2021-7-7 00:16 |

Sygnum Bank AG, the first-ever digital asset bank, has started offering Ethereum 2.0 staking. The bank unveiled this news through an official announcement earlier today, noting that this move makes it the first bank in the world to support Ethereum in its journey to embracing a Proof-of-Stake (PoS) model. Reportedly, adding support for ETH 2.0 staking is part of Sygnum’s wider goal of expanding its offering.

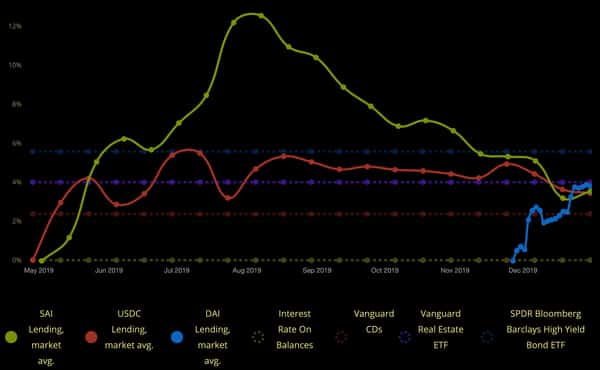

According to the announcement, the bank’s clients will get to enjoy a yield of up to 7% per annum by staking ETH through their current wallets. Sygnum has integrated this service into its institutional-grade platform to ensure the staking process is secure and seamless. Allegedly, the staked ETH will be stored in user accounts under high-security standards.

Explaining why the bank decided to start supporting ETH 2.0 staking, its Head of Business Units, Thomas Eichenberger, cited client demand. He pointed out that Ethereum’s position as a leading cryptocurrency makes its staking a core element for digital asset portfolios. To this end, Sygnum’s pioneering spirit led it to offer this service as an expansion to its range of attractive, regulated yield generating products. In so doing, Eichenberger believes the bank’s clients will get a unique chance to amass other forms of returns apart from capital appreciation.

ETH staking continues gaining popularityCommenting on Sygnum’s support of ETH 2.0 staking, the bank’s Head of Accounts and Custody, Thomas Brunner, said,

Sygnum clients can participate in the new proof-of-stake Ethereum and benefit from potentially higher staking rewards now. This is a compelling choice for long-term investors in the Ethereum ecosystem.

ETH staking continues gaining popularity, with the total amount of staked ETH surging past 6.1 million. At the time of writing, ETH is changing hands at $2,305.77 (£1,670.54) after gaining 6.34% over the past 24 hours. This means that the staked ETH is worth $14.06. The number of validators has also increased to more than 185,000, according to data from the Ethereum Launchpad.

Previously, analysts from American investment bank JP Morgan published a report, saying Ethereum’s upgrades might significantly expand the staking market. In the report, the analysts pointed out that staking currently generates $9 billion (£6.52 billion) in revenue annually. According to them, Ethereum’s shift to a PoS consensus mechanism can grow the staking market to $40 billion (£28.98 billion) by 2025.

The post Swiss-based Sygnum becomes the first bank to offer ETH 2.0 staking appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|