Taxes / Заголовки новостей

The IRS Will Be Examining Crypto Exchanges More Closely Soon

The United States Internal Revenue Service (IRS) looks to be accelerating its examination of cryptocurrency exchanges. The agency has been working with multiple startups to monitor transactions, including contracts to trace Monero transactions. дальше »

2020-10-8 16:00

|

|

Israeli regulators propose Bitcoin be taxed as a currency, not an asset

“The regulatory reality in Israel is not adapted to the existing reality in the field,” the proposed bill states.

дальше »2020-9-25 23:50

|

|

Universities Should Be the Latest Institutions to Begin Accepting Cryptocurrency

Universities have received some of the largest cryptocurrency donations in the nonprofit sector; however, not many universities accept Bitcoin or other cryptocurrency donations yet. According to a Coinbase study, 56% of the top 50 universities now have at least one course on blockchain or cryptocurrency. дальше »

2020-8-30 22:56

|

|

Do The IRS Crypto Tax Letters Violate Taxpayer Rights?

The IRS is sending letters to bitcoin investors again, warning them about potential misreporting and, according to its own watchdog, violating their rights. The post Do The IRS Crypto Tax Letters Violate Taxpayer Rights? appeared first on Bitcoin Magazine. дальше »

2020-8-28 20:25

|

|

South Korea Finalizes Cryptocurrency Income Tax of 20%

South Korea has finalized a new 20% tax rate for income generated from crypto trading.

дальше »2020-7-22 12:23

|

|

Swiss Government Makes Moves to Encourage Crypto Businesses

The Swiss government is making key legislative changes to financial laws to improve legal conditions for blockchain businesses. дальше »

2020-7-1 11:00

|

|

Top Accounting Firm EY Launches Crypto Tax Prep Service

EY, one of the big four accounting firms, has announced the launch of its in-house cryptocurrency tax service, EY CryptoPrep. The service is a fully automated, web-based product that will... The post Top Accounting Firm EY Launches Crypto Tax Prep Service appeared first on Crypto Briefing. дальше »

2020-6-20 03:53

|

|

Bitcoin Cash 'Sleeper' Tax Remains Hot Issue for BCH Community

Bitcoin Cash supporters demand to know why a controversial miner’s tax remains in the code for its May network update

дальше »2020-4-16 21:30

|

|

How to Report Bitcoin Forks and Ethereum Airdrops on Your Taxes

The advent of Bitcoin, Ethereum, and other cryptocurrencies has introduced unprecedented ways to distribute new assets, creating complex tax situations. Here’s how to account for forks and airdrops, and a...The post How to Report Bitcoin Forks and Ethereum Airdrops on Your Taxes appeared first on Crypto Briefing. дальше »

2020-4-11 06:21

|

|

5 Tips For Minimizing Your Bitcoin and Crypto Taxes

Here are a few things you can do to minimize your bitcoin and cryptocurrency gains and, in turn, your tax liability. The post 5 Tips For Minimizing Your Bitcoin and Crypto Taxes appeared first on Bitcoin Magazine. дальше »

2020-4-1 16:10

|

|

No Tax for You: Why Crypto Traders and Miners Might Head to Portugal

Zero taxes for crypto traders and miners: Is Portugal poised to become a Bitcoin tax haven?

дальше »2020-3-28 15:41

|

|

New Library Aims to Tackle Bitcoin Taxation and Law Controversies

Lukka Inc released a new library compiling the best academic papers on tax, legal, and accounting questions in cryptocurrency. The library focuses on questions that lack official guidance or regulatory...The post New Library Aims to Tackle Bitcoin Taxation and Law Controversies appeared first on Crypto Briefing. дальше »

2020-3-27 06:43

|

|

Steem Scandal, Blockchain Voting Fiasco & More: Bad Crypto News of the Week

Check the bad crypto news of the past week.

