2020-10-7 16:26 |

The second-largest network is enjoying immense growth.

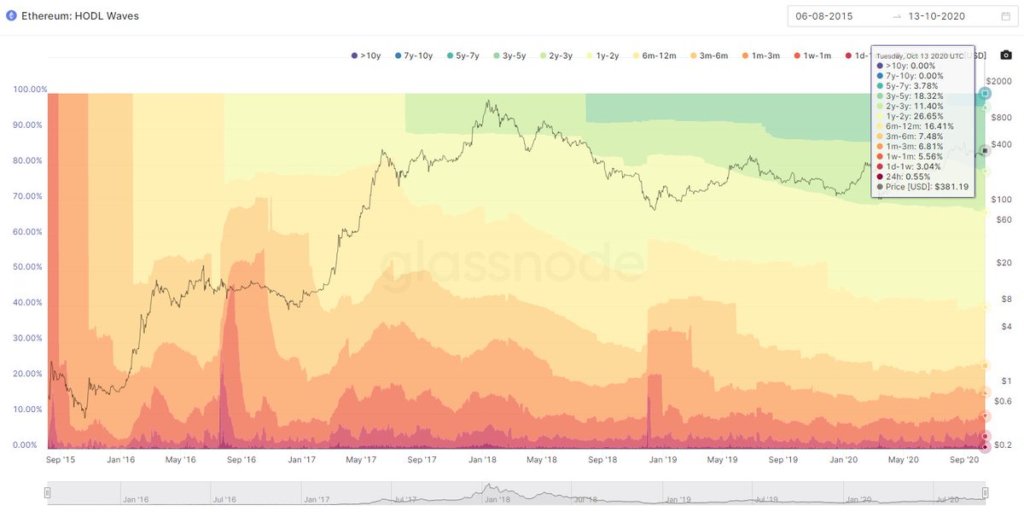

The average estimated number of hashes per second produced by the miners in the Ethereum network has reached its all-time high, surpassing 250 trillion/second. Ethereum's hash rate has increased by 80% since the beginning of the year.

Back in August 2018, the hash rate found its top after growing since the launch of the project in 2015.

And the force behind this explosive growth is the one and only Decentralized Finance (DeFi).

“Ethereum miners have pushed the hash rate to a new record high in the wake of the DeFi hype and surging fees,” noted Glassnode.

During this period, the DeFi sector grew by more than 1,400%, which in turn propelled fees on the Ethereum network to skyrocket to a new record. Ethereum miners actually made $166 million from transaction fees last month, up 47% from August peak.

But unlike the network growth, the price of the digital asset hasn’t been having a good time for the past few weeks. Since hitting a two-year high at $480 in early September, the ETH price has declined by more than 30%.

At the time of writing, ETH/USD has been trading just over $340, in red, while YTD gains are still 160%.

Just like other Ethereum factors are affected by DeFi, the ongoing poor price performance has also been driven by the deep losses recorded by DeFi tokens as the sector cools off following wilds past couple of months.

Also Read: Vitalik Buterin: Ethereum has No Non-L2 Path for Scalability in Medium Term with ETH 2.0 Years Away

“ETH is still looking absolutely horrendous along with other alts. For the past few months, ETH has been a reliable leading indicator on BTC's direction,” noted trader CryptoSqueeze.

$ETH/BTC chart looks terrible.

