2025-12-29 01:30 |

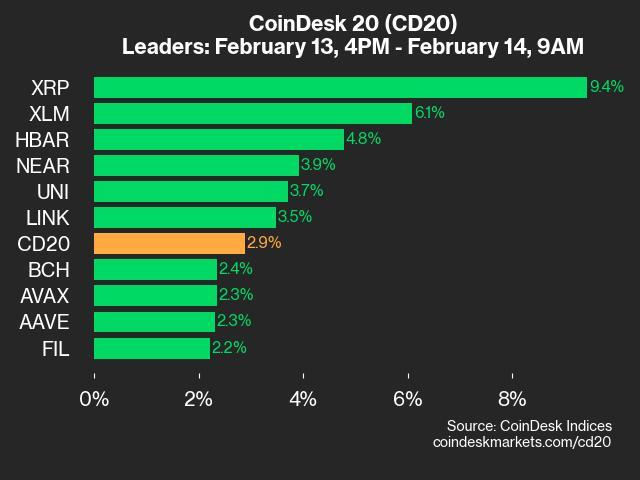

Stellar has never been the loud project in crypto, and honestly, that’s probably part of why it’s still around. XLM doesn’t chase hype cycles or jump on whatever narrative is trending that week. It sticks to one job and keeps doing it: moving money across borders quickly and cheaply.

That makes it easy to ignore at times, but it also makes Stellar surprisingly resilient. So if someone is holding 6,744 XLM today, the real question is pretty simple. What could that realistically turn into by 2027 if Stellar just keeps moving forward the way it has so far?

Where XLM Stands Right NowAt the moment, the XLM price trades around $0.23, which puts Stellar’s market cap near $7.6 billion. At that price, 6,744 XLM is worth roughly $1,551. Stellar is clearly established, but it’s also not priced like it has already taken over global payments.

That’s why projections for the next couple of years vary so much. There’s room on the upside, but the path there matters.

In a more conservative scenario, Stellar continues to grow slowly and steadily. It stays relevant in payments and remittances, adds partnerships over time, and avoids any major setbacks, but nothing dramatically changes overnight.

If that’s how things unfold, the XLM price ending up somewhere between $0.35 and $0.45 by

2027 feels reasonable. That would push Stellar’s market cap into the $11 to $15 billion range.

For someone holding 6,744 XLM, that would mean a value of roughly $2,300 to $3,000. It’s not a huge leap, but it does show steady, meaningful progress.

As Adoption Becomes More Visible and Stellar Expands GloballyThings start to get more interesting when Stellar sees stronger real-world use, especially from fintechs and cross-border payment platforms. As more transactions flow through the network, the need for settlement liquidity naturally grows.

In that kind of environment, XLM trading in the $0.60 to $0.90 range feels reasonable. That would put Stellar’s market cap closer to the $20 to $30 billion range.

This feels like the most balanced outcome. It doesn’t require Stellar to dominate global finance, just to keep expanding where it already fits naturally.

A more aggressive scenario assumes Stellar becomes a widely used payment rail for banks and fintechs around the world. If that happens, demand for XLM as a settlement asset could increase significantly.

Under such adoption, a price range of roughly $1.20 to $1.80 seems possible. That would place the value of 6,744 XLM somewhere in the $8,000 to $12,000 range.

The result rests on the quality of execution, growth within regulatory-friendly levels, and Stellar continuing to improve quietly without whittling away at the earned trust along the way.

Read Also: Here’s Where Solana’s SOL Price Is Be Headed This Week

What’s Next for StellarThen there’s the very optimistic case. If Stellar somehow becomes a core piece of global settlement infrastructure, XLM reaching $3.00 isn’t impossible.

That would put Stellar’s market cap close to $100 billion and turn 6,744 XLM into just over $20,000. Possible, but it would require Stellar to operate at a truly global level.

Stellar isn’t built for fast pumps or flashy narratives. Its upside comes from slow, steady adoption. For long-term holders, the real question isn’t hype. It’s whether Stellar keeps quietly expanding its role in global payments between now and 2027.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Stellar Price Prediction: How Much Will 6,744 XLM Be Worth by 2027? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Stellar (XLM) на Currencies.ru

|

|