2019-5-12 01:59 |

Mid May Update: Technicals

XLMBTC is coming alive, along with the rest of the altcoins market. It doesn’t show on the daily timeframe but when we zoom in on 4H, there is an obvious increase in volume and ATR (volatility) that are usually indicators of a trend reversal. XLM did violate coupe of strong support zones and we would first need it to claw back up to the 1753 sats zone before we can talk about a real bull trend.

Daily chart still looks the same, as the potential trend reversal is in its nascent phase. We are still yet to see a green candle on a daily before we can talk about an actual reversal start but the overall market sentiment seems to be very bullish. Bitcoin has been on a run for couple of weeks now, but altcoins were in suspense that appears to ending today.

But considering how cheap XLM is and probability of altcoin season looking much better now than yesterday, this could be a good entry position. If you are a cautious trader, a tight stop loss will make you sleep better tonight while you dream about more than solid gains with your XLM.

Weekly chart still shows potential falling wedge – a bullish trend reversal indicator. This setting is somewhat invalidated but it could still play out should volume pick up.

One thing to bear in mind is the turbulent and erratic nature of bitcoin – a sudden thrust up or slide down is always on the cards which would invalidate this and all other analysis and predictions. In such cases, market is shaken up with most traders exiting altcoins and entering bitcoin positions, especially in the initial phases of bitcoin pumps. So it is always good idea to keep a close eye on bitcoin’s behaviour before opening a long or a short on any other coin in the market.

Should this happen, stop by again to check out our updated charts and thoughts.

Trading volumes are looking okayish but there is a bid disparity between the reported volume that is 15x larger than the “Real 10” volume (trading volume on the exchanges that prevent wash trading). This means that XLM’s liquidity is massively inflated which is worrisome.

Additionally, XLM comparatively has a weak buy support, according to coinmarketbook.cc. Buy support is measuring sum of buy orders at 10% distance from the highest bid price. This way we can eliminate fake buy walls and whale manipulation and see the real interest of the market in a certain coin. XLM currently has $3.9 million of buy orders measured with this method, which sets XRP buy support/market cap ratio at 0.20% which is a low ratio among the bluechip coins. Bitcoin and Ethereum have a 0.27% and 0.28% ratios, respectively. This novel metric indicates there are a lot of manipulations, inflated liquidity and fake orders on XLM trading pairs.

Social MetricsStellar’s market sentiment score, measured by the market analytics firm Predicoin, paints a neutral picture.

Predicoin wraps its analysis up into a single simple indicator known as the SentScore, which is formed from the combination of five different verticals: news, social media, buzz, technical analysis and fundamentals.

Stellar currently has a Sentscore of 4.6 which is defined as “the neutral zone”. You can see that Reddit buzz has decreased in the last 30 days with Twitter and search volume also going down slightly. Sentscore is also marginally down. All of this summed up means that Stellar had a quiet April with little new interest in the project.

Overall, Predicoin’s Sentscore is an excellent indicator of community interest and can provide useful insight into which coins are trending right now.

Early May Update: FundamentalsBelow are some of the most important news around the project in the last 30 days.

wevest Digital AG, a Berlin-based fintech company offering digital investment banking services for small and medium-sized enterprises (SMEs), will use the Stellar network for its upcoming Security Token services. After extensive diligence and testing, wevest has identified Stellar as the most suitable platform for its new product. Payments platform Wirex is launching 26 stablecoins on the Stellar blockchain network. The U.K.-based firm announced the news on Thursday, saying that the stablecoins will be backed by fiat currencies including the U.S. dollar, euro, the British pound, Hong Kong dollar and the Singapore dollar.XLM is officially available on Coinsquare and CoinDeal exchanges! You can now fund your account with XLM and withdraw it directly to your wallet.Below is our long-term forecast where we cover general market movements and sentiment shifts before delving deeper into the specific predictions for XLM.

Stellar IntroStellar Lumens is a cryptocurrency platform that focuses on remittance and cross-border payments.

