2020-5-31 03:38 |

Over the past few months and years, financial derivatives like options and futures have become increasingly important to crypto. As a result, the data these markets have shown more and more about which way traders are leaning.

Case in point: Just recently, it was reported by a top options exchange that investors are starting to get long-term bullish on Ethereum.

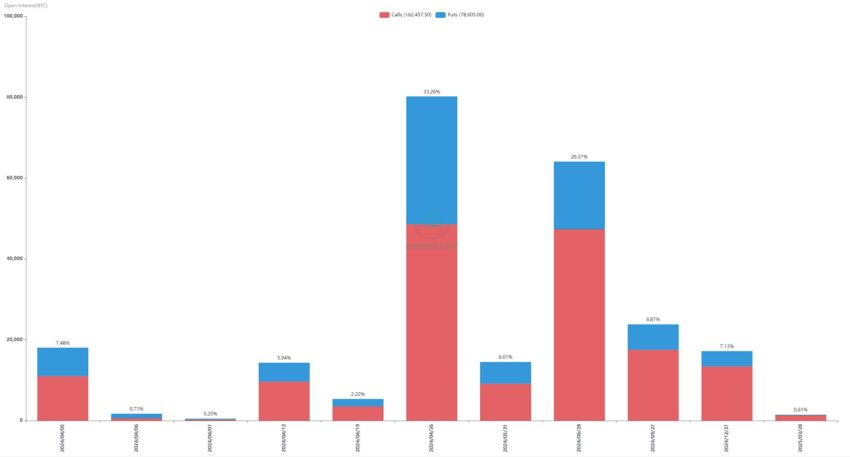

Deribit reports investors are buying long-term Ethereum callsIn derivatives exchange Deribit’s latest weekly report, it was revealed that there have recently been “structural changes in [the] options market” for Bitcoin and Ethereum.

The company noted that along with trading volumes rising, there has also been an influx in “long-term call buying” with ETH.

Call options, as Investopedia describes, are financial contracts that “give the buyer the right, but not the obligation” to buy the asset “at a specified price within a specific time period.”

Basically, what Deribit is saying is that there is a growing number of traders that are long-term bullish on Ethereum, despite the fact that ETH is still around 80 percent below its all-time high set in 2018.

Other data sets confirm the growing sentiment amongst Ethereum investors to accumulate.

As reported by CryptoSlate previously, blockchain analytics firm Santiment found that there has been a strong increase in accumulation by some of ETH’s “whale” addresses over the past few weeks.

Chart of ETH whale holdings from blockchain analytics firm Santiment“ETH whale addresses have just hit a 10-month high with the cumulative holdings of the top 100 non-exchange wallets now owning over 21,800,000 Ethereum,” Santiment wrote.

There are reasons to be bullish on ETHAlthough it is basically impossible to tell why Deribit traders, in particular, are suddenly accumulating ETH call options, there is a confluence of fundamental reasons why analysts are suddenly bullish on Ethereum.

Mythos Capital founder Ryan Sean Adams recently remarked that ETH is “doubly” undervalued, as CryptoSlate reported earlier this week.

Adams largely attributed his bullish sentiment to the image below, which shows that the price of ETH has been closely correlated with the transaction fees Ethereum users pay to get their transactions processed over the past four or five years.

Ethereum transaction fees have spiked over recent weeks alongside Bitcoin fees, suggesting that ETH has room to rally to the upside.

ETH Price Vs Ethereum Blockspace FeesAlongside the increasing usage of Ethereum, analysts have seen the fundamental case for decentralized finance increase massively over the past few weeks as central banks have grown increasingly “dovish” with policy due to COVID-19.

This is a trend that Ethereum will benefit from due to it being the de-facto go-to blockchain for DeFi applications.

The post “Structural” shift in crypto options shows there’s an influx of long-term Ethereum bulls appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|