2024-5-13 15:08 |

In a striking development, Tether CEO Paolo Ardoino publicly challenged Ripple CEO Brad Garlinghouse following comments about potential SEC scrutiny of USDT.

This confrontation underscores the regulatory complexities facing stablecoin issuers and the intense competition within the cryptocurrency sector.

Tether CEO Confronts Ripple’s Brad Garlinghouse Over FUDPaolo Ardoino responded to Garlinghouse’s comments by taking to social media. He accused people of spreading “fear, uncertainty, and doubt” (FUD), particularly as Ripple prepares to enter the stablecoin market.

At a pivotal moment, Tether, the issuer of the world’s most utilized stablecoin, USDT, stands. With a user base mainly in emerging markets and developing countries, USDT is a crucial financial resource, offering access to financial services from which many are otherwise excluded.

Amid these accusations, Brad Garlinghouse aired his concerns on the “World Class” podcast with Chris Vasquez. He discussed the severe implications for the broader crypto market if the U.S. government were to act against Tether, emphasizing Tether’s critical role.

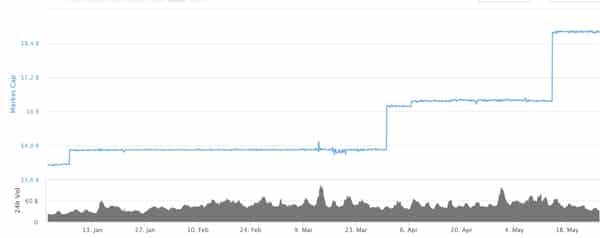

Total Reserves as of the last Reserves Report. Source: TetherIn response to the FUD accusation, Tether reiterated its dedication to compliance and transparency. The company complies with regulatory standards and collaborates with global law enforcement to block and report illicit transactions. These efforts ensure the safety and stability of Tether’s operations. They block over $1.3 billion tied to scams, hacks, and money laundering, as Ardoino highlighted.

“The real facts show how Tether USDt, leveraging the transparency of the blockchain technology and working with global law enforcement is able to comply with requirements,” he said.

Moreover, Tether supports a highly skilled internal investigation team. Ardoino noted that this team uses advanced tools to monitor both primary and secondary market transactions. Their work is enhanced through partnerships with analytics firms like Chainalysis, which supply cutting-edge software to bolster monitoring and compliance.

This dispute not only points to the SEC’s potential actions but also to the competitive dynamics in the cryptocurrency industry, where the launch of new stablecoins by companies like Ripple could alter market dynamics and regulatory focus. As Ripple gears up to introduce its stablecoin, the stakes are considerable, putting Garlinghouse’s actions and words under intense scrutiny.

As the cryptocurrency sector evolves, the interaction among competition, regulatory challenges, and market stability grows increasingly complex. Tether and Ripple must navigate these waters carefully, balancing aggressive business tactics with strict compliance and ethical standards.

The post Tether Responds to Ripple: A Defense of Transparency and Compliance appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|