I'll be looking to buy at $285 pic.twitter.com/i9bocYHpfE

— Squeeze (@cryptoSqueeze) September 21, 2020

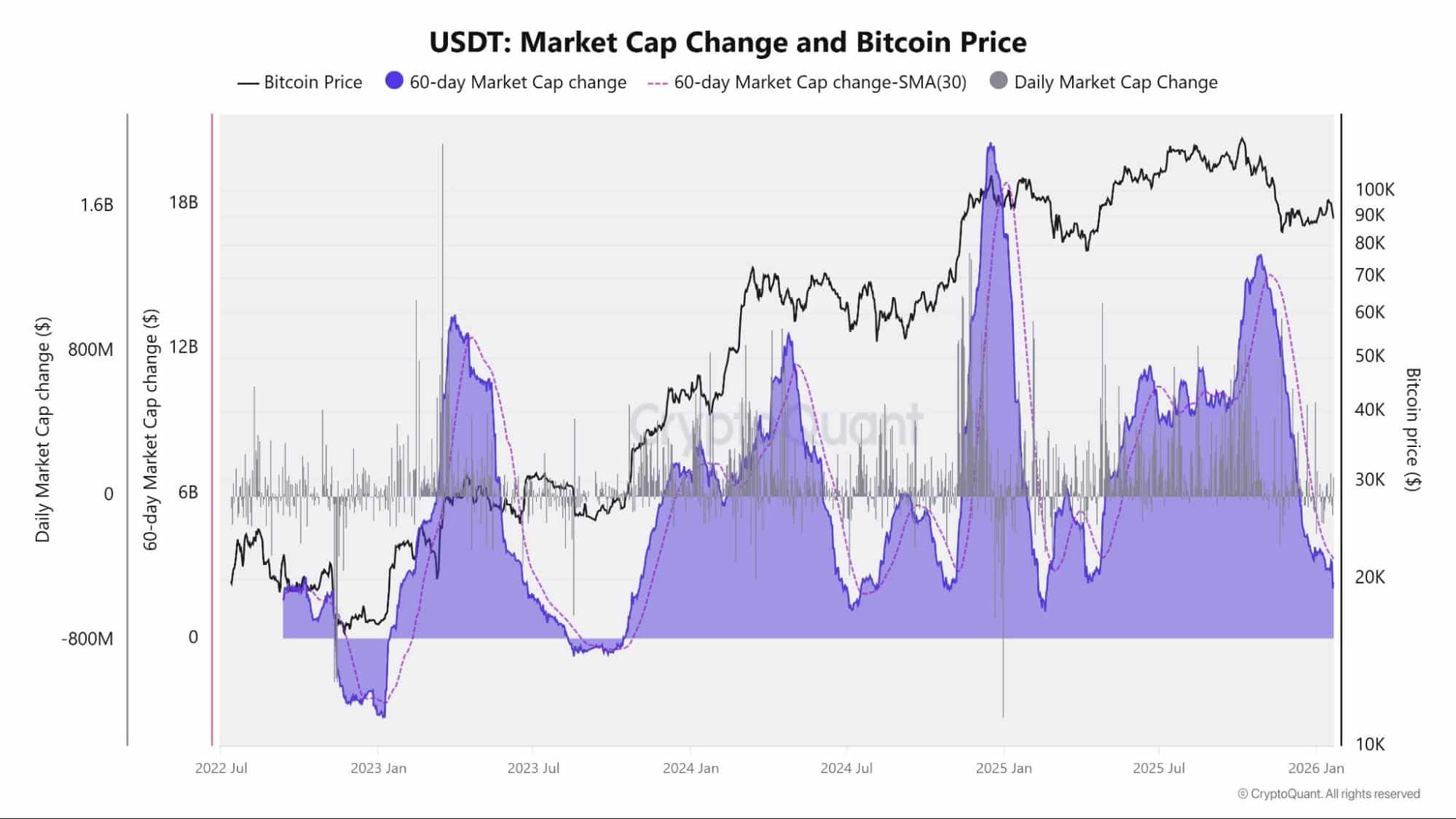

This is why the cryptocurrency with a $38 billion market cap could be replaced by Tether as the second biggest digital asset in the near future.

Compared to Ether’s stagnant growth, Tether’s market cap has been on a constant incline and jumped a whopping 300% YTD. Stablecoins growth and adoption has actually been a forerunner for central bank digital currencies “and promises to be more enduring than alt-coin speculative excesses.”

And if the current trend prevails, “the market cap of Tether may surpass Ethereum next year,” noted Bloomberg Intelligence analyst Mike McGlone in the latest report on crypto outlook.

Source: Bloomberg Intelligence Report“It should take something significant to stall the increasing adoption of Tether, the top stable coin, which is on pace to match the capitalization of Ethereum in a bit less than a year, based on the regression trend since the start of 2019,” McGlone said.

Ethereum (ETH) Live Price 1 ETH/USD =341.6774 change ~ -1.40Coin Market Cap

38.58 Billion24 Hour Volume

15.05 Billion24 Hour Change

-1.40 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD");The post Tether Could Replace Ether Next Year, Despite Ethereum Miners Pushing Network to New Highs first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Santiment Network Token (SAN) на Currencies.ru

|

|