2021-8-24 16:52 |

A trio of Swiss-based crypto-friendly banks has announced plans to offer regulated tokenized assets using the Tezos blockchain. The banks are Crypto Finance, InCore Bank, and Inacta.

Regulated Trio Team Up with Tezos to Create Tokenized AssetsTezos was chosen because of its unique blockchain. The network is self-upgrading, which enables the activation of essential consensus updates without splitting the network.

The banks plan to integrate financial products for their institutional clients using a new token standard on the Tezos blockchain.

The new standard dubbed “DAR-1” was created based on Tezos' FA2 design. The DAR-1 token standard enables smart contracts necessary to support the modern financial markets in compliance with regulations.

Crypto Finance would serve as the infrastructure provider on the project, while InCore Bank would handle the tokenization using the new DAR-1 token standard, which Inacta developed.

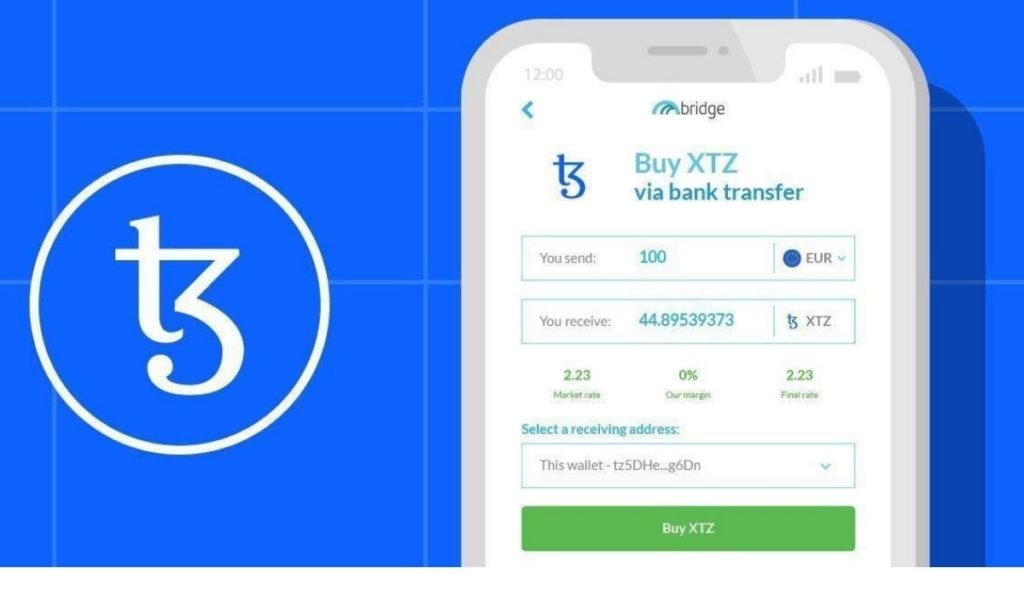

In addition to the joint partnership, InCore Bank has also introduced institutional-grade storage, staking, and trading services for XTZ, the native cryptocurrency of the Tezos blockchain.

This would make InCore Bank the first Swiss business-to-business bank to launch staking services for the Tezos network, unlocking new yield earning products for institutional customers.

The XTZ staking with InCore Bank can be initiated directly via embarking, unlike the traditional staking method. Clients will receive periodic statements regarding staking payouts.

Tezos is quite popular in Switzerland, which is not surprising as the network's founders, the Tezos Foundation, is based there. Last year, Swiss-based digital asset firm Sygnum Bank launched trading and custody services for Tezos.

More recently, Crypto exchange Gemini announced the listing of the Tezos token on its Gemini Earn platform. Gemini Earn is a passive income program where tokens are locked with world-class security and interest accrued daily.

Tezos Rolling Out Upgrades On NetworkIn recent times Tezos has welcomed integrations from different protocols as it continues to upgrade its network.

Tezos is an open-source proof of stake blockchain network that powers applications and tools behind leading financial institutions, central banks, NFTs, DeFi platforms, and so on.

The network's seventh successful upgrade called Granada went live this year. Granada contains numerous bug fixes and minor improvements for the Tezos protocol. The update cuts block times in half and decreases smart contract gas consumption by 3-6x. It also introduces liquidity banking.

The upgrade, which is the third to occur this year, was named after a Spanish city. Granada goes live less than three months after the previous one, dubbed Florence.

The Florence upgrade was the update that doubled the size of maximum operations (from 16kB to 32kB), reduced gas in smart contract execution. It streamlined the amendment process by deactivating unused test chains on the Tezos protocol.

Tezos/USD XTZUSD 4.0571 -$0.02 -0.57% Volume 621.26 m Change -$0.02 Open$4.0571 Circulating 856.76 m Market Cap 3.48 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=XTZ&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~XTZ~USD"); The post Swiss Companies to Offer Institutions Tokenized Assets Built on Tezos (XTZ) first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Tezos (XTZ) на Currencies.ru

|

|