Stellar is aiming to be an open financial system that gives people of all income levels access to low-cost financial services. These services include, but are not limited to:

RemittancesMicropaymentsMobile BranchesMobile MoneyIn addition to these services, one very powerful feature of the network is their Distributed Exchange. Users can liquidate/exchange their funds for other cryptocurrencies or fiat currencies using the platform’s exchange anchors.

During January, XLM recorded an all time high price of $0.93, shooting up from $0.39 just a few days earlier.

On the 8th of March 2018, Stellar announced a new partnership between themselves and Keybase.

The next big month for Stellar and XLM came in the shape of July. After passing through April, May and June with very little to shout about, the Stellar project hit headlines once again with an announcement from the Stellar Development Foundation that highlighted Stellar XLM had become the world’s first blockchain product to be recognised by Sharia law. Through the year, Stellar have continued to make progression with XLM, through further partnership announcements that are all helping XLM to become a powerful rival to XRP.

We should consider crypto valuations like educated gambling, a ‘prediction market’ where we are betting on the odds of project and token success. There are some catalysts of success we can identify:

Real user traction is the most important driver of success, that is what most of holders call “adoption”. If people start using certain crypto project because they find it useful and it makes their life easier, that is a guarantee of success. So far, almost no crypto project can claim to have done so.

Strong financial warchest that will enable teams behind the project to develop their visions, incentivize other developers to join them and start using their product is also a crucial aspect of any project. Tied into it is treasury management – especially for the project that had big ICO proceeds. Temptation to squander all those millions into “conferences and events” (read hard-core partying on yachts and luxury hotels) was massive, especially if we consider that majority of token projects founders were no-names and ordinary employees that worked for a paycheck before the ICO fairy-tale happened to them.

Another adoption indicator – network effects, where every additional user of a good or service adds to the value of that product to others. When a network effect is present, the value of a product or service increases according to the number of others using it.

If you can objectively notice that your favorite token project has some of these traits happening for it, be happy – you might have found a winner.

Token success drivers (favourable demand-supply dynamics, programmable incentives on token, aligned incentives with management team and consensus on token as common unit of value creation).Token success is completely dependent on tokenomics. As defined by infloat.co, tokenomics involves the incentivization of certain stakeholders to ensure particular behavior.

So, tokenomics is essentially an incentive structure designed to ensure that a token has a purpose and utility within its native network. It is the study of how coins/tokens work within the broader ecosystem that can be considered as a sovereign micro-economy. This includes such things like token distribution as well as how they can be used to incentivize positive behaviour in the network.

For example, bitcoin is designed to ensure that bitcoin miners have a reason to mine new bitcoin. Miners validate bitcoin transactions and receive (or create) newly minted bitcoin in the process.

On the other hand, individuals, businesses and other bitcoin users pay a transaction fee for miners to include their transaction in the next block. This ensures that even when all bitcoin have been minted (to the tune of 21 million, which should happen in around 2140), bitcoin miners are still incentivized to keep ‘mining’ (i.e. validating transactions).

To paraphrase all of the above in the simplest terms: if you, after weeks of research and reading, can’t figure out why the project needs to have a token, it probably doesn’t.

So why does the token exist then?

– To make the project founders rich.

But there are some people on Twitter, Reddit, Telegram claiming otherwise.

-Yes, they are either: paid to do so by those same founders, they are desperate and delusional bad holders or they are just stroking their own ego with newly learned fancy economic terms and jargon.

Needless to say – stay clear of such projects.

