2024-6-21 08:15 |

What Are Futures?

Futures trading is a financial strategy enabling investors to speculate on future price movements of assets such as commodities, indices, and currencies. In a futures contract, the buyer commits to purchasing a specific asset at a predetermined price and date, allowing for strategic planning and potential profit.

These contracts are traded on exchanges, with their value influenced by the supply and demand of the underlying asset. Trading can be conducted on various online platforms, and it is highly recommended to use reliable platforms for this purpose. For example, futures trading with Plus500 is a popular option for those looking to invest in futures contracts.

How Do Futures Work?

Futures trading involves two parties entering into a contract to buy or sell an asset at a future date. The buyer of the contract agrees to purchase the underlying asset at a predetermined price and date in the future, while the seller agrees to provide the asset at that set price and time.

The value of a futures contract is determined by the current market price of the underlying asset, as well as factors such as supply and demand, interest rates, and economic conditions.

Futures contracts are often used for hedging purposes, allowing businesses to lock in a price for commodities they will need in the future. This helps to mitigate the risk of fluctuating prices.

What is Sustainable Investing?

Sustainable investing integrates environmental, social, and governance (ESG) factors into investment decisions. This approach goes beyond traditional financial analysis to assess the long-term sustainability of a company’s practices and their impact on society and the environment. Sustainable investors seek to maximize financial returns while promoting positive changes in areas such as climate action, human rights, and corporate responsibility.

Why Invest in Green Energy?

