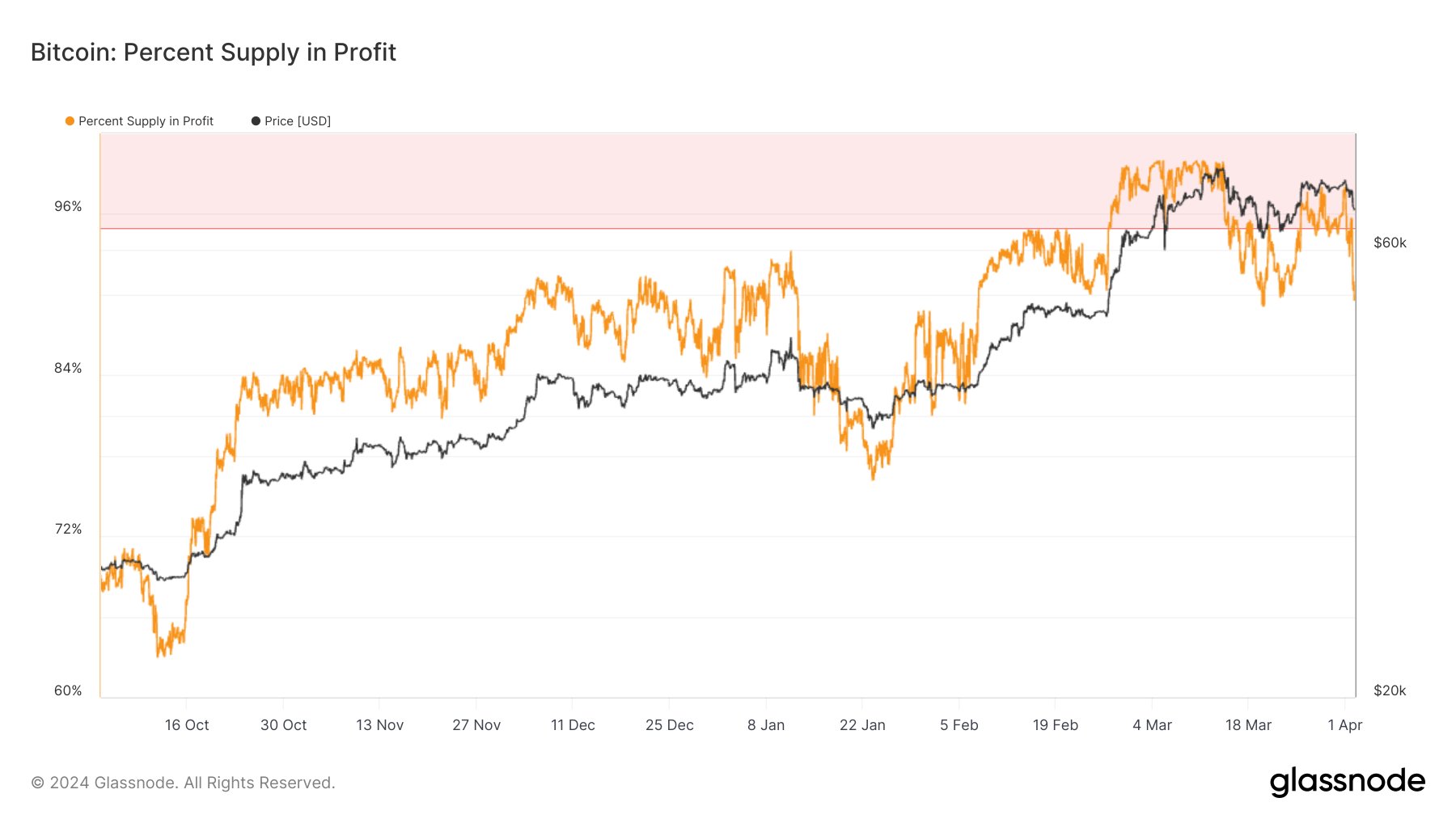

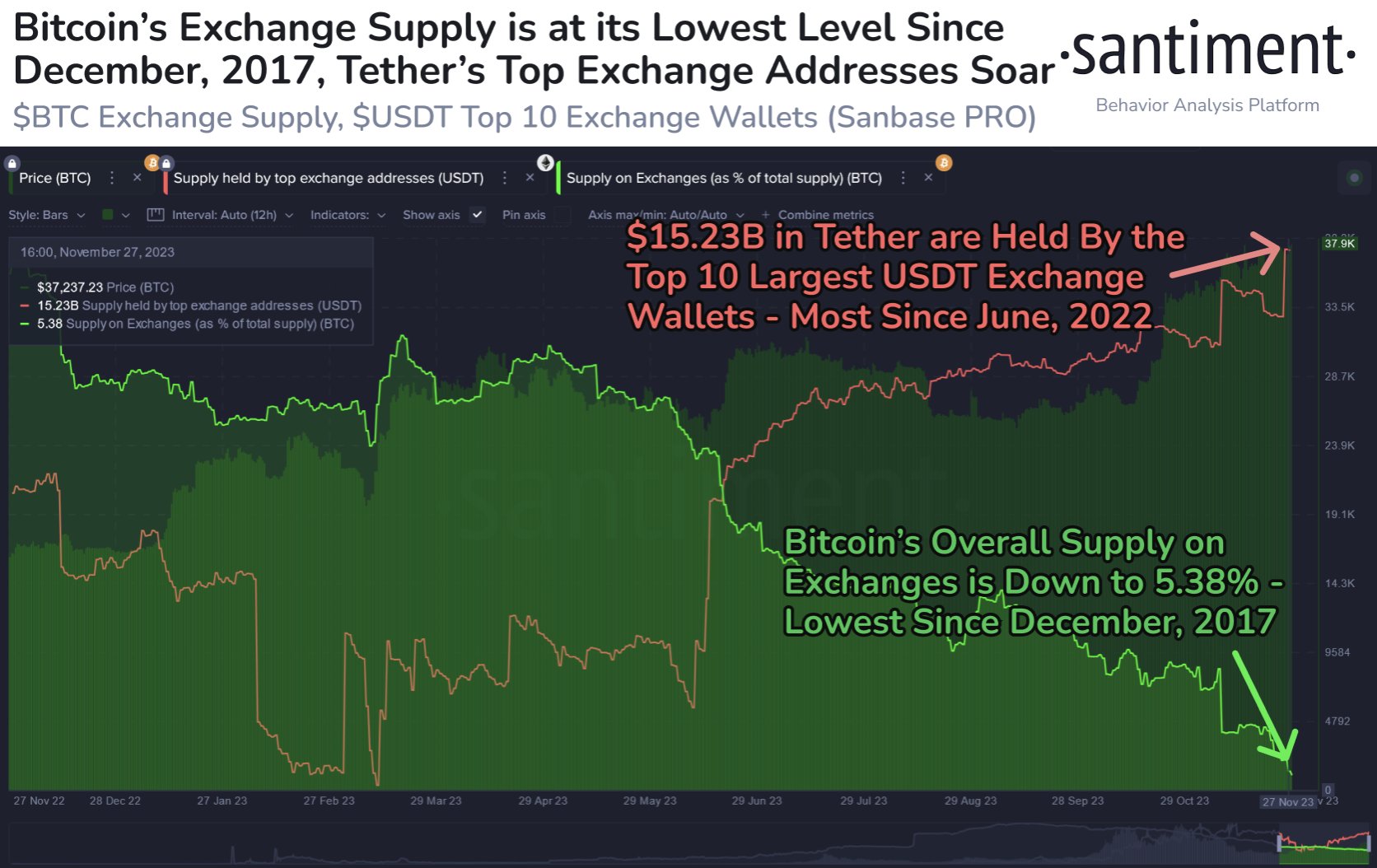

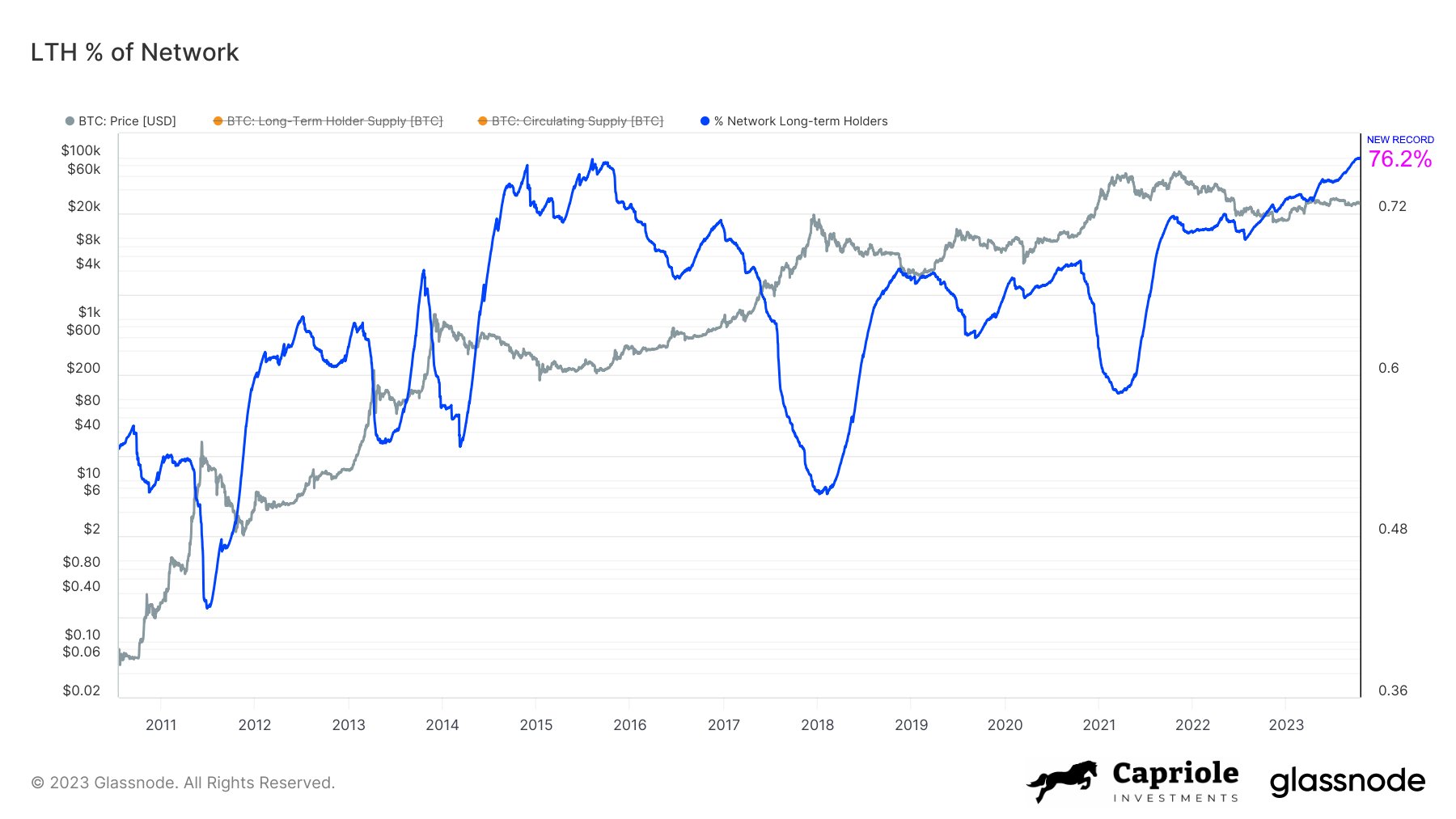

Importance of the HalvingThe halving event is significant for several reasons. Firstly, it directly impacts the supply of new bitcoins entering circulation. With the block reward reduced, the rate of new bitcoin creation slows down, leading to a gradual decrease in the available supply. This scarcity is a fundamental factor driving Bitcoin's value proposition as a store of value.

Secondly, the halving has historically been associated with bullish price movements. Previous halvings, such as those in 2012 and 2016, were followed by substantial increases in Bitcoin's price. This pattern is partly attributed to the reduced supply coupled with sustained demand, leading to a potential imbalance that favors price appreciation.

TD Direct Investing

Bitcoin has increased around 743% since the last halving in 2020, rising from ~$8,755 to an all time high of $73,790 on March 14, 2024. While past performance is no guarantee of future results, market participants are expecting to see another increase in the price of BTC, as strong institutional demand for the asset is coming in from recently approved spot Bitcoin exchange traded products in the United States, Germany and Hong Kong, as well as the London Stock Exchange that is getting ready to offer physical Bitcoin exchange traded notes.

Bitcoin Magazine and Kraken Halving LivestreamTo celebrate this momentous occasion, Bitcoin Magazine is hosting a halving livestream event tonight, powered by Kraken. This livestream, which will feature key players in the Bitcoin industry like Strike CEO Jack Mallers, as well as celebrities like Dave Portnoy, will delve into the top 21 moments of the last Bitcoin epoch, highlighting important milestones and developments within the Bitcoin ecosystem.

The livestream isn't just about reflecting on the past; it's also about looking towards the future of Bitcoin. The winners of the Nitrobetting Bitcoin Halving 1 BTC prize challenge are also to be announced during the event, it showcases the growing interest and engagement surrounding Bitcoin and its halving events.

The livestream can be found here.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|