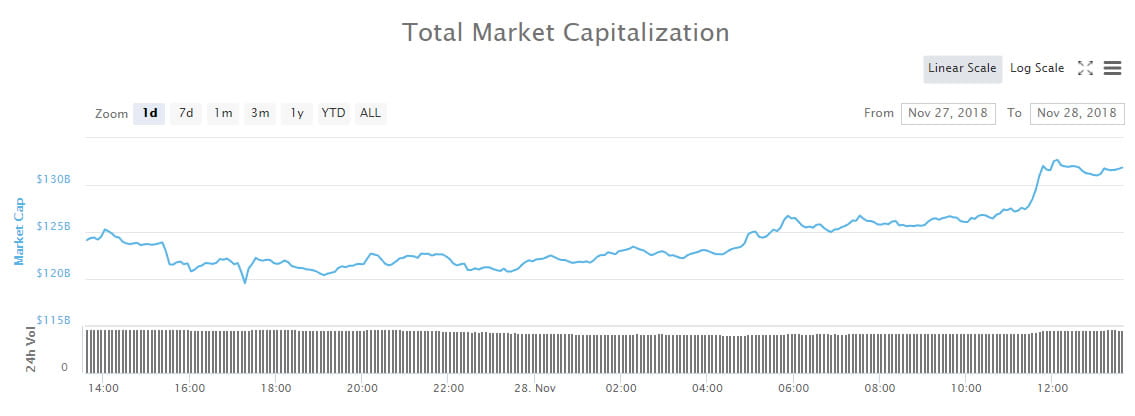

Market Movements and Sentiment ShiftThe downfall of altcoins that were mainstream media darlings at the start of the year, XLM among them, can be attributed, in part, to novice investors getting scared off once the bear market kicked in with a vengeance. Every resurgence of bitcoin in recent period, was met with the inability of altcoins to rally with it. Reason for that can be rookie investors learning from their mistakes, while smart money that was previously watching from the sidelines has begun to enter.

These entities weren’t about to buy BTC when it was trading at an all-time high, but they’ll take a look now, having missed the boat the first time around. None of them, it seems, are interested in altcoins however, despite the fact that many are trading at a 5x discount. Institutional investors may be cautious, but they’re not foolish.

Our XLM Price Prediction for 2019It is quite clear that cryptocurrency price predictions should be taken with a grain of salt, but there are factors to look out for that will almost certainly have a bearing on the future price of the wider cryptocurrency market. This includes:

The level and nature of regulations imposed in dominating cryptocurrency marketsThe level of cryptocurrency adoption in the coming year and beyondThe level of growth in the cryptocurrency futures marketThe utility of tokens and the ability of the underlying technology to solve real-world problemsXLM, as the rest of the market, is tied at the hip of bitcoin’s price action. If bitcoin embarks on another bull run, XLM can hope for one as well. Since that is very unlikely, don’t expect much to change for XLM price-wise in this year. So 2019 will be a year of boring sideways action with minor bitcoin ignited jumps and slumps.

In general:

The main currency in cryptocurrency markets is Bitcoin and given this, altcoins tend to fuel Bitcoin runs and Bitcoin tends to do the same in return. Given this relationship, Bitcoin price movements (or lack thereof) tend to effect altcoin prices.

When Bitcoin goes up swiftly, it will likely:

Suppress or depress altcoins as money flows into Bitcoin;Or, take altcoins along for the rideIn cases when Bitcoin plunges, it will likely:

Depress altcoins as money flows into fiat;Or, cause altcoins to boom as money flows into them, but this is rarely the case.When Bitcoin moves sideways, it will likely:

Cause altcoins to mimic that as traders wait for a clear sign on the direction of the market;Or, cause altcoins to flourish as traders look for returns in altcoins and try to get favorable trades in terms of BTC pairs. XLM-BTC Price CorrelationThe vast majority of trading that occurs in the crypto markets are between BTC and Altcoin trading pairs. Since most Altcoins do not pair with fiat currencies (and only a few are paired with stable coins like USTD), Bitcoin is the next best option. Therefore, when Bitcoin is stable, it forms as the ideal base currency for buying Altcoins (which is why Altcoins tend to do well when Bitcoin goes sideways).

Correlation is measured on a scale from -1 to 1. Values above 0 shows the degree to which altcoin is moving in the same direction as BTC prices (either up or down in tandem), and values below 0 shows the degree to which altcoin moves in the opposite direction of BTC prices (so when BTC goes down, altcoin goes up, or vice versa). Values around 0 shows that when BTC price moves, altcoins stays steady, or alternatively that when altcoin moves up or down that the BTC price is staying steady.