дальше »2020-3-8 02:00

|

|

Gemcoin Founder Admits to Fraud in $147 Million Scheme

Gemcoin mastermind faces 10-year prison sentence over $147 million cryptocurrency scheme

дальше »2020-2-20 07:20

|

|

The IRS Is Inviting Crypto Firms to a ‘Summit’ in DC Next Month

The IRS will hold a summit to better inform its thinking around taxing cryptocurrencies next month. дальше »

2020-2-19 00:15

|

|

Russia Leads Multinational Stablecoin Initiative

Could Russian lead BRICS countries in finding innovative solutions to the functioning of the current global framework in transitioning to green economies

дальше »2020-2-14 16:48

|

|

Coinbase resources for 2019 tax returns

Learn about working at Coinbase: https://www.coinbase.com/careers - Medium дальше »

2020-2-12 00:31

|

|

2020 Bitcoin Adoption: Why Nonprofits Will Lead the Way

The tax benefits of donating bitcoin to nonprofits could help push bitcoin adoption in 2020. The post 2020 Bitcoin Adoption: Why Nonprofits Will Lead the Way appeared first on Bitcoin Magazine. дальше »

2020-2-11 16:00

|

|

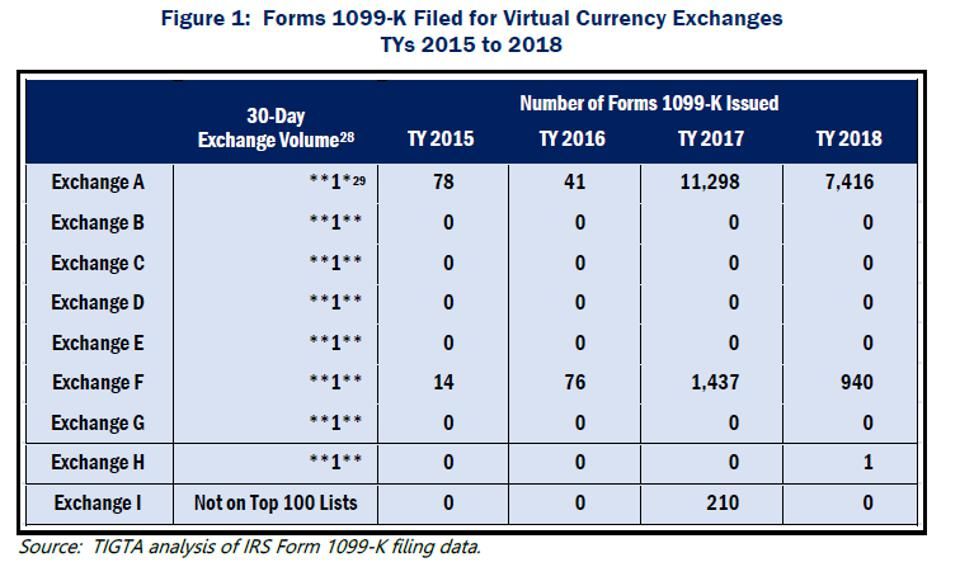

Coinbase Issues Tax Form 1099K: What Does This Mean for Crypto Investors?

Crypto investors across the United States began receiving their 1099K tax documents from cryptocurrency exchange Coinbase this week. But what does the form actually mean for crypto investors, and what actions need to be taken, if any? Clarifying the 1099K Tax Form From Coinbase For Crypto Investors It’s tax season once again in the United... The post appeared first on NewsBTC. дальше »

2020-1-28 20:00

|

|

If This Is You, You May Not Need to Report Crypto Tax Gains to the IRS

It’s a new year, and this means that last year’s calendar and tax year have come to a close, and it’s time once again to start tallying up your crypto holdings, gains, and losses, to figure out exactly what you need to report to the IRS in order to comply legally with your obligation as... The post appeared first on NewsBTC. дальше »

2020-1-21 19:00

|

|

Britain’s Tax Agency Offering Contract for Tech to Combat Crypto Tax Evasion

As cyber crimes evolve, Britain’s tax agency pursues new tech to combat growing tax evasion using crypto

дальше »2020-1-21 04:00

|

|

New Hampshire Lawmakers Vote Down Crypto Tax Bill

New Hampshire legislators have scrapped a bill that would have allowed state agencies to accept cryptocurrencies for tax payments. дальше »

2020-1-16 21:25

|

|

Bithumb Cryptocurrency Exchange Goes to Court Over $69M Tax Bill

Bithumb crypto exchange is taking South Korean tax officials to court over a $69 million tax bill

