2023-3-4 14:59 |

A new report by the Wall Street Journal alleges that Tether accessed global banking accounts through crypto firms that used fraudulent documents and shell companies.

Investigations by the Wall Street Journal revealed that Tether accessed the banking system by opening accounts under different corporate names whose executives bore slightly different names to established executives.

Tether Turkish Account Had Terrorist TiesAccording to documents reviewed by the Wall Street Journal, Taiwanese accounts were opened under the name of a company called Hylab technology.

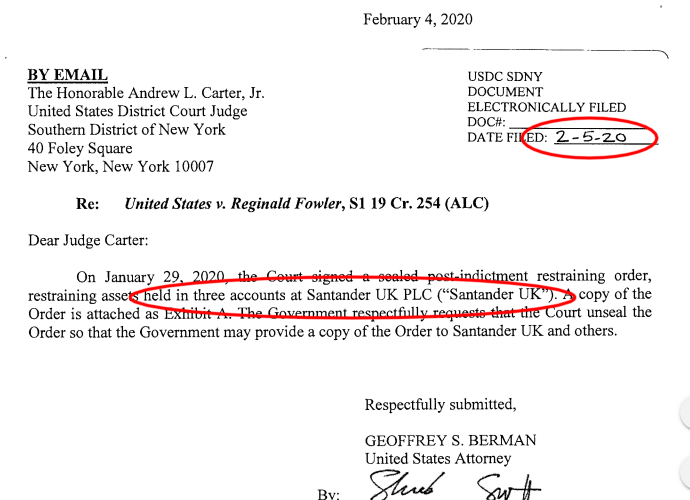

One account in Turkey was opened in the name of a firm called Denix Royal Dis Ticaret Limited Sirketi. Following a 2020 crackdown, the U.S. Justice Department alleged a terrorist group used the account to launder funds. According to the DoJ, the group transacted $80 million with the account as part of an initiative to convert crypto donations into cash. The terrorists allegedly also used an account at the crypto exchange Bitfinex, Tether’s sister company.

Another company, Crypto Capital, opened accounts for crypto firms, including Bitfinex and Tether, in the name of several shell companies. These accounts became money transmitter businesses for crypto firms, but U.S. authorities later seized their assets.

New York-based Signature Bank closed an account in the name of a Tether part-owner Christopher Harborne after it realized the account was related to Bitfinex.

According to Tether, the allegations by the Wall Street Journal were “wholly inaccurate and misleading.” On the other hand, Crypto critic Molly White said that the WSJ couldn’t have made “this stuff up.”

More Tether FUD from WSJhttps://t.co/l6DBFEtENp

— Tether (@Tether_to) March 3, 2023the alleged money laundering involved a company called AML Global

can't make this stuff up pic.twitter.com/gHini2Aq40

Tether previously clashed with the publication over allegations the Journal made that Tether’s 3-month T-bill backing its USDT stablecoin were unsafe assets. Tether recently removed the commercial paper from USDT backing.

BUSD Market Cap Falls to Below $10 BillionStablecoin users flocked to Tether after the New York State Financial Services Department ordered Paxos, the issuer of BUSD, a Tether rival, to stop minting the coin and to end its relationship with the coin’s namesake exchange Binance.

Around mid-February, the concentration of USDT in Curve’s busdv2 pool fell to 4% while BUSD’s share increased to 69%. At press time, BUSD’s concentration had risen to 77%, while USDT’s share rose to 7%.

Stablecoin Reserves in Curve busdv2 Pool | Source: Curve FinanceFollowing the NYSFSD ban, Paxos redeemed $6.7 billion BUSD, while BUSD’s market cap dipped below $10 billion on March 3, 2023, for the first time since June 2021. Paxos has promised to support the coin until at least Feb. 2024.

Data from Kaiko revealed that market depth within 2% of BUSD-USDT and BUSD-DAI trading pairs fell from $200 million before the NYSFSD clampdown to $123 million at press time.

Market depth is a measure of open buy and sell orders around a given price region, in this case, the market price.

For Be[In] Crypto’s latest Bitcoin (BTC) analysis, click here.

The post Tether Partners Used Fraudulent Documents to Give Company Access to Bank Accounts, Says Report appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|