2022-5-23 00:12 |

On May 19, Tether released its latest quarterly assurance opinion showing its reserves’ strength and the relevant reductions in commercial paper investments, as well as a total increase in U.S. treasury bills. Tether Holdings Limited, the blockchain-enabled platform demonstrated that its consolidated assets outperformed its consolidated liabilities.

Reaffirming Tether’s resilience in the marketOver the last quarter, the report showed an estimated 17% decrease in its (Tether) commercial paper holdings, falling from $24.2 billion to $20.1 billion. A further 20% decline has been recorded since April 1 and will be indicated in the Q2 2022 report.

Aside from the group’s latest assurance opinion, its Consolidated Reserves Report broke down the assets amassed, as of 31st of March, 2022. Consolidated total assets tallied at least US$82,424,821,101, and demonstrate average maturity reduction with more priority on short-term assets.

The reserves held for the issued digital tokens exceed the amount expected to recover the digital tokens issued.

The report also shows an increase in Tether’s investment in the money market and U.S. treasury bills, with an increase of 13%, rising from $34.5 billion to $39.2 billion.

In addition to this increase, the average rating of commercial paper and certificates of deposit went up from A -2 to A-1. Secured loans have also lessened by $1 billion.

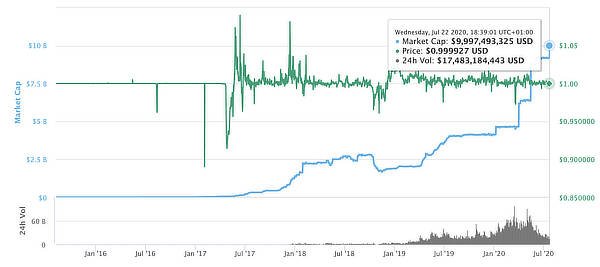

Tether’s recent slide below its dollar pegPaolo Ardoino, Tether’s CTO might have praised the group’s stablecoin for maintaining its stability throughout the chaotic turn of events and highly volatile market conditions. Yet, it’s hard to dismiss Tether’s drop in the market recently.

According to CoinMarketCap’s price data, Tether, the reserve-backed stablecoin which is supposed to be pegged 1:1 to the US Dollar fell to as low as 95 cents earlier in the global session. ten days ago, it was last at 99 cents.

On the brighter side, Tether does not seem to extend systemic risks to the financial system, considering the extent of volatility.

Moreover, the group declared that Tether’s vulnerability to commercial paper over the past six months and at this moment holds the majority of its reserves in U.S. Treasuries.

By market cap, Tether continues to be the largest stablecoin, along with USD Coin and Binance USD. Stablecoin accounts for close to 87% of the overall $169.5 billion stable coin market by marketcap.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|