2020-3-14 15:48 |

Coinspeaker

Tesla (TSLA) Stock Shows Volatility, Price Crashes to $500 Despite Dow Recovery on Friday

Giving a much-needed breather to investors, the Dow Jones Industrial Average closed this week on Friday on a positive note. Crashing close to 21,000 levels on Thursday, Dow Jones made a quick recovery on Friday surging nearly 2000 points. However, Wall Street’s top performer for 2020, Tesla Inc (NASDAQ: TSLA) stock continues to remain volatile. Despite the overall markets making a solid recovery on Friday, Tesla stock remained under the selling pressure. The Tesla stock price plunged nearly $100 reaching close to $500 before recovering again.

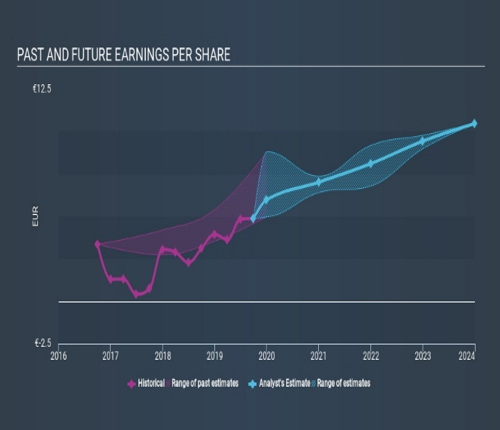

Tesla (TSLA) Stock Price MovementsOn Friday closing, the Tesla (TSLA) stock was 2.5% down trading at a price of $546 sustaining its market cap just above $100 billion. Friday’s price drop for TSLA could be reportedly based on Morgan Stanley cut its target price to $480 from the previous $500 levels.

After a massive bull run earlier till mid-February, investors seem to be reconsidering Tesla’s valuations. Besides, Tesla is facing a severe production jolt on its Shanghai gigafactory facility with the coronavirus outbreak.

Just in the first 40 days of 2020, Tesla (TSLA) stock price surged by a whopping 100% going all the way above $900. The rally came amidst a strong Q4 2019 numbers and company CEO announcing to roll-out 500,000 cars this year. However, the slowdown in the global economy and China’s manufacturing taking a hit has got investors worried.

The weel started for TSLA stock at the levels around $600-630, however, then it was falling with small jumps higher. Only on Tuesday, it managed to reach $659. The most serious falls happened on Thursday and Friday.

The Tesla stock has crashed nearly 45% over the last month amidst the stock market crash. It means that the company has eroded nearly $50 billion from its market cap in less than a month’s time. With this, Tesla (TSLA) stock’s year-to-date returns have crashed to 20% from over 100%. However, if we see, the Dow Jones has also crashed nearly 40% during the same period.

Elon Musk Looks to Expand Tesla’s ProductionTesla CEO Elon Musk is moving aggressively ahead with the company expansion plans. Last month, Tesla raised $2.3 billion in a common stock offering which it plans to use for opening another gigafactory in Europe.

The coronavirus outbreak in China has put Tesla on backfoot by severely impacting its manufacturing. However, Elon Musk refuses to give up this early. To compensate for its falling price and the production cut, Tesla is looking to expand its manufacturing facility in China.

On the other hand, Elon Musk is also looking for new manufacturing facilities in the central U.S. to open a gigafactory for its Cybertruck and Model Y production. Besides, earlier this week, Elon Musk said that Tesla has successfully attained a milestone of 1 million car deliveries.

It looks like Elon Musk is ready to flex all his muscles to stay up to his commitment and not give up on any of the newly presented challenges. Moreover, with the recent overhaul in Tesla’s production abilities, Musk has shunned down all his long time critics. Tesla’s performance over the last year has helped it become the second-largest automobile company in the market.

Analysts have been revising their targets and outlook for Tesla and many believe it could be potentially a game-changer in the automobile industry over the next decade.

Tesla (TSLA) Stock Shows Volatility, Price Crashes to $500 Despite Dow Recovery on Friday

origin »Bitcoin price in Telegram @btc_price_every_hour

TeslaCoilCoin (TESLA) на Currencies.ru

|

|