2025-1-31 17:13 |

According to a report from crypto exchange CEX.IO, stablecoin transfers reached $27.6 trillion in 2024, outpacing Visa and Mastercard’s combined transaction volume by 7.68%.

The report pointed out that stablecoins consistently outperformed traditional payment providers throughout the year despite a dip in Q3 due to broader market slowdowns.

Chart showing the trading volume for stablecoins compared to Visa and Mastercard in 2024 (Source: CEX.IO)This trend signals a shift in global remittances as legacy providers like Western Union and MoneyGram struggle to adapt to a rising demand for digital assets.

The stablecoin supply expanded by 59% during this period, exceeding $200 billion. This growth pushed stablecoins to represent 1% of the total US dollar supply, a significant increase from 0.63% at the start of the year.

USDC leads as Solana gains dominanceCircle’s USDC emerged as the dominant stablecoin for on-chain transactions, accounting for 70% of total transfer volume. However, its influence weakened slightly in Q3 due to a temporary decline in DeFi activity.

Tether’s USDT, the largest stablecoin by market cap, experienced substantial growth, with its total transfer volume more than doubling. Despite this, its market share declined from 43% to 25% last year.

Graph showing the total stablecoin supply in 2024 (Source: CEX.IO)Solana became the most active blockchain for stablecoin transfers, overtaking Tron and Ethereum in January 2024. The surge in Solana-based activity propelled USDC’s market share, with 73% of the network’s stablecoin supply tied to USDC transactions.

According to CEX.IO:

“This increase aligned with Solana’s overall ecosystem growth, as stablecoins on the network were predominantly used for DeFi and other dApp activities.”

Bots fuel stablecoin volumeCEX.IO pointed out that Bot-driven trading played a significant role in stablecoin transactions last year, with automated systems responsible for 70% of total volume.

According to the company’s research, bot-driven trades were particularly dominant on Ethereum, Base, and Solana.

The crypto exchange reported that unadjusted transaction volumes—primarily reflecting bot activity—represented 77% of all stablecoin transfers in 2024. This marked a fourfold increase from 2023, with Base even overtaking Ethereum in Q4 stablecoin volume due to the rise of automated trading.

Chart showing stablecoin bot transactions in 2024 (Source: CEX.IO)It continued that unadjusted transactions comprised over 98% of total stablecoin activity in networks where USDC dominates, such as Solana and Base.

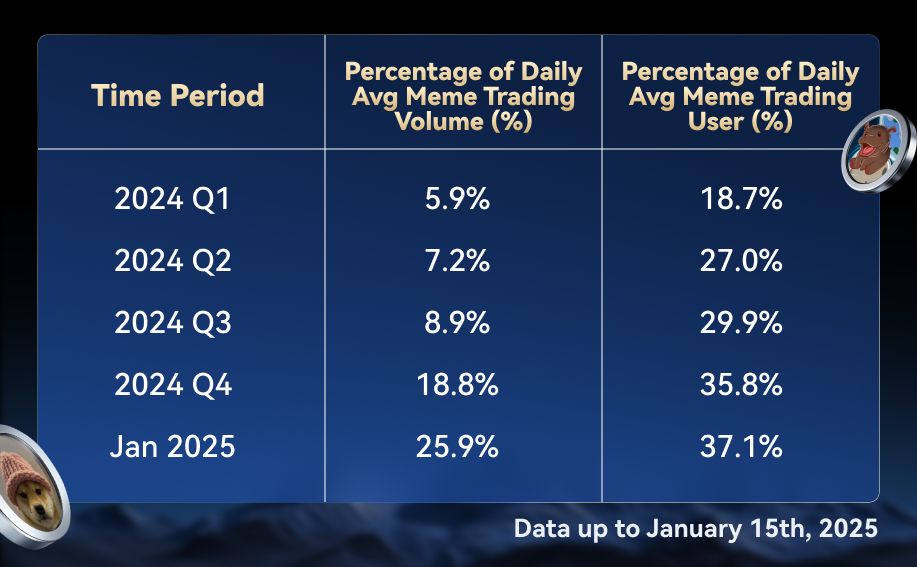

This surge was fueled by these networks’ high transaction speeds, low costs, booming DeFi ecosystem, and rapid proliferation of meme tokens. In December alone, memecoins accounted for 56% of Solana’s decentralized exchange (DEX) trading volume.

Chart showing the unadjusted stablecoin trading volume in 2024 (Source: CEX.IO)Despite concerns over bots manipulating markets through frontrunning and sandwich attacks, CEX.IO noted that they also improve efficiency. These automated systems facilitate arbitrage, execute recurring smart contract transactions, and help cover users’ gas fees.

CEX.IO added:

“As a result, bot dominance in stablecoin transactions could also represent the maturation of certain networks.”

What next for stablecoins?The exchange said stablecoins cemented their role as essential liquidity sources in DeFi, trading, and cross-border payments in 2024. This trend is expected to persist in 2025, particularly in post-halving cycles, which historically trigger increased trading volume and capital flows.

Supply expansion is also likely to continue. The company noted that previous market cycles showed stablecoin growth extends beyond bullish phases, often persisting even in early downturns. For instance, in 2022, stablecoin supply kept rising until March—five months after the market’s peak. This suggests that demand could remain steady even if broader market conditions weaken.

Another key development could involve a shift beyond USDT-dominated networks like Tron. The report noted that USDT faces growing competition and increased regulatory scrutiny, which could erode its market share and impact Tron’s dominance in stablecoin transactions.

Meanwhile, Ethereum’s upcoming Pectra update, expected in March 2025, could strengthen the network’s appeal as a stablecoin hub. The upgrade aims to improve scalability, reduce gas fees, and enhance user experience across Ethereum Layer 1 and Layer 2 networks.

The post Stablecoins surpass Visa and Mastercard with $27.6 trillion transfer volume in 2024 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|