XLM has had a correlation coefficient of 0.90+ for the most of its market life, with occasional drop to zero territory mostly due to the fact XLM couldn’t follow suit bitcoin’s sudden jolts upwards; as shown on the image below – source.

A bullish Bitcoin usually drives Altcoin holders to dump their Altcoins into Bitcoin (because why take risks betting on smaller volume coins when you can make gains on the largest and most traded cryptocurrency).

Considering that Bitcoin is the ‘anchor’ of the crypto market, when Bitcoins price starts to fall, traders begin to sell all other coins and retreat back to fiat or stable coins like Tether.

Majority of altcoins will failThe majority of projects will fail — some startups are created just to gather funds and disappear, some would not handle the competition, but most are just ideas that look good on paper, but in reality, are useless for the market.

Vitalik Buterin, co-founder of Ethereum said:

“There are some good ideas, there are a lot of very bad ideas, and there are a lot of very, very bad ideas, and quite a few scams as well”

As a result, over 95% of successful ICOs and cryptocurrency projects will fail and their investors will lose money. The other 5% of projects will become the new Apple, Google or Alibaba in the cryptoindustry. Will XLM be among those 5%?

Hard to tell but probability for that is better than with most other altcoins but still far from being a wrap.

XLM is pinning most of their hopes on their partnership with IBM which is one of the highlights of project’s history to date. On the other side, the niche XLM is competing in is fiercely crowded with other top-notch crypto projects, most notably XRP. Since the race is considered by many to be a winner takes all, XLM is dancing on a razor thin edge in an effort to capture the global market of payments and value transfers.

All of this summed up means one thing: XLM might live through couple of orchestrated and, for a regular trader, completely unpredictable pumps but the majority of time will be murky sideways trading with small volume and no significant interest from the market.

Price will heavily depend on what BTC will do and since many analysts think BTC will not be making big moves in this year, it is hard to expect XLM will do them either. The price will probably stagnate and record slow-moving depreciation or appreciation depending on the team activity, potential technological breakthrough or high-level partnership.

Predicting token price is thankless task – it is not much different than gambling. However, people still gladly make their predictions and even more bigger pool of people search and read them. So here are couple of independent sources and their musings about XLM price in this year.

#1 Long ForecastLong Forecast gave an entirely conservative prediction, where they forecasted that by the end of 2019, XLM might reach $0.30, which make sit look like it won’t grow much as compared to the current price. Maybe, the end of 2019 prediction is missing if this can be considered the prediction for the 1st half of 2019.

#2 Wallet InvestorWallet Investor updates prices and predictions every three minutes using the latest technical analysis. They have very conservatively made a 5-Year forecast of $1.005.

#3 Mega Crypto PriceThe price forecast at Mega Crypto Price has been very optimistic for all the cryptocurrencies and its the same for XLM, too, predicting that Stellar could be worth $5.10 by the end of 2019. The team says that this can be achieved as long as there are no major security flaws and the overall sector performs well.

#4 Monetize InfoMonetize believes that Stellar’s major partnerships will be the major reason behind an upcoming price surge, which might result in XLM’s price reaching $2-$3 by 2019. Beyond IBM, Stellar’s partners include Stripe, Deloitte, etc.

For example, Stripe gave Stellar a 3-million-dollar capital injection a few years back which Stellar immediately returned in XLM.

#5 The Economy Forecast AgencyThis website features a long-range forecasting model to make market forecasts for corporate clients. The website has its own price prediction for 2020, which says XLM will see a high of $0.64 in 2020, which is by far the most conservative and pessimistic of XLM’s price predictions.

The post Stellar Lumens (XLM) Price Prediction 2019 – Fuel The Jets, We Might See A Take-Off After All (Mid May Update) appeared first on CaptainAltcoin.

origin »Theresa May Coin (MAY) на Currencies.ru

|

|