дальше »2020-1-17 13:26

|

|

US Taxes Aided Bitcoin’s Massive 16% Rally: Here’s Why

Bitcoin (BTC) has been posting strong and consistent gains over the past several days, with its recent dip to lows of $6,800 being closely followed by a massive price surge that has allowed it to gain a position within the lower-$8,000 region. дальше »

2020-1-9 00:00

|

|

IRS Targets Crypto Trading and Gig Economy for 2020 Tax Season

The U. S. Internal Revenue Service (IRS) is directly focusing on crypto trading for the 2020 Tax Day with a checkbox on the tax form enquiring after people’s involvement in virtual currency activities. дальше »

2020-1-8 17:00

|

|

TaxBit raises $5 million to automate cryptocurrency tax compliance

TaxBit, which offers cryptocurrency tax automation software targeted for crypto users, exchanges, and merchants, today announced a seed round funding of $5 million. Participating investors include TTV Capital, Dragonfly Capital Partners, Collaborative Fund, Winklevoss Capital, Valar Ventures, Global Founders Capital, Table Management, Album VC, who previously led TaxBit’s pre-seed round, and more. дальше »

2020-1-6 19:33

|

|

The Taxman Is After Your Bitcoin: Harvest Your Losses Before It’s Too Late

The year is coming to an end, and a lot of people have started thinking about minimizing their tax burden. If you’re a bitcoin investor, things get even more complex. The IRS recently sent out 10,000 letters to cryptocurrency investors, and this is an indication of how serious they are when it comes to cryptocurrency […] The post The Taxman Is After Your Bitcoin: Harvest Your Losses Before It’s Too Late appeared first on Bitcoin Magazine. дальше »

2020-1-2 21:20

|

|

Harsh Laws Make Bitcoin Holders Consider Renunciation or Dual Citizenship

As digital currencies become a mainstay in society, a great number of governments have enforced strict tax guidelines, severe money transmission rules, and tough regulations. Because of a few nation-states’ harsh rules against cryptos, there are individuals who plan to renounce their citizenship in order to become stateless. дальше »

2019-12-28 20:08

|

|

US Lawmakers Ask IRS to Clarify Crypto Tax Rules Around Airdrops, Forks in New Letter

Congressmen are again asking the IRS for clarity on its recent cryptocurrency tax guidance. дальше »

2019-12-21 20:53

|

|

How To Minimize Your Bitcoin Tax Liability Before The New Year

Calculating cryptocurrency taxes and pulling together all the necessary information for tax reporting is never the most exciting thing for bitcoin investors. The whole process can be painful – especially if you have been trading across multiple exchanges. дальше »

2019-12-20 21:22

|

|

Brazil’s Tax Authority Fines Those Who Fail to Declare Bitcoin and Crypto

The tax authority of Brazil fines taxpayers who fail to declare their Bitcoin and crypto transactions

дальше »2019-12-7 01:40

|

|

Brazil IRS Creates Penalty Code For Dishonest Crypto Taxpayers

The IRS in Brazil has turned the spotlight on crypto deals and transfers, creating a special penalty code to fine for misreporting. Brazil Requires Monthly Filings for Crypto Activity Failing to file a monthly report of crypto asset movements triggers “Revenue code 5720 – Default for Default / Incorrect / Delay in Reporting on Transactions Performed with Crypto”, reported community portal OBN. дальше »

2019-12-6 19:28

|

|

If Bitcoin Price Drops — an Opportunity for Crypto Tax Planning

Bitcoin price drops – last chance to reduce tax due before the end of the year

дальше »2019-11-30 06:45

|

|

US Judge Denies Customer’s Plea to Quash IRS Bitstamp Inquiry

A Washington Western District Court judge has rejected petitioner William Zietzke’s appeal to stop the U. S. Internal Revenue Service (IRS) from accessing his Bitstamp trade data. An IRS summons invoked Zietzke to file a petition to quash the tax agency’s investigation into his private accounts. дальше »

2019-11-28 21:30

|

|

US Judge Refuses to Quash IRS Summons for Bitstamp Exchange Records

A federal judge denied a bitcoin user's petition to stop the IRS from gathering data about his cryptocurrency holdings from the Bitstamp exchange. дальше »

