STH / Заголовки новостей

STHs faced substantial losses as Bitcoin briefly fell below $60k

Bitcoin’s volatility over the weekend translated to a sharp drop to below $60,000 on June 24, leading to over $537 million in realized losses for the market. As with most spikes in realized losses, this sell-off was predominantly driven by short-term holders, who accounted for almost the entire amount of realized losses. дальше »

2024-6-26 05:00

|

|

Bitcoin short-term holder realized price growth hits a speed bump

The realized Bitcoin price represents the average on-chain acquisition cost. It’s a handy metric as it perfectly gauges the market’s valuation baseline at any given point. When dissected through the lens of short-term and long-term holders, it provides insights into the cohorts’ investment horizons and their acute effect on Bitcoin’s price. дальше »

2024-3-22 18:30

|

|

Bitcoin’s March madness: Short-term holders bear the brunt of volatility

Quick Take March has proven to be a tumultuous month for Bitcoin, showcasing fluctuations from an opening at roughly $61,000 to a steady rise above $67,000. Despite this progress, the path was not without its challenges. дальше »

2024-3-22 18:02

|

|

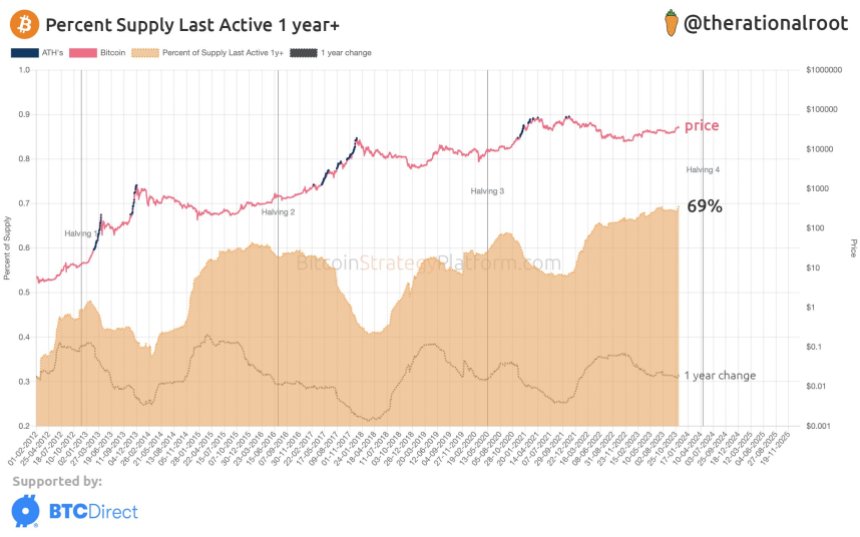

Bitcoin HODLers Grows As Significant Supply Remains Locked

Despite a larger portion of Bitcoin’s total supply being “inactive” for over a year, recent data revealed impressive growth in investors holding on to their BTCs during the rally. Bitcoin HODLing Yawns For Growth With Lesser Supply On Wednesday, November 15, a crypto analyst known as Root took to his official X (formerly Twitter) handle to share valuable data concerning Bitcoin. дальше »

2023-11-17 19:00

|

|

How short-term holders keep Bitcoin price stable but constrained

Bitcoin has maintained a tight trading range between $28,000 and $30,000 since April 2023, a prolonged sideways movement that has been a rarity in the market. One of the reasons for this squeezed price range, especially after BTC dropped below $30,000, is price support created by short-term holders. дальше »

2023-8-10 21:45

|

|

Market back in profit-taking mode despite flat Bitcoin shows key metric

Despite Bitcoin’s price staying below the critical $30,000 mark, recent spikes in a key market metric, the Spent Output Profit Ratio (SOPR), suggest the market is in a profit-taking regime. BTC has been flatlining around $29,200, unable to regain the $30,000 level it lost on July 23. дальше »

2023-8-5 20:45

|

|

BTC’s ‘Hands of Steel’- 37% of Bitcoin’s Supply Hasn’t Moved Since 2017, 55% Sat Idle After 2018’s Bottom

Just recently, the onchain data and research company Glassnode published a report that introduces variations of Bitcoin’s Spent Output Profit Ratio (SOPR) and Market Value to Realized Value (MVRV) Ratio. дальше »

2021-3-17 20:00

|

|