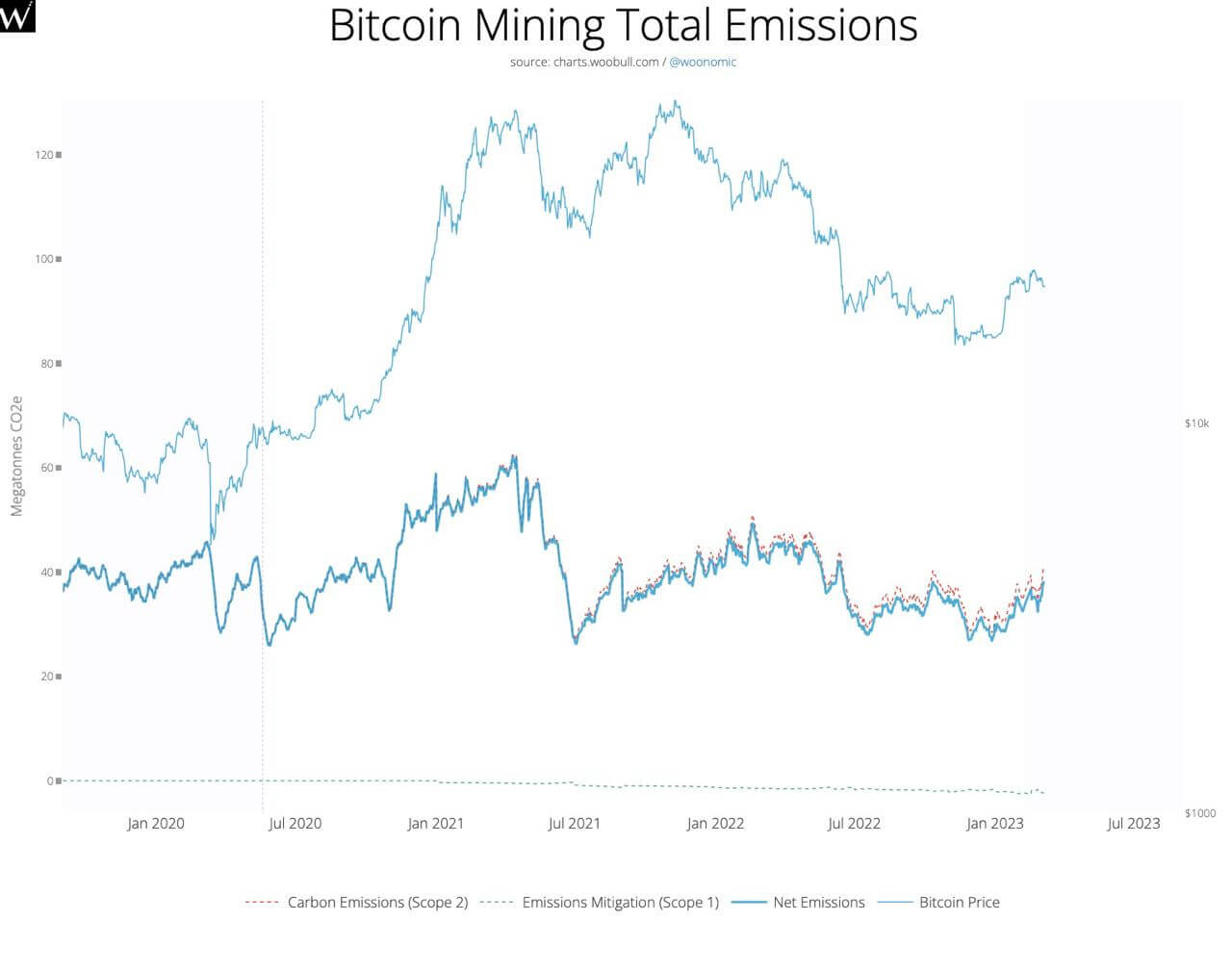

Green energy refers to renewable sources of energy that are environmentally friendly and have low or no carbon emissions. This encompasses solar, wind, hydro (which powers approximately 25% of all Bitcoin mining), and geothermal energy, among others. Investing in green energy is vital for several compelling reasons:

Climate change: The burning of fossil fuels is a major contributor to greenhouse gas emissions, which are the primary cause of global warming. Cost-effective: Advances in technology have made green energy increasingly competitive with traditional energy sources. In fact, in many cases, it is now more cost-effective to invest in renewable energy than non-renewable sources.How Can Green Energy Be Traded Through Futures?

Green energy can be traded through futures just like any other commodity. Investors can purchase futures contracts for renewable energy sources such as wind, solar, hydro, or biomass.

These contracts allow investors to secure a set amount of green energy at a specific price and time in the future. By investing in green energy futures, investors can support the growth of renewable energy while also potentially profiting from its increasing demand.

Furthermore, with the rise of Environmental, Social, and Governance (ESG) investing, green energy futures are becoming an attractive option for socially responsible investors. These investors have a strong interest in supporting sustainable and environmentally-friendly businesses.

What Are the Benefits of Trading Green Energy Futures?

Risk management: Futures contracts allow investors to hedge against potential price fluctuations in the market. By securing a fixed price for green energy, investors can mitigate their risk and protect themselves from unexpected changes in the market. Portfolio diversification: Adding green energy futures to an investment portfolio can provide diversification and reduce overall risk. As renewable energy sources become increasingly important, having exposure to this sector can help balance out the volatility of other investments. Potential for profit: As the demand for green energy grows, so does its profit potential. By investing in green energy futures, investors can capitalize on this growing market and potentially earn a return on their investment. Environmental impact: By investing in green energy futures, investors are supporting the growth of renewable energy sources, which have a positive impact on the environment. This aligns with the values of socially responsible investing and can make a significant contribution to addressing climate change.Conclusion

Green energy futures offer a unique opportunity for investors to not only diversify their portfolios and manage risk but also contribute to the growth of sustainable and environmentally friendly businesses. With the increasing demand for renewable energy, these futures have the potential to be profitable investments while making a positive impact on the environment. As ESG investing continues to gain traction, green energy futures are likely to become an even more attractive option for socially responsible investors in the future.

origin »Bitcoin price in Telegram @btc_price_every_hour

Restart Energy MWAT (MWAT) на Currencies.ru

|

|