2019-11-27 02:00

|

|

4 Possible Reasons Bitcoin Dropped to $6.5K, According to VanEck Exec

China and taxes may be behind $6,500 Bitcoin price drop

дальше »2019-11-26 11:44

|

|

Thailand Introduces Blockchain-Based Tax Refunds for Oil Exporters

The Thai Excise Department to introduce a blockchain-based tax payback system for oil exporters

дальше »2019-11-26 01:48

|

|

IRS Dispels Crypto Tax Confusion

The U. S. Internal Revenue Service (IRS) has cleared up some confusion about how cryptocurrency transactions are taxed, particularly regarding like-kind exchanges and promotional airdrops. As the tax agency intensifies its enforcement efforts, more people are seeking the best tax software to help them. дальше »

2019-11-18 01:00

|

|

Crypto Tax Guidelines Leave More Questions Than Answers

Cryptocurrency holders have long wrestled with their tax obligations. These fiduciary duties have been complicated by tax agencies, which are several steps behind technology and now playing crypto catch-up. дальше »

2019-11-8 19:04

|

|

Britain’s Tax Authority Updates Crypto Guidelines

Her Majesty’s Revenue and Customs (HMRC) has updated its guidelines on the taxation of transactions involving crypto assets. The United Kingdom’s tax authority clarifies its stance on cryptocurrencies and explains which taxes apply to specific activities carried out by business entities and private individuals. дальше »

2019-11-5 01:00

|

|

British Tax Authority Updates Cryptocurrency Guidelines, Says It Is Not Money

Her Majesty’s Revenue and Customs has updated cryptocurrency taxation guidelines for businesses and individuals

дальше »2019-11-5 00:48

|

|

The Future of Cryptocurrencies in the UK Hangs on FCA’s Decision

The U.K. is starting to lose its position as a fintech leader, and the proposed crypto ban will make it worse. Will the FCA save this from happening?

дальше »2019-10-29 15:57

|

|

Crypto and Blockchain News From German-Speaking World: Oct. 20-26

Cointelegraph auf Deutsch presents a weekly digest of developments from the German-speaking world

дальше »2019-10-27 04:01

|

|

Op Ed: How to Understand Taxable Events for Cryptocurrency

The average investor may not be sure of what cryptocurrency events are considered “taxable” and which are not. So here’s a list to help. The post Op Ed: How to Understand Taxable Events for Cryptocurrency appeared first on Bitcoin Magazine. дальше »

2019-10-17 23:27

|

|

Despite Setback in Ohio, Tax Payments in Bitcoin a Viable Trend

Even though Ohio has suspended its groundbreaking program, the idea of using bitcoin for tax payments isn’t going anywhere. The post Despite Setback in Ohio, Tax Payments in Bitcoin a Viable Trend appeared first on Bitcoin Magazine. дальше »

2019-10-16 23:49

|

|

IRS Will Ask If You Own Cryptocurrency on its New Income Tax Form 1040

The US Internal Revenue Service (IRS), a bureau of the Department of Treasury, recently added a question regarding cryptocurrency ownership to its standard 1040 income tax form for the upcoming tax filing season. A draft... дальше »

2019-10-13 12:37

|

|

IRS Releases Tax Guidance on Hard Forks and Airdrops

The IRS has attempted to add tax clarity for cryptocurrencies following hard forks and airdrops but questions remain. The post IRS Releases Tax Guidance on Hard Forks and Airdrops appeared first on Bitcoin Magazine. дальше »

2019-10-11 19:10

|

|

Crypto Outpaces Political Donation Laws in Japan

A major Japanese news publication has reported that crypto donations to individual politicians are legal and do not need to be reported publicly as donations. Japan’s Ministry of Internal Affairs and Communications verified that even though it is illegal to donate cash or securities directly to a politician or political campaign, crypto donations still fly […] The post Crypto Outpaces Political Donation Laws in Japan appeared first on Bitcoin News. дальше »

2019-10-7 05:30

|

|

Ohio Removes Option to Pay Taxes With Crypto While Local SLP Project Presses Forward

The state of Ohio has become an unexpected center of American fintech focus in recent years, thanks to remarkable developments at the intersection of crypto, blockchain and government. That said, the online crypto portal that has allowed Ohio businesses to pay their taxes with bitcoin since last year, ohiocrypto. дальше »

2019-10-3 15:35

|

|