2023-5-10 19:09 |

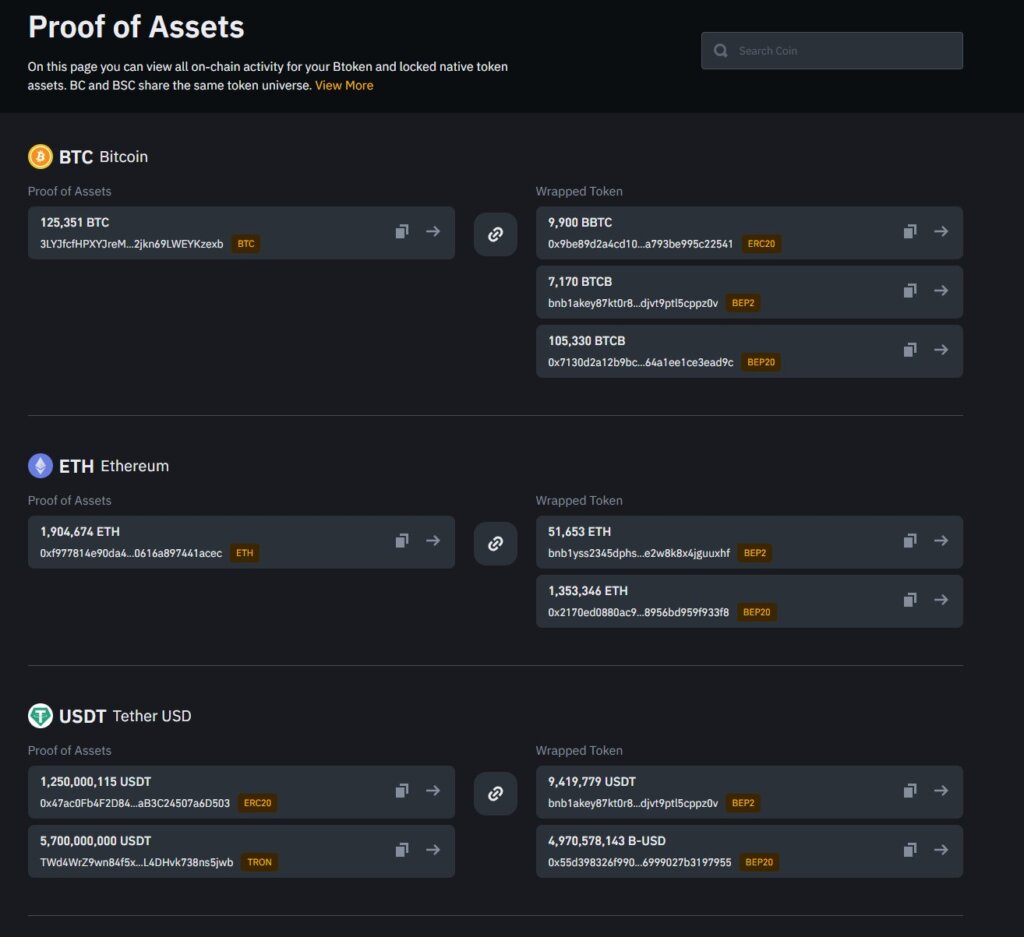

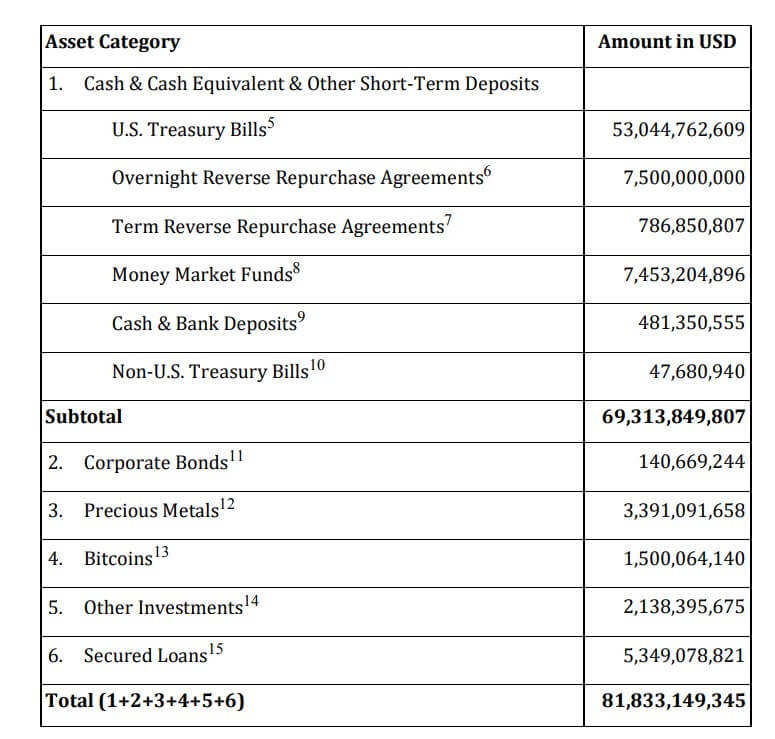

Stablecoin issuer Tether (USDT) said it holds $1.5 billion worth of Bitcoin (BTC) in its reserves — equating to 2% of its total reserves.

The stablecoin issuer further revealed that it held $3.39 billion in precious metals like gold. This accounts for 4% of its total reserves.

A further breakdown of the reserves – provided by the company for the first time – showed the company had its reserves in overnight repo and corporate bond allocations.

Tether said the majority of its investments, about 85%, are being held in cash, cash equivalents, and other short-term deposits.

Source: Tether Attestation Net profit of $1.48 billionIn its latest Q1 2023 attestation, Tether reported a net profit of $1.48 billion, adding that its excess reserves reached an all-time high of $2.44 billion — up from the $1.48 billion recorded in the last quarter of 2022.

Speaking on this milestone, Tether’s CTO Paolo Ardoino said the growth in its reserves and profit reflected the company’s “strength and stability.”

Ardoino added:

“We continue to monitor the risk-adjusted return on all assets within our portfolio on an ongoing basis and expect to make further changes as the overall economic environment changes and the market cycle progresses as a part of our normal, ongoing risk management processes.”

Assets exceed liabilitiesAccording to the report, Tether’s consolidated total asset at the end of 2023 Q1 was $81.8 billion, with the majority in U.S. Treasury Bills. It reported its total liabilities as of May 9, 2023, to be $79.39 billion, of which $79.37 billion were related to the digital tokens it issued.

Meanwhile, the company claims it is now working to reduce its dependence on pure bank deposits for liquidity by leveraging “the Repo market as an additional measure to ensure higher standards of protection for its users by maintaining the required liquidity.”

Ardoino said:

“Tether continues to evaluate the global economic environment and has taken necessary steps to ensure that its customers’ funds are not exposed to high-risk scenarios.”

The company reported $481 million in cash and bank deposits.

Despite criticisms, USDT adoption has increased following the recent regulatory troubles batting its major rivals, USD Coin (USDC) and Binance USD (BUSD).

USDT’s circulating supply sits at $82.54 billion as of press time, according to CryptoSlate data.

The post Tether attestation shows $1.5B worth of Bitcoin in reserves appeared first on CryptoSlate.

origin »Bitcoin (BTC) на Currencies